Global Hardware Acceleration Market - Key Trends & Drivers Summarized

Why Is Hardware Acceleration Becoming Indispensable in High-Performance Computing?

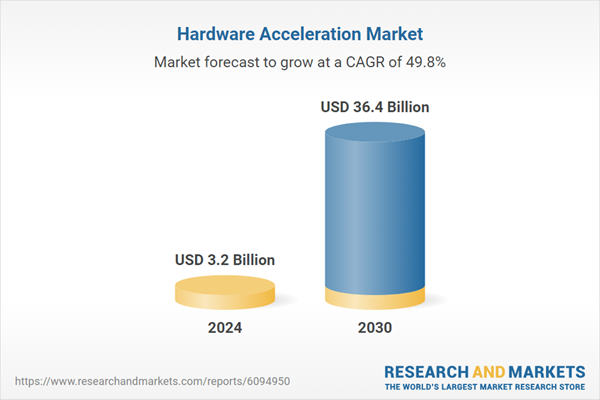

The global hardware acceleration market is rapidly expanding as the need for faster and more efficient data processing intensifies across sectors such as artificial intelligence, machine learning, cloud computing, and real-time analytics. Hardware acceleration involves offloading specific tasks from the CPU to dedicated hardware components like GPUs, FPGAs, or ASICs, thereby significantly improving processing speed and energy efficiency. As data volumes soar and applications become more compute-intensive - ranging from autonomous vehicles and blockchain validation to high-frequency trading and genomic sequencing - traditional CPU-based systems struggle to meet the required performance benchmarks. Hardware accelerators, with their parallel processing capabilities, provide the necessary computational muscle to handle these complex tasks. This evolution has made acceleration hardware a foundational element in enterprise data centers, edge computing environments, and even consumer electronics like smartphones and gaming consoles.How Are Advancements in Semiconductor Design Driving the Market Forward?

Breakthroughs in chip architecture and semiconductor fabrication technologies are playing a pivotal role in the development and adoption of hardware accelerators. New generations of GPUs from companies like NVIDIA and AMD offer thousands of cores optimized for massive parallelism, essential for training deep learning models. FPGAs and ASICs, once confined to niche applications, are now being integrated into mainstream computing platforms due to their programmability, lower latency, and energy efficiency. Furthermore, system-on-chip (SoC) designs are enabling the integration of various accelerators onto a single chip, reducing latency and enhancing computational throughput. Innovations such as 3D stacking, chiplet architecture, and advanced interconnects are pushing the limits of scalability and performance. As Moore's Law slows, the role of hardware acceleration becomes even more pronounced in achieving desired computational gains without simply increasing transistor counts.What Role Do Industry-Specific Applications Play in Fueling Adoption?

The demand for hardware acceleration is being amplified by its expanding application footprint across industries. In the financial sector, accelerators are used for risk modeling, fraud detection, and algorithmic trading, where microseconds can determine competitive advantage. Healthcare and life sciences utilize these technologies for complex image processing, molecular simulations, and diagnostics powered by AI. In media and entertainment, hardware accelerators enable real-time video encoding, rendering, and streaming, improving quality while reducing latency. The automotive industry relies on them for real-time sensor fusion and decision-making in advanced driver-assistance systems (ADAS). Even cybersecurity is leveraging acceleration to perform rapid encryption, threat detection, and intrusion prevention at scale. These industry-specific use cases demand a combination of high-speed processing, low latency, and real-time responsiveness - capabilities that hardware accelerators are uniquely suited to deliver.What Are the Primary Catalysts Driving Growth in the Hardware Acceleration Market?

The growth in the hardware acceleration market is driven by several factors. Chief among them is the rising volume and complexity of data that modern applications must process, prompting the need for faster, more efficient computational methods. The proliferation of artificial intelligence and machine learning across sectors necessitates specialized hardware that can manage training and inference workloads at scale. The transition to edge computing and the increasing need for real-time analytics are pushing organizations to adopt accelerators that can perform localized processing with minimal latency. Additionally, improvements in chip design, cost efficiency, and energy optimization are making these solutions accessible to a wider range of users - from cloud service providers to embedded device manufacturers. The growing use of accelerators in industry-specific applications such as finance, automotive, and healthcare also reinforces demand. Finally, strategic investments from leading tech firms and semiconductor companies are accelerating innovation, ecosystem development, and broader adoption of hardware acceleration solutions globally.Report Scope

The report analyzes the Hardware Acceleration market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Graphics Processing Unit, Video Processing Unit, AI Accelerator, Regular Expression Accelerator, Cryptographic Accelerator, Other Types); Application (Deep Learning Training Application, Public Cloud Inference Application, Enterprise Inference Application, Other Applications); End-Use (IT & Telecom End-Use, BFSI End-Use, Retail End-Use, Hospitality End-Use, Logistics End-Use, Automotive End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Graphics Processing Unit segment, which is expected to reach US$13.6 Billion by 2030 with a CAGR of a 53.1%. The Video Processing Unit segment is also set to grow at 52.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $847.4 Million in 2024, and China, forecasted to grow at an impressive 46.9% CAGR to reach $5.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Hardware Acceleration Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Hardware Acceleration Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Hardware Acceleration Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Albanese Confectionery, American Licorice Company, Arcor, August Storck, Brach’s Confections and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Hardware Acceleration market report include:

- Advanced Micro Devices (AMD)

- Arm Holdings

- Broadcom Inc.

- Cavium (Marvell Technology Group)

- Cisco Systems

- Cray (Hewlett Packard Enterprise)

- Graphcore

- Intel Corporation

- IBM

- Mellanox Technologies

- Microsoft

- NVIDIA Corporation

- Qualcomm

- Xilinx

- Alibaba DAMO Academy

- Armory Technologies

- Cerebras Systems

- Fujitsu

- Google (TPU - Tensor Processing Units)

- Huawei

- Inspur

- Micron Technology

- OpenAI

- Samsung Electronics

- Tenstorrent

- Wave Computing

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Advanced Micro Devices (AMD)

- Arm Holdings

- Broadcom Inc.

- Cavium (Marvell Technology Group)

- Cisco Systems

- Cray (Hewlett Packard Enterprise)

- Graphcore

- Intel Corporation

- IBM

- Mellanox Technologies

- Microsoft

- NVIDIA Corporation

- Qualcomm

- Xilinx

- Alibaba DAMO Academy

- Armory Technologies

- Cerebras Systems

- Fujitsu

- Google (TPU - Tensor Processing Units)

- Huawei

- Inspur

- Micron Technology

- OpenAI

- Samsung Electronics

- Tenstorrent

- Wave Computing

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.2 Billion |

| Forecasted Market Value ( USD | $ 36.4 Billion |

| Compound Annual Growth Rate | 49.8% |

| Regions Covered | Global |