Global Avionics Data Loaders Market - Key Trends & Drivers Summarized

Why Are Avionics Data Loaders Essential to Modern Aircraft Operations and System Integrity?

Avionics data loaders play a crucial role in ensuring the safe, efficient, and up-to-date operation of modern aircraft by serving as the primary interface for uploading critical software, databases, and operational configurations to onboard avionics systems. These tools are responsible for transferring navigation data, flight management system (FMS) updates, terrain awareness information, weather files, engine health monitoring algorithms, and other operational datasets required for optimal aircraft performance. Given that commercial and military aircraft rely on increasingly complex and interconnected systems, regular data updates are essential not only for regulatory compliance but also for situational awareness, mission readiness, and flight optimization. Without reliable data loading infrastructure, avionics systems risk becoming outdated or malfunctioning - jeopardizing safety, increasing maintenance overhead, and limiting mission capability. Moreover, avionics data loaders are pivotal to pre-flight readiness, especially in fleets that must adhere to strict scheduling and operational mandates. Whether for airliners that require navigation database revisions every 28 days or combat aircraft that rely on tactical mission data, loaders act as the vital bridge between ground systems and onboard computers. As aircraft manufacturers and operators transition to more digital, software-centric platforms, the frequency, size, and complexity of data loads continue to grow, demanding loaders with faster transfer speeds, broader compatibility, and enhanced security. This foundational role ensures avionics data loaders are not just peripheral tools but critical enablers of modern aviation performance, compliance, and airworthiness.How Are Advancements in Connectivity, Security, and Storage Driving Next-Generation Data Loaders?

The design and functionality of avionics data loaders are evolving rapidly due to innovations in data transfer technology, cybersecurity protocols, and compact, high-speed storage solutions. Traditional ARINC 615 and ARINC 615A-based systems, which utilize floppy disks or PCMCIA cards, are being phased out in favor of modern, network-based data loaders that support Ethernet and wireless transmission over secure, encrypted channels. These newer platforms significantly reduce data load times and minimize human intervention, improving turnaround times and reducing error rates. Enhanced onboard memory and solid-state drives (SSDs) allow for the storage of larger files, supporting high-resolution terrain mapping, AI-assisted predictive maintenance models, and real-time flight data updates. Cybersecurity has become a central feature, with advanced encryption standards (AES), digital signatures, and multi-factor authentication protocols being integrated to prevent unauthorized access or data corruption - an essential upgrade given the sensitivity of avionics software. Integration with maintenance information systems and enterprise resource planning (ERP) tools is also becoming standard, allowing seamless synchronization of aircraft data with ground-based operational systems. Furthermore, user interfaces are being reimagined with touchscreen displays, automated prompts, and diagnostic feedback, making it easier for ground crews to execute data uploads efficiently. Some data loaders now offer remote functionality via satellite or 5G, enabling updates while aircraft are on the move or at remote airfields. As aviation becomes more data-driven and time-sensitive, the role of data loaders is shifting from mere upload devices to intelligent, secure, and interconnected gateways central to fleet readiness and avionics modernization.Why Is Global Demand for Avionics Data Loaders Increasing Across Commercial, Defense, and Business Aviation?

The demand for avionics data loaders is rising steadily across commercial, defense, and business aviation sectors as all facets of the aviation ecosystem become increasingly reliant on digital systems that require constant updates and performance validation. In commercial aviation, the growth of global air travel, the expansion of aircraft fleets, and the rising adoption of connected aircraft technologies necessitate more frequent and robust data transfer processes. Airlines need efficient, scalable solutions to manage and update large volumes of avionics data for navigation, route optimization, and compliance across hundreds of aircraft - making advanced data loaders a mission-critical asset. In defense aviation, where situational awareness and mission specificity are paramount, data loaders support rapid reconfiguration of avionics systems, mission planning files, and software-defined radio updates, often under highly secure and classified protocols. Military aircraft operating in multiple theaters require loaders that can handle encrypted mission packages and rapidly adapt to changing environments. The business aviation sector, while smaller in scale, places a premium on uptime and customer experience, making the ability to quickly update entertainment systems, weather maps, and FMS data equally important. Globally, regions with rapidly growing aviation infrastructure - such as Asia-Pacific, the Middle East, and Latin America - are increasing their investment in avionics support systems, including data loaders, to meet international standards and operational demands. Additionally, the proliferation of new aircraft platforms like electric aircraft and UAVs is expanding the market footprint for lightweight, software-focused data loaders designed for autonomous or semi-autonomous flight systems. Collectively, these dynamics are driving sustained demand for modern, secure, and adaptable avionics data loading solutions worldwide.What Factors Are Driving the Continued Growth and Evolution of the Avionics Data Loaders Market?

