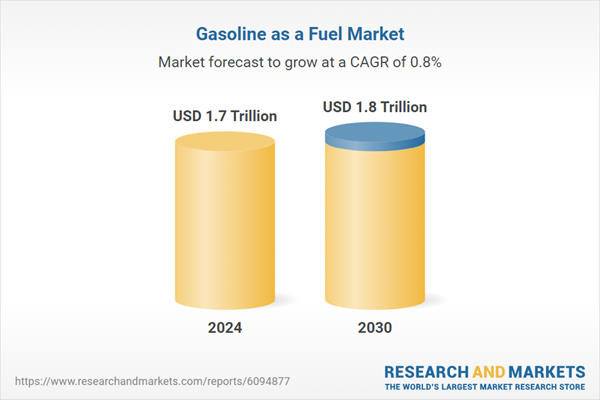

Global 'Gasoline as a Fuel' Market - Key Trends & Drivers Summarized

Why Does Gasoline Continue to Dominate Transport Despite the Rise of Electric Vehicles?

Gasoline remains a cornerstone of the global transportation sector, even as electric vehicles (EVs) and alternative fuels gain traction. This continued dominance is rooted in a combination of existing infrastructure, internal combustion engine (ICE) vehicle saturation, and the limited pace of EV adoption in key emerging markets. As of now, gasoline powers over 90% of light-duty vehicles globally, particularly in regions like North America, Latin America, Southeast Asia, and parts of Africa where electrification efforts are either nascent or challenged by economic and logistical barriers. Moreover, gasoline offers convenience through an established and expansive refueling network, making it the default choice for long-distance travel, rural commutes, and fleet operations. In many economies, subsidies and government pricing mechanisms also help maintain gasoline's affordability relative to alternative fuels. While EVs continue to surge in popularity in urban centers, the transition is uneven, and gasoline remains the practical fuel for millions - especially where electricity grids are unreliable or charging infrastructure is insufficient.How Are Fuel Standards, Refining Technologies, and Emissions Policies Impacting Supply Dynamics?

The global gasoline market is increasingly shaped by tighter environmental regulations and advances in refining technologies. Governments across regions are mandating cleaner-burning fuels with lower sulfur content, such as Euro 6 standards in Europe and Tier 3 standards in the U.S., prompting refiners to invest heavily in upgrading infrastructure. These cleaner formulations aim to reduce particulate emissions and improve engine efficiency, which in turn affects fuel pricing and supply chains. Moreover, innovations in catalytic cracking, hydrocracking, and alkylation processes are enhancing the yield and quality of gasoline from crude oil, allowing refiners to meet stricter standards without sacrificing supply. Blending mandates are also playing a critical role - bioethanol is being increasingly mixed into gasoline to lower its carbon footprint, with countries like Brazil, the U.S., and India advancing ethanol-blending programs aggressively. These shifts are creating a more complex and fragmented gasoline supply chain, where fuel quality, composition, and pricing are determined not just by oil availability but by regional policy and technological readiness.What Is the Influence of Global Oil Markets, Consumer Behavior, and Vehicle Trends?

The pricing and demand for gasoline are heavily influenced by global oil market dynamics, shifting mobility patterns, and evolving consumer behavior. Crude oil prices directly impact gasoline retail rates, and geopolitical events such as conflicts, sanctions, or OPEC+ production decisions can cause rapid and widespread fluctuations in supply and pricing. Post-pandemic recovery trends have seen a resurgence in personal vehicle usage as people prioritize safety over shared transport, boosting short-term gasoline demand. However, longer-term consumer behavior is gradually shifting, especially among younger generations in developed nations who are embracing ride-sharing, public transportation, and EVs. At the same time, global automakers are producing more fuel-efficient gasoline vehicles to meet fleet emission targets, extending the life of gasoline in the fuel mix. In markets like China, hybrid vehicles that use gasoline more efficiently are also gaining ground, serving as a bridge between ICE and fully electric models. This behavioral mosaic is contributing to a market that is both evolving and deeply entrenched, responding to pressures from both innovation and inertia.What Are the Real Growth Drivers Sustaining Gasoline's Role in the Global Fuel Mix?

The growth in the global gasoline as a fuel market is driven by several factors rooted in end-user reliance, infrastructure compatibility, and the inertia of existing vehicle fleets. First, the sheer volume of internal combustion vehicles on the road - over 1.3 billion globally - ensures sustained gasoline demand, particularly in countries with slower EV penetration. Second, the global fuel distribution network, built over decades, supports gasoline seamlessly, making it the most accessible and logistically viable transport fuel in both developed and developing nations. Third, urban expansion in emerging markets continues to drive demand for personal mobility, where gasoline-powered two-wheelers and small cars dominate due to their affordability and range. Additionally, fuel tax structures in many countries still favor gasoline over diesel or alternative fuels, keeping it competitive at the consumer level. Blending mandates with ethanol and other additives are enhancing the environmental profile of gasoline, making it more palatable under evolving emissions frameworks without requiring drastic changes in vehicle or infrastructure design. Lastly, the pace of global EV infrastructure development remains uneven, and until grid capacity, charging availability, and consumer economics align universally, gasoline will remain a key pillar in the global transportation fuel mix.Report Scope

The report analyzes the Gasoline as a Fuel market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Application (Passenger Cars Application, Commercial Vehicles Application, Small Engines Application, Marine Engines Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Some of the 48 companies featured in this Gasoline as a Fuel market report include -

- Adani Total Gas Limited

- Aldrees Petroleum & Transport Services Co.

- Amoco (BP)

- Aral AG (BP)

- Bharat Petroleum Corporation Limited

- BP plc

- Castrol (BP)

- Chevron Corporation

- China National Petroleum Corporation (CNPC)

- China Petroleum & Chemical Corporation (Sinopec)

- Citgo Petroleum Corporation

- ConocoPhillips

- ENOC (Emirates National Oil Company)

- Equinor ASA

- ExxonMobil Corporation

- Galp Energia

- Gazprom Neft

- Hindustan Petroleum Corporation Limited

- Idemitsu Kosan Co., Ltd.

- Indian Oil Corporation Limited

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Passenger Cars Application segment, which is expected to reach US$763.3 Billion by 2030 with a CAGR of a 0.5%. The Commercial Vehicles Application segment is also set to grow at 1.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $475.8 Billion in 2024, and China, forecasted to grow at an impressive 1.6% CAGR to reach $322.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Gasoline as a Fuel Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Gasoline as a Fuel Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Gasoline as a Fuel Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd., AZZ Inc., Beta Engineering, CG Power and Industrial Solutions Ltd., CIGRE and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Select Competitors (Total 48 Featured):

- Adani Total Gas Limited

- Aldrees Petroleum & Transport Services Co.

- Amoco (BP)

- Aral AG (BP)

- Bharat Petroleum Corporation Limited

- BP plc

- Castrol (BP)

- Chevron Corporation

- China National Petroleum Corporation (CNPC)

- China Petroleum & Chemical Corporation (Sinopec)

- Citgo Petroleum Corporation

- ConocoPhillips

- ENOC (Emirates National Oil Company)

- Equinor ASA

- ExxonMobil Corporation

- Galp Energia

- Gazprom Neft

- Hindustan Petroleum Corporation Limited

- Idemitsu Kosan Co., Ltd.

- Indian Oil Corporation Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Adani Total Gas Limited

- Aldrees Petroleum & Transport Services Co.

- Amoco (BP)

- Aral AG (BP)

- Bharat Petroleum Corporation Limited

- BP plc

- Castrol (BP)

- Chevron Corporation

- China National Petroleum Corporation (CNPC)

- China Petroleum & Chemical Corporation (Sinopec)

- Citgo Petroleum Corporation

- ConocoPhillips

- ENOC (Emirates National Oil Company)

- Equinor ASA

- ExxonMobil Corporation

- Galp Energia

- Gazprom Neft

- Hindustan Petroleum Corporation Limited

- Idemitsu Kosan Co., Ltd.

- Indian Oil Corporation Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 192 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.7 Trillion |

| Forecasted Market Value ( USD | $ 1.8 Trillion |

| Compound Annual Growth Rate | 0.8% |

| Regions Covered | Global |