Global Automotive Exhaust Aftertreatment Systems Market - Key Trends & Drivers Summarized

How Are Exhaust Aftertreatment Systems Redefining Emission Control in Modern Vehicles?

As environmental consciousness intensifies across the globe, automotive exhaust aftertreatment systems have become a cornerstone of cleaner vehicle operations. These systems are designed to reduce harmful emissions - including nitrogen oxides (NOx), carbon monoxide (CO), hydrocarbons (HC), and particulate matter (PM) - emitted from internal combustion engines. Utilizing technologies like diesel oxidation catalysts (DOC), diesel particulate filters (DPF), and selective catalytic reduction (SCR), aftertreatment systems convert toxic gases into less harmful substances before they exit the tailpipe. The push for cleaner air has not only made these systems mandatory in regions with strict emission norms, but also led to continuous innovation in component durability, thermal management, and chemical efficiency. Today's vehicles, particularly in the diesel-powered segment, are equipped with intricate exhaust setups that work in harmony with engine control units and sensors to meet stringent standards without compromising performance. As hybrid and even plug-in hybrid models continue to feature combustion engines, the relevance of aftertreatment systems remains firm across diverse vehicle architectures.What Regulatory Forces Are Driving Technological Advancements in Emission Treatment?

Emission legislation is the most influential driver behind the rapid evolution of automotive aftertreatment systems. Regulatory frameworks like Euro 6 in Europe, Bharat Stage VI in India, and Tier 3 in North America have set aggressive reduction targets for NOx and PM emissions. To comply, automakers have had to adopt more complex and efficient aftertreatment solutions that can perform reliably across varied driving conditions. These regulations also extend to real driving emissions (RDE) and on-board monitoring (OBM), forcing systems to operate effectively not only in labs but also in real-world conditions. This has spurred advancements such as twin-dosing SCR setups, improved catalyst coatings, integrated sensors for continuous diagnostics, and faster light-off catalysts for cold starts. The trend toward lifecycle emissions analysis has further encouraged automakers to develop systems that remain effective over longer operational lifespans. Consequently, regulation is not merely a compliance burden, but a catalyst for technological breakthroughs that shape the future of exhaust management.Why Is Component Integration Critical to Achieving Emission Goals?

In the past, exhaust treatment components like catalytic converters, filters, and sensors operated somewhat independently. Today, achieving emission goals demands a holistic, fully integrated approach. Modern systems blend DOC, DPF, SCR, and ammonia slip catalysts into compact, modular units optimized for both space and performance. These systems communicate in real-time with engine control units, leveraging data from temperature, pressure, and NOx sensors to regulate dosing and filter regeneration processes. This tight integration improves the system's responsiveness to different load profiles and enhances overall fuel economy by minimizing parasitic losses. In hybrid vehicles, where engine-off periods are frequent, the system must be agile enough to function efficiently with intermittent exhaust flow. Thermal management has also become a focal point, with techniques like active heating and insulation ensuring optimal catalyst temperature across varied driving cycles. As vehicles become more software-defined, the coordination between aftertreatment systems and broader vehicle dynamics will further enhance emission reduction effectiveness.What Drives the Growth in the Automotive Exhaust Aftertreatment Systems Market?

The growth in the automotive exhaust aftertreatment systems market is driven by several key factors tied to emission regulations, powertrain diversification, and industry innovation. First, the global enforcement of stringent emission standards is compelling automakers to implement sophisticated multi-stage exhaust treatment systems across all vehicle classes, including light-duty, heavy-duty, and non-road mobile machinery. Second, the sustained use of diesel engines in commercial transportation, agriculture, and construction - sectors with long product cycles - ensures ongoing demand for advanced aftertreatment solutions. Third, as hybrid vehicles proliferate, the need for systems that function effectively during frequent engine starts and stops is increasing. Additionally, the automotive industry's push toward modular platforms is encouraging the development of scalable, easily integrated exhaust treatment units that reduce manufacturing complexity. Technological advancements, such as the adoption of high-efficiency catalysts, intelligent dosing systems, and predictive diagnostics, are further enhancing the performance and reliability of these systems. Finally, increasing public scrutiny of air quality and health impacts is reinforcing government incentives and consumer demand for cleaner vehicles, sustaining long-term market momentum.Report Scope

The report analyzes the Automotive Exhaust Aftertreatment Systems market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Fuel Type (Gasoline Fuel, Diesel Fuel); Distribution Channel (OEM Distribution Channel, Aftermarket Distribution Channel); End-Use (Passenger Cars End-Use, Commercial Vehicles End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Gasoline Fuel segment, which is expected to reach US$36.3 Billion by 2030 with a CAGR of a 10.2%. The Diesel Fuel segment is also set to grow at 14.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $8.5 Billion in 2024, and China, forecasted to grow at an impressive 15.6% CAGR to reach $12.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Exhaust Aftertreatment Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Exhaust Aftertreatment Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Exhaust Aftertreatment Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

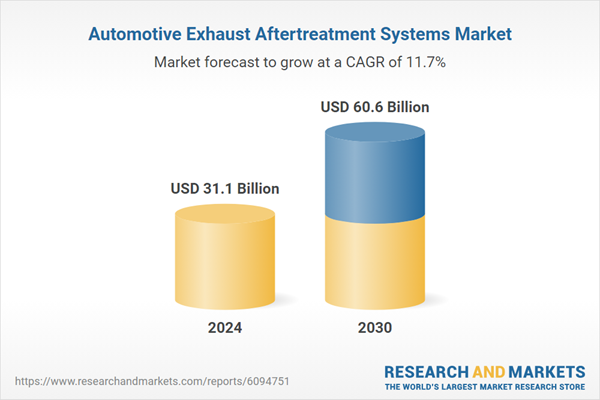

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Autoliv Inc., Bosch Mobility Solutions, Continental AG, Denso Corporation, Delphi Technologies (BorgWarner) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Automotive Exhaust Aftertreatment Systems market report include:

- Aisin Corporation

- Bosal Group

- Cataler Corporation

- CDTi Advanced Materials Inc.

- Cummins Inc.

- Denso Corporation

- Donaldson Company, Inc.

- Eberspacher Group

- Emitec Technologies GmbH

- Faurecia

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aisin Corporation

- Bosal Group

- Cataler Corporation

- CDTi Advanced Materials Inc.

- Cummins Inc.

- Denso Corporation

- Donaldson Company, Inc.

- Eberspacher Group

- Emitec Technologies GmbH

- Faurecia

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 358 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 31.1 Billion |

| Forecasted Market Value ( USD | $ 60.6 Billion |

| Compound Annual Growth Rate | 11.7% |

| Regions Covered | Global |