Global Autonomous Underwater Vehicles (AUVs) for Offshore Oil and Gas IRM - Key Trends & Drivers Summarized

Why Are AUVs Revolutionizing Offshore Inspection, Repair, and Maintenance Operations?

Autonomous Underwater Vehicles (AUVs) are transforming the landscape of offshore oil and gas Inspection, Repair, and Maintenance (IRM) by providing a safer, more efficient, and cost-effective alternative to traditional diver-led and Remotely Operated Vehicle (ROV)-based operations. Operating without the need for surface tethers or constant human control, AUVs offer unparalleled flexibility in conducting complex underwater tasks across vast and challenging offshore environments. They can autonomously navigate pipelines, risers, subsea structures, and wellheads, collecting high-resolution sonar and visual data used to assess structural integrity, corrosion, leakage, and marine growth. This eliminates the need for costly surface vessels and extended deployment crews, which are traditionally required for ROV operations. Moreover, AUVs can operate at extreme depths and in hostile conditions where human intervention is impractical or dangerous, such as areas with strong currents, low visibility, or potential gas leaks. Their ability to carry multiple sensors and operate for extended durations allows for comprehensive, uninterrupted data collection in a single mission. As the oil and gas industry grapples with aging offshore infrastructure and increasingly stringent regulatory oversight, the need for accurate and timely IRM operations has never been more critical. AUVs address this need by enabling continuous monitoring, early detection of faults, and predictive maintenance, thereby helping operators avoid unplanned shutdowns, environmental incidents, and costly emergency interventions. With growing focus on operational resilience, asset longevity, and risk mitigation, AUVs are no longer seen as experimental tools - they are becoming essential assets in the digital transformation of offshore energy operations.How Are Technological Advancements Driving the Performance and Utility of AUVs in IRM?

The performance and utility of AUVs in offshore IRM are being significantly enhanced by rapid advancements in sensor technology, artificial intelligence, autonomy algorithms, and energy storage systems. Modern AUVs are equipped with advanced sonar systems, including multibeam echosounders, side-scan sonar, and sub-bottom profilers that provide detailed three-dimensional imaging of subsea infrastructure. These imaging capabilities are complemented by high-definition cameras and non-contact measurement tools that allow for precise inspection of welds, joints, and coatings. AI-driven data analytics and onboard processing now enable AUVs to make real-time decisions, such as adjusting their inspection routes based on anomalies detected during a mission. These adaptive capabilities significantly reduce mission time and increase inspection accuracy. Additionally, improvements in battery technology - especially the use of lithium-ion and solid-state batteries - are extending mission duration and range, allowing AUVs to cover larger areas with fewer recharging interruptions. Innovations in underwater communication, including acoustic and optical data links, are enhancing data transmission and remote supervision capabilities, even in deep-sea environments. Modular design is also becoming standard, enabling quick payload swaps and functional upgrades, which enhances mission versatility without requiring full system overhauls. Navigation technologies such as inertial navigation systems (INS), Doppler velocity logs (DVL), and real-time kinematic (RTK) GPS are delivering sub-meter accuracy even in GPS-denied environments. Together, these technological advancements are making AUVs not just data-gathering platforms but smart, adaptive agents capable of complex inspection and maintenance tasks under the sea, thereby increasing their value in high-stakes offshore energy operations.Why Is Industry Adoption of AUVs Accelerating Across Global Offshore Oil and Gas Fields?

Adoption of AUVs for IRM is accelerating globally due to increasing operational demands, maturing subsea infrastructure, and a growing emphasis on reducing offshore risks and costs. Energy companies operating in mature basins such as the North Sea, Gulf of Mexico, and Southeast Asia are under pressure to maintain aging assets while ensuring operational efficiency and regulatory compliance. AUVs provide a highly effective means of achieving this by enabling frequent and thorough inspections without the need for large vessel support or extended manned operations. As exploration and production shift to more remote and deeper water fields - such as those off the coasts of Brazil, West Africa, and the Arctic - the logistical and safety challenges of conventional IRM methods have become increasingly apparent. In these contexts, AUVs offer unmatched operational independence and flexibility, which is critical for consistent and reliable infrastructure monitoring. Moreover, the industry's growing commitment to environmental stewardship and zero-incident goals makes autonomous inspection tools highly attractive, as they minimize human exposure and reduce the carbon footprint associated with traditional vessel-supported inspections. Global oil majors, national oil companies, and offshore service providers are therefore investing in AUV fleets, developing in-house expertise, and partnering with technology firms to integrate AUVs into routine maintenance programs. Regulatory bodies and classification societies are also recognizing AUV-based inspections as valid methods for certifying structural integrity, further accelerating adoption. As cost pressures and production optimization remain top priorities in the post-pandemic energy market, AUVs are emerging as a critical enabler of smarter, leaner, and safer offshore operations across the global oil and gas sector.What Factors Are Driving the Robust Growth of the Global AUV Market for Offshore IRM?

