Global 'Gummy Vitamins' Market - Key Trends & Drivers Summarized

Why Are Gummy Vitamins Reshaping the Nutraceutical Consumption Landscape?

Gummy vitamins have rapidly evolved from a niche children's supplement to a mainstream, multi-generational format that dominates the nutraceuticals market. What began as a way to make vitamins more palatable for kids has transformed into a lifestyle-driven product category embraced by adults, seniors, and even athletes. This shift is largely due to the unique blend of function and form that gummy vitamins offer - convenient, tasty, and chewable supplements that make adherence easier for users who dislike pills or capsules. Unlike traditional formats, gummies are often perceived as enjoyable and indulgent, which significantly improves consumer compliance with daily nutritional routines. As a result, they've become a preferred choice for multivitamins, as well as for specialized formulations targeting immunity, sleep, beauty, digestion, and cognitive health.Furthermore, the broader wellness movement and rise of self-directed health management are reinforcing gummy vitamins as a core product in household health routines. In a time when consumers are increasingly skeptical of overprocessed products, gummies offer transparency and a sense of control. Brands are capitalizing on this by launching sugar-free, organic, vegan, and allergen-free variants, making gummies more accessible across a wider audience. The personalization trend is also impacting the sector, with custom-formulated gummy subscriptions gaining traction among consumers who prioritize tailored nutrition. These consumer behaviors are supporting a continuous wave of innovation and expansion within the gummy vitamin category.

How Is Technology Redefining Gummy Formulation and Production?

The production of gummy vitamins has undergone significant technological transformation to support demand across diverse health verticals. Originally limited by ingredient stability and taste-masking challenges, manufacturers now use advanced microencapsulation and cold-processing techniques to include a broader range of active ingredients without compromising flavor or texture. High-performance pectin and starch bases are replacing gelatin to cater to vegan consumers while improving shelf stability and temperature resistance. These technical improvements have enabled manufacturers to include complex ingredients like probiotics, omega-3s, adaptogens, and botanical extracts into gummy formulations - something that was previously unfeasible in chewable formats due to degradation or poor solubility.Automation and precision in gummy molding equipment have also made it easier to produce consistently dosed, mass-market products at scale, while meeting regulatory guidelines for functional foods and dietary supplements. High-throughput machinery integrated with real-time quality control systems now supports cleaner production and faster product cycles. As ingredient sourcing continues to evolve, many companies are also investing in sustainable packaging and clean-label formulations to align with consumer preferences. The ability to track sourcing, manufacturing, and nutrient bioavailability more transparently has significantly elevated the profile of gummy vitamins from a candy-like supplement to a science-backed delivery format.

Where Is Demand Rising the Fastest and Who's Fueling It?

The gummy vitamin market is witnessing widespread geographical expansion, with North America remaining the largest and most established region due to high consumer awareness, brand innovation, and distribution maturity. The United States leads in both consumption and product variety, with strong participation from both legacy pharmaceutical firms and nutraceutical startups. Europe follows closely, especially in the UK, Germany, and the Nordics, where clean-label and vegan trends are driving product diversification. Asia-Pacific is experiencing rapid growth fueled by increasing health consciousness, rising disposable incomes, and urban lifestyle shifts in countries like India, China, and Australia. These markets are also seeing expanded e-commerce access and direct-to-consumer models that bring international brands within reach.Within demographics, millennials and Gen Z are primary drivers of market momentum, valuing both aesthetics and functionality in wellness products. This consumer base is heavily influenced by social media, influencer marketing, and wellness content, making them responsive to visually appealing and flavor-enhanced supplement formats. Meanwhile, older adults are being drawn in through formulations focused on joint health, bone density, and cognitive support, with ease of consumption playing a critical role. Children's formulations remain strong, but the real acceleration lies in adult-specific gummies targeting personalized health needs. Retailers and brands are responding by expanding shelf space and online visibility for gummy formats across grocery, pharmacy, and digital platforms alike.

What's Powering the Boom in the Gummy Vitamins Market Today?

The growth in the gummy vitamins market is driven by several factors related to formulation technology, end-user trends, and distribution innovation. Technological advancements in encapsulation and ingredient stabilization have broadened the functional range of gummy vitamins, allowing the inclusion of sensitive and once-impossible ingredients like collagen peptides, adaptogens, and fish oil without taste or texture issues. End-use expansion is equally vital - consumers across age groups are turning to gummies for specialized health needs, whether it's immunity, sleep enhancement, beauty-from-within, or gut health. Additionally, lifestyle shifts toward pill fatigue, preference for clean-label supplements, and growing acceptance of nutraceuticals as daily essentials are fueling broader usage.On the distribution front, the success of gummy vitamins is tightly linked to the rise of health-focused e-commerce, direct-to-consumer brands, and cross-channel visibility through supermarkets, drugstores, and wellness platforms. Customized offerings, attractive packaging, and influencer endorsements have made gummies a marketing-friendly product with broad visual and emotional appeal. The convergence of convenience, taste, and science-backed nutrition continues to position gummy vitamins not just as a passing trend, but as a central delivery format in the evolving global supplement market.