The growth in the global avionics data loaders market is driven by a convergence of technological modernization, increased aircraft digitalization, evolving regulatory mandates, and strategic defense priorities. One of the primary factors is the ongoing transition toward software-defined aircraft architectures, where frequent updates and real-time system reconfiguration are becoming the norm. This shift significantly raises the importance of agile, fast, and secure data loading systems. Regulatory agencies such as the FAA and EASA are implementing more stringent requirements for avionics software integrity, cyber protection, and navigation data accuracy, compelling airlines and operators to adopt compliant data loading technologies. The rising frequency of mandatory navigation database updates, coupled with the growing file sizes associated with high-resolution maps, predictive analytics, and AI-assisted maintenance tools, demands data loaders that are faster, more intelligent, and highly secure. The increasing lifecycle of aircraft and the need to modernize legacy platforms without full replacement are also fueling demand for backward-compatible and upgradeable data loaders. Simultaneously, the growing trend toward real-time fleet management and condition-based maintenance is driving the integration of data loaders into broader aircraft health monitoring systems. In the defense sector, geopolitical tensions and modernization programs are expanding the need for cyber-resilient, deployable data loaders that can function in mobile and contested environments. Moreover, as OEMs strive to deliver more integrated and smart cockpit ecosystems, they are partnering with avionics loader providers to streamline system compatibility and reduce time-to-certification. These forces, combined with a general aviation-wide shift toward increased automation and operational transparency, are ensuring that avionics data loaders remain a key investment area in the evolution of digital aviation.Report Scope

The report analyzes the Avionics Data Loaders market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Airborne Data Loader, Portable Data Loader); Application (Airlines Application, MROs Application, Avionics Equipment Suppliers Application, Aircraft Manufacturers Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Airborne Data Loader segment, which is expected to reach US$19.7 Billion by 2030 with a CAGR of a 6.5%. The Portable Data Loader segment is also set to grow at 4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.1 Billion in 2024, and China, forecasted to grow at an impressive 5.5% CAGR to reach $4.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Avionics Data Loaders Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Avionics Data Loaders Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Avionics Data Loaders Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Allied Motion Technologies, ARC Systems Inc., Emrax d.o.o., Evolito Ltd, Geiger Engineering GmbH and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Avionics Data Loaders market report include:

- AgiLynx Inc.

- Astronics Corporation

- Avionica LLC

- Avionics Interface Technologies (AIT)

- Avidyne Corporation

- Collins Aerospace

- Honeywell International Inc.

- L3Harris Technologies, Inc.

- MBS Electronic Systems GmbH & Co. KG

- NAVBLUE

- Panasonic Avionics Corporation

- Performance Software

- Rolls-Royce Controls and Data Services

- Satcom Direct, Inc.

- S-TEC Corporation

- Spectralux Avionics

- Spidertracks

- Techsat GmbH

- Teledyne Controls

- VECTRONIC Aerospace GmbH

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AgiLynx Inc.

- Astronics Corporation

- Avionica LLC

- Avionics Interface Technologies (AIT)

- Avidyne Corporation

- Collins Aerospace

- Honeywell International Inc.

- L3Harris Technologies, Inc.

- MBS Electronic Systems GmbH & Co. KG

- NAVBLUE

- Panasonic Avionics Corporation

- Performance Software

- Rolls-Royce Controls and Data Services

- Satcom Direct, Inc.

- S-TEC Corporation

- Spectralux Avionics

- Spidertracks

- Techsat GmbH

- Teledyne Controls

- VECTRONIC Aerospace GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 141 |

| Published | January 2026 |

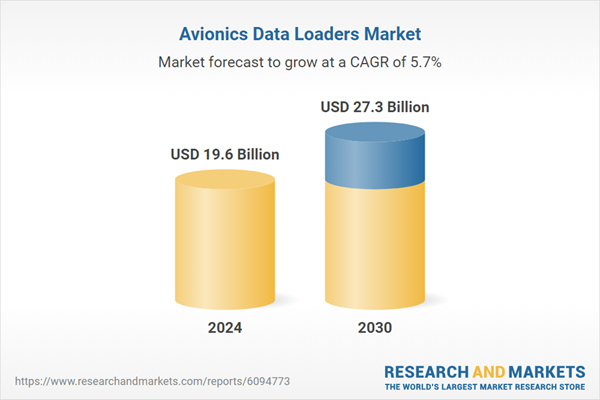

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 19.6 Billion |

| Forecasted Market Value ( USD | $ 27.3 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |