Global Forged Automotive Components Market - Key Trends & Drivers Summarized

Why Are Forged Components Essential to Automotive Performance and Safety?

Forged automotive components are indispensable in modern vehicle design due to their superior mechanical strength, fatigue resistance, and structural integrity. Forging involves shaping metal using localized compressive forces, resulting in a refined grain structure that delivers enhanced durability and load-bearing capacity compared to cast or machined parts. In the automotive sector, forging is widely used to produce critical structural and powertrain components such as crankshafts, connecting rods, transmission gears, axle beams, and steering knuckles - parts that must endure high stress and thermal variations over long operating lifecycles.These components are particularly vital in commercial vehicles, performance cars, off-highway equipment, and heavy-duty trucks where reliability and mechanical toughness are paramount. As vehicle OEMs push for lighter yet stronger platforms to meet fuel efficiency, emission, and safety targets, forged parts are gaining even more relevance. Their ability to be precision-engineered from high-strength alloys enables tighter tolerances and increased performance under dynamic loading conditions, making them foundational to modern automotive engineering.

How Are Material and Process Innovations Enhancing Forging Capabilities?

Advances in materials and forging technologies are reshaping the competitiveness of forged automotive components. High-strength, low-alloy steels, aluminum alloys, and titanium-based materials are being used to manufacture lighter yet equally robust parts. These advanced alloys help automakers reduce vehicle weight while maintaining component integrity - a key goal in meeting global fuel economy and emission standards.Technological developments in precision forging, closed-die forging, and warm/hot forging processes are enabling better dimensional accuracy, finer surface finish, and reduced post-processing requirements. Automation, robotic handling, and computer-aided die design (CADD) are improving production efficiency and repeatability. Near-net-shape forging, in particular, minimizes material waste and machining costs. Simultaneously, real-time monitoring, sensor feedback, and predictive maintenance in forging presses are increasing operational uptime and quality consistency, making high-volume production both cost-effective and scalable.

Which Vehicle Segments and Components Are Driving Demand for Forged Parts?

The demand for forged components is most pronounced in powertrain and chassis systems across both passenger and commercial vehicles. In internal combustion engine (ICE) vehicles, forged crankshafts, camshafts, and connecting rods are critical to engine stability and durability. In transmissions, gears and shafts forged to precision are vital to torque delivery and drivetrain performance. Suspension and steering systems also rely on forged control arms, knuckles, and tie rods for their high-strength-to-weight ratios and resistance to fatigue.With the rise of electric vehicles (EVs), the demand profile is shifting toward forged parts used in thermal management systems, suspension assemblies, and differential units. Forged aluminum and lightweight steel parts are increasingly integrated into EV platforms to offset battery weight and improve range efficiency. Heavy-duty trucks, agricultural equipment, and off-road vehicles continue to be major consumers of forged components due to their demanding load and performance environments. Globally, the growth of vehicle production in emerging markets and the rise of premium vehicles with performance features are further boosting demand.

What Are the Key Drivers Supporting Growth in the Forged Automotive Components Market?

The growth in the forged automotive components market is driven by multiple factors tied to mechanical performance requirements, production scalability, and the evolving automotive landscape. A central driver is the increasing demand for high-strength, fatigue-resistant components that can perform reliably under variable load, temperature, and terrain conditions. Forged parts provide unmatched durability for such applications, ensuring long-term reliability in safety-critical systems.The growing focus on lightweighting - particularly in the context of regulatory pressure to reduce CO2 emissions - is encouraging OEMs to adopt forged aluminum and hybrid-material components that combine strength with reduced mass. Additionally, the rise in vehicle electrification and expansion of hybrid architectures are creating new requirements for high-precision, thermally stable forged parts. The trend toward global automotive manufacturing platforms and modular vehicle architectures also favors forging due to its repeatability and compatibility with mass customization.