The growth in the global Autonomous Underwater Vehicle market for offshore oil and gas IRM is driven by a combination of economic, technological, environmental, and strategic factors. One of the primary drivers is the industry's increasing focus on digital transformation and the integration of Industry 4.0 technologies into field operations. AUVs play a pivotal role in this shift by enabling high-frequency data acquisition, predictive maintenance, and digital twin development for offshore assets. The continued push toward unmanned, low-carbon offshore operations is also a major catalyst, with AUVs offering a sustainable and scalable alternative to vessel-based inspections. Rising offshore capital expenditures, particularly in deepwater and ultra-deepwater projects, are prompting operators to seek IRM solutions that can support higher production uptime while minimizing inspection costs and HSE risks. In parallel, global regulatory trends mandating frequent inspection of subsea assets for environmental and safety compliance are creating sustained demand for autonomous technologies. The evolution of subsea resident AUV systems - permanently stationed on the seafloor and ready for deployment - marks a significant leap in operational readiness and cost-efficiency, reducing mobilization times and enabling real-time asset surveillance. Increased competition among AUV manufacturers and service providers is also driving innovation, reducing system costs, and expanding customization options for various IRM applications. Strategic collaborations between oil companies, research institutions, and robotics startups are leading to faster commercialization of new AUV capabilities. As energy markets recover and operators prioritize resilience and sustainability, the confluence of these factors is positioning AUVs as indispensable tools in the offshore oil and gas value chain, fueling robust and sustained market growth in the years ahead.Report Scope

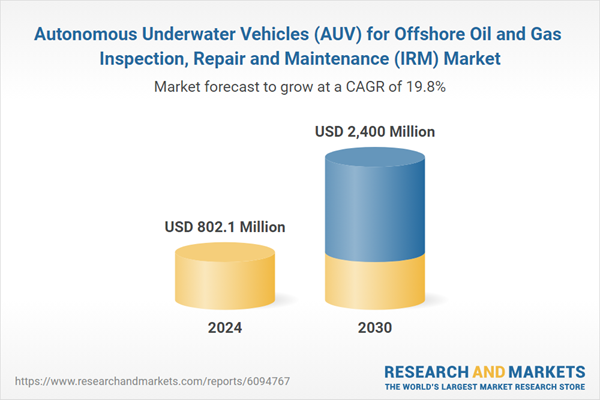

The report analyzes the Autonomous Underwater Vehicles (AUV) for Offshore Oil and Gas Inspection, Repair and Maintenance (IRM) market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Man-Portable, Light Weight Vehicle, Heavy Weight Vehicle); Water Depth (Shallow Water, Deepwater, Ultra-Deepwater); Propulsion (Electric Propulsion, Mechanical Propulsion, Hybrid Propulsion).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Man-Portable Vehicles segment, which is expected to reach US$1.4 Billion by 2030 with a CAGR of a 21.8%. The Light Weight Vehicle segment is also set to grow at 16.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $210.8 Million in 2024, and China, forecasted to grow at an impressive 18.6% CAGR to reach $361.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Autonomous Underwater Vehicles (AUV) for Offshore Oil and Gas Inspection, Repair and Maintenance (IRM) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Autonomous Underwater Vehicles (AUV) for Offshore Oil and Gas Inspection, Repair and Maintenance (IRM) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Autonomous Underwater Vehicles (AUV) for Offshore Oil and Gas Inspection, Repair and Maintenance (IRM) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Anduril Industries, Airbus Group Inc., BAE Systems plc, Bharat Electronics Limited, Boeing Company and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Autonomous Underwater Vehicles (AUV) for Offshore Oil and Gas Inspection, Repair and Maintenance (IRM) market report include:

- Aker Solutions

- Atlas Elektronik GmbH

- Baker Hughes

- Bluefin Robotics (General Dynamics Mission Systems)

- Boskalis

- DeepOcean

- DOF Subsea

- ECA Group

- Fugro

- Helix Energy Solutions Group

- Houston Mechatronics (Nauticus Robotics)

- IKM Subsea

- InterMoor

- Kongsberg Maritime

- Oceaneering International, Inc.

- Ocean Infinity

- Saab Seaeye

- Schlumberger

- Subsea 7

- TechnipFMC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aker Solutions

- Atlas Elektronik GmbH

- Baker Hughes

- Bluefin Robotics (General Dynamics Mission Systems)

- Boskalis

- DeepOcean

- DOF Subsea

- ECA Group

- Fugro

- Helix Energy Solutions Group

- Houston Mechatronics (Nauticus Robotics)

- IKM Subsea

- InterMoor

- Kongsberg Maritime

- Oceaneering International, Inc.

- Ocean Infinity

- Saab Seaeye

- Schlumberger

- Subsea 7

- TechnipFMC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 225 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 802.1 Million |

| Forecasted Market Value ( USD | $ 2400 Million |

| Compound Annual Growth Rate | 19.8% |

| Regions Covered | Global |