Global Depression Drugs Market - Key Trends & Drivers Summarized

Why Does the Demand for Depression Drugs Continue to Escalate Worldwide?

Depression remains one of the most prevalent and debilitating mental health disorders globally, driving sustained demand for pharmacological treatments. Major depressive disorder (MDD), bipolar depression, dysthymia, and seasonal affective disorder collectively account for a substantial share of the global mental illness burden. The ongoing rise in diagnosed cases - partly fueled by growing public awareness, reduced stigma, and improved access to psychiatric care - has led to a consistent increase in the prescription of antidepressant medications. Additionally, recent global events, including economic stress, conflict, and pandemic-related isolation, have heightened the need for effective, scalable mental health solutions.Depression drugs serve a critical role in stabilizing neurochemical imbalances and alleviating symptoms such as persistent sadness, lack of motivation, and suicidal ideation. Antidepressants are also frequently prescribed for off-label uses such as chronic pain, anxiety, and sleep disorders, expanding their therapeutic utility. As healthcare systems prioritize mental health and integrate it into primary care models, antidepressant therapy is becoming a frontline treatment option, driving growth in both generic and branded drug segments.

How Are Drug Classes and Novel Mechanisms of Action Evolving to Meet Clinical Needs?

The depression drug market comprises several well-established classes, including Selective Serotonin Reuptake Inhibitors (SSRIs), Serotonin-Norepinephrine Reuptake Inhibitors (SNRIs), Tricyclic Antidepressants (TCAs), and Monoamine Oxidase Inhibitors (MAOIs). SSRIs and SNRIs dominate prescriptions due to their favorable safety profiles, ease of use, and broad applicability. However, limitations such as delayed onset of action, partial response, and side effects including weight gain and sexual dysfunction have underscored the need for alternative treatments.This has led to the emergence of newer agents with novel mechanisms of action. Atypical antidepressants targeting glutamatergic pathways, such as NMDA receptor antagonists, are gaining attention for their rapid-acting effects. Esketamine nasