Global 'Gemstone Certification' Market - Key Trends & Drivers Summarized

Why Is Gemstone Certification Becoming Non-Negotiable in the Modern Jewelry Industry?

As global demand for precious and semi-precious stones continues to grow, gemstone certification has emerged as a fundamental requirement in the jewelry supply chain. Consumers today are more informed and discerning, seeking assurances regarding the authenticity, origin, quality, and ethical sourcing of gemstones before making a purchase. Certification acts as an authoritative guarantee, validating a stone's characteristics - such as cut, clarity, carat weight, and color - while also disclosing any treatments or enhancements. This has become crucial in both high-end luxury transactions and everyday retail, where trust and transparency directly influence buying decisions. With increasing incidences of fraud, synthetics, and treated stones entering the market, certified documentation from reputed gemological laboratories (such as GIA, IGI, and AGS) is now a key differentiator for both jewelers and consumers. As digital marketplaces and cross-border sales expand, the need for universally accepted grading and certification is growing - positioning gemstone certification not just as an industry standard, but as a global necessity.How Are Technology and Laboratory Standards Enhancing Trust in Certification?

Technological advancements are playing a pivotal role in elevating the precision, credibility, and scalability of gemstone certification. Modern gemological laboratories are leveraging advanced spectroscopy, X-ray diffraction, laser inscription, and microscopic imaging to deliver highly accurate assessments of a gemstone's physical and chemical properties. These tools help differentiate natural stones from synthetics or simulants and can also detect microscopic treatments or enhancements that may not be visible to the naked eye. Blockchain technology is also making inroads, with some certification bodies exploring digital ledgers to provide tamper-proof provenance records - from mine to market - ensuring transparency in ethical sourcing. Additionally, laser-engraved certificate numbers on stones themselves are helping reduce fraud and verify authenticity throughout the resale or appraisal process. Rigorous standardization practices and adherence to ISO-accredited testing protocols are reinforcing trust in certification bodies, enabling gem traders, manufacturers, and retailers to align with global compliance expectations while offering greater confidence to end consumers.What Role Do Market Trends and Ethical Consumerism Play in Shaping Certification Demand?

The rise of ethical consumerism, sustainable sourcing, and responsible luxury has had a direct impact on the demand for certified gemstones. Today's buyers - especially younger consumers and affluent millennials - expect assurance not only on gemstone quality but also on ethical mining practices, labor conditions, and environmental stewardship. Certification programs are expanding to include origin tracing, with increasing emphasis on conflict-free diamonds and responsibly sourced colored stones from places like Sri Lanka, Colombia, and Mozambique. Retailers and brands are responding by making third-party gemstone certification a mandatory part of their value chain, particularly in global markets where legal requirements or trade regulations enforce declaration of stone origin and treatment history. Moreover, the growing secondary market for fine jewelry and investment-grade gemstones has heightened the importance of certification for resale and insurance purposes. Whether buying for fashion, investment, or tradition, consumers are demanding documentation that adds verifiable, enduring value - pushing the gemstone certification market further into the spotlight.What Factors Are Fueling the Rapid Growth of the Global Gemstone Certification Market?

The growth in the global gemstone certification market is driven by several core factors linked to consumer behavior, regulatory evolution, technological integration, and trade expansion. The first major driver is increasing consumer demand for transparency, especially in luxury goods, where buyers want detailed, verified information about the stones they purchase. Second, the rise of global e-commerce and digital jewelry platforms has made certification indispensable for remote transactions, ensuring buyer trust across geographies. Third, international trade regulations - such as those enforced by the Kimberley Process for diamonds - are pressuring industry stakeholders to adopt certification to avoid supply chain disruptions and legal penalties. Fourth, technological innovation in gem testing and digital certification is allowing labs to process stones faster and with greater precision, making certification more accessible and scalable even for mid-range markets. Lastly, the growth of investment in gemstones as alternative assets is pushing institutional and private investors to demand standardized, credible certification - further anchoring it as an essential pillar in the global gemstone trade.Report Scope

The report analyzes the Gemstone Certification market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Certification (Emerald Certification, Pearl Certification, Sapphire Certification, Ruby Certification, Other Certifications); Category (Natural Category, Synthetic Category).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Some of the 42 companies featured in this Gemstone Certification market report include -

- AGL (American Gemological Laboratories)

- AGS (American Gem Society)

- AnchorCert Gem Lab

- Bahrain Institute for Pearls and Gemstones (Danat)

- CGL (Central Gem Laboratory)

- CISGEM (Centro Informazioni e Servizi Gemmologici)

- DSEF German Gem Lab

- EGL USA (European Gemological Laboratory USA)

- GCI (Gemological Center of Israel)

- GIA (Gemological Institute of America)

- GII (Gemological Institute of India)

- GRS (GemResearch Swisslab)

- Gubelin Gem Lab

- HRD Antwerp

- IGI (International Gemological Institute)

- IIGJ (Indian Institute of Gems & Jewellery)

- ImaGem Inc.

- Indian Diamond Institute (IDI)

- International Gem Testing Laboratory (IGTL)

- Japan Germany Gemmological Laboratory (JGGL)

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Emerald Certification segment, which is expected to reach US$108.5 Million by 2030 with a CAGR of a 3.5%. The Pearl Certification segment is also set to grow at 3.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $61.2 Million in 2024, and China, forecasted to grow at an impressive 5.7% CAGR to reach $52.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Gemstone Certification Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Gemstone Certification Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Gemstone Certification Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Laboratories, Alimera Sciences, Inc., Applied Medical Technology, Inc. (AMT), Avanos Medical, Inc., B. Braun Melsungen AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Select Competitors (Total 42 Featured):

- AGL (American Gemological Laboratories)

- AGS (American Gem Society)

- AnchorCert Gem Lab

- Bahrain Institute for Pearls and Gemstones (Danat)

- CGL (Central Gem Laboratory)

- CISGEM (Centro Informazioni e Servizi Gemmologici)

- DSEF German Gem Lab

- EGL USA (European Gemological Laboratory USA)

- GCI (Gemological Center of Israel)

- GIA (Gemological Institute of America)

- GII (Gemological Institute of India)

- GRS (GemResearch Swisslab)

- Gubelin Gem Lab

- HRD Antwerp

- IGI (International Gemological Institute)

- IIGJ (Indian Institute of Gems & Jewellery)

- ImaGem Inc.

- Indian Diamond Institute (IDI)

- International Gem Testing Laboratory (IGTL)

- Japan Germany Gemmological Laboratory (JGGL)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AGL (American Gemological Laboratories)

- AGS (American Gem Society)

- AnchorCert Gem Lab

- Bahrain Institute for Pearls and Gemstones (Danat)

- CGL (Central Gem Laboratory)

- CISGEM (Centro Informazioni e Servizi Gemmologici)

- DSEF German Gem Lab

- EGL USA (European Gemological Laboratory USA)

- GCI (Gemological Center of Israel)

- GIA (Gemological Institute of America)

- GII (Gemological Institute of India)

- GRS (GemResearch Swisslab)

- Gubelin Gem Lab

- HRD Antwerp

- IGI (International Gemological Institute)

- IIGJ (Indian Institute of Gems & Jewellery)

- ImaGem Inc.

- Indian Diamond Institute (IDI)

- International Gem Testing Laboratory (IGTL)

- Japan Germany Gemmological Laboratory (JGGL)

Table Information

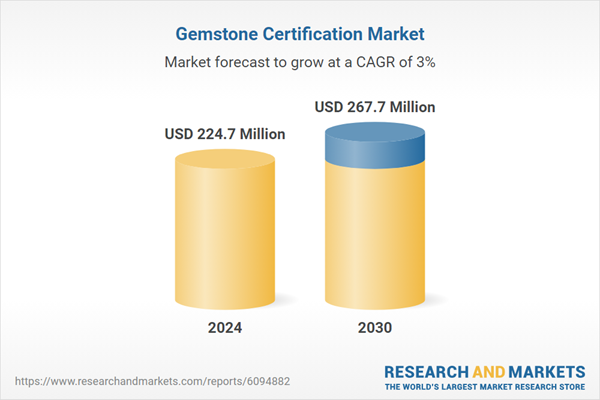

| Report Attribute | Details |

|---|---|

| No. of Pages | 282 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 224.7 Million |

| Forecasted Market Value ( USD | $ 267.7 Million |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Global |