Report Scope

The report analyzes the Gummy Vitamins market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Multi Vitamins, Single Vitamins); Source (Plant-based Source, Animal-based Source); Distribution Channel (Online Distribution Channel, Offline Distribution Channel).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Some of the 34 companies featured in this Gummy Vitamins market report include -

- ABH Labs LLC

- Amway Corporation

- Bettera Brands LLC

- Bayer AG

- Biocaro Pharmaceutical Co., Ltd

- Church & Dwight Co., Inc.

- Estrellas Life Sciences Pvt Ltd

- Ferrara Candy Company

- Gimbal Brothers Inc.

- GlaxoSmithKline plc

- Hero Nutritionals LLC

- Healthvit

- Herbaland Naturals Inc.

- IM Healthcare

- Life Science Nutritionals

- Lonza Group

- Makers Nutrition LLC

- Melrob Group

- Nature's Bounty Co.

- Nature's Way Products LLC

- Nestlé Health Science

- Nutra Solutions USA

- Olly Public Benefit Corporation

- Otsuka Pharmaceutical Co., Ltd.

- Reckitt Benckiser Group plc

- Santa Cruz Nutritionals Inc.

- Sirio Pharma Co.

- Softigel

- The Clorox Company

- The Good Vitamin Co.

- Unilever PLC

- Vitakem Nutraceutical Inc.

- Zanon Lifesciences Pvt Ltd

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Multi Vitamins segment, which is expected to reach US$9.4 Billion by 2030 with a CAGR of a 11.8%. The Single Vitamins segment is also set to grow at 7.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.9 Billion in 2024, and China, forecasted to grow at an impressive 14.7% CAGR to reach $2.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Gummy Vitamins Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Gummy Vitamins Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Gummy Vitamins Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ACE Surgical Supply Co., BEGO, Bioteck, Biotech Dental, Botiss Biomaterials and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Select Competitors (Total 34 Featured):

- ABH Labs LLC

- Amway Corporation

- Bettera Brands LLC

- Bayer AG

- Biocaro Pharmaceutical Co., Ltd

- Church & Dwight Co., Inc.

- Estrellas Life Sciences Pvt Ltd

- Ferrara Candy Company

- Gimbal Brothers Inc.

- GlaxoSmithKline plc

- Hero Nutritionals LLC

- Healthvit

- Herbaland Naturals Inc.

- IM Healthcare

- Life Science Nutritionals

- Lonza Group

- Makers Nutrition LLC

- Melrob Group

- Nature's Bounty Co.

- Nature's Way Products LLC

- Nestlé Health Science

- Nutra Solutions USA

- Olly Public Benefit Corporation

- Otsuka Pharmaceutical Co., Ltd.

- Reckitt Benckiser Group plc

- Santa Cruz Nutritionals Inc.

- Sirio Pharma Co.

- Softigel

- The Clorox Company

- The Good Vitamin Co.

- Unilever PLC

- Vitakem Nutraceutical Inc.

- Zanon Lifesciences Pvt Ltd

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABH Labs LLC

- Amway Corporation

- Bettera Brands LLC

- Bayer AG

- Biocaro Pharmaceutical Co., Ltd

- Church & Dwight Co., Inc.

- Estrellas Life Sciences Pvt Ltd

- Ferrara Candy Company

- Gimbal Brothers Inc.

- GlaxoSmithKline plc

- Hero Nutritionals LLC

- Healthvit

- Herbaland Naturals Inc.

- IM Healthcare

- Life Science Nutritionals

- Lonza Group

- Makers Nutrition LLC

- Melrob Group

- Nature's Bounty Co.

- Nature's Way Products LLC

- Nestlé Health Science

- Nutra Solutions USA

- Olly Public Benefit Corporation

- Otsuka Pharmaceutical Co., Ltd.

- Reckitt Benckiser Group plc

- Santa Cruz Nutritionals Inc.

- Sirio Pharma Co.

- Softigel

- The Clorox Company

- The Good Vitamin Co.

- Unilever PLC

- Vitakem Nutraceutical Inc.

- Zanon Lifesciences Pvt Ltd

Table Information

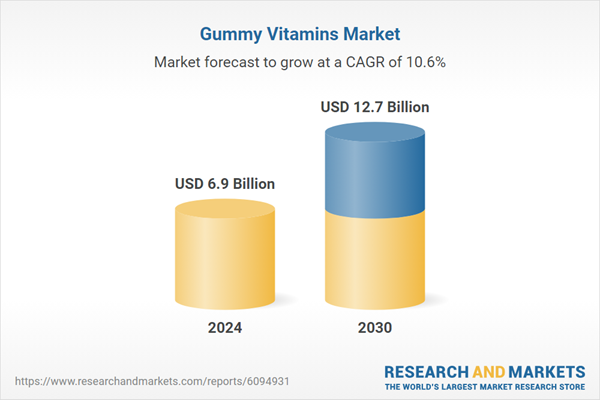

| Report Attribute | Details |

|---|---|

| No. of Pages | 358 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.9 Billion |

| Forecasted Market Value ( USD | $ 12.7 Billion |

| Compound Annual Growth Rate | 10.6% |

| Regions Covered | Global |