Increasing investments in forging automation, integration of Industry 4.0 technologies, and vertical integration strategies among OEMs and tier-1 suppliers are further propelling market expansion. These combined trends are ensuring that forged automotive components remain central to both legacy and next-generation vehicle development strategies worldwide.

Report Scope

The report analyzes the Forged Automotive Components market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Vehicle Type (Heavy Commercial Vehicles, Light Commercial Vehicles, Passenger Cars); Automotive Component (Connecting Rods, Injectors, Gears, Crankshafts, Axles, Bearings, Pistons, Steering Knuckles, Other Automotive Components); Material (Steel Material, Aluminum Material, Other Materials); Forging Process (Impression Die Forging Process, Cold Forging Process, Open Die Forging Process, Seamless Rolled Ring Forging Process); Application (Power Train Components Application, Chassis Components Application, Transmission Parts Application, Other Parts Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Heavy Commercial Vehicles segment, which is expected to reach US$35.5 Billion by 2030 with a CAGR of a 4.6%. The Light Commercial Vehicles segment is also set to grow at 2.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $12.7 Billion in 2024, and China, forecasted to grow at an impressive 7.2% CAGR to reach $11.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Forged Automotive Components Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Forged Automotive Components Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Forged Automotive Components Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Avon Products, Inc., Beiersdorf AG, Church & Dwight Co., Inc., Clariant AG, Colgate-Palmolive Company and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Forged Automotive Components market report include:

- AAM (American Axle & Manufacturing)

- Bharat Forge Ltd.

- China Forging Group Co., Ltd

- Constellium SE

- Coscast

- Daimler AG

- Dongfeng Forging Co., Ltd

- Dongkuk Steel Mill Co., Ltd

- Endurance Technologies Ltd

- Forgings India Ltd

- GF Casting Solutions

- Honda Motor Co., Ltd.

- Hyundai Mobis

- JBM Group

- Kalyani Forge Ltd

- Linamar Corporation

- Magna International Inc.

- Mahindra Forgings Ltd

- Metaldyne Performance Group

- Nanjing Forge Steel Co. Ltd

- Nemak S.A.B. de C.V.

- Robert Bosch GmbH

- SinterCast AB

- Thyssenkrupp AG

- Waupaca Foundry

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AAM (American Axle & Manufacturing)

- Bharat Forge Ltd.

- China Forging Group Co., Ltd

- Constellium SE

- Coscast

- Daimler AG

- Dongfeng Forging Co., Ltd

- Dongkuk Steel Mill Co., Ltd

- Endurance Technologies Ltd

- Forgings India Ltd

- GF Casting Solutions

- Honda Motor Co., Ltd.

- Hyundai Mobis

- JBM Group

- Kalyani Forge Ltd

- Linamar Corporation

- Magna International Inc.

- Mahindra Forgings Ltd

- Metaldyne Performance Group

- Nanjing Forge Steel Co. Ltd

- Nemak S.A.B. de C.V.

- Robert Bosch GmbH

- SinterCast AB

- Thyssenkrupp AG

- Waupaca Foundry

Table Information

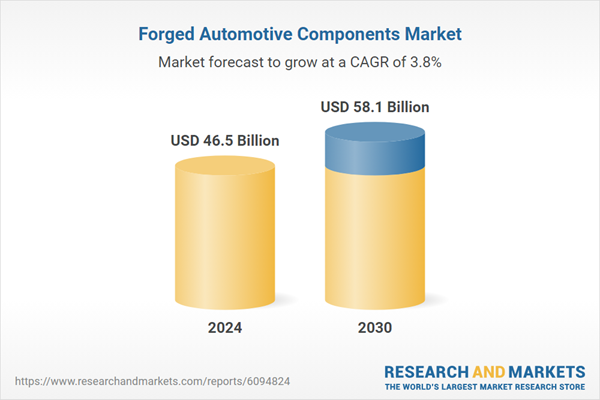

| Report Attribute | Details |

|---|---|

| No. of Pages | 592 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 46.5 Billion |

| Forecasted Market Value ( USD | $ 58.1 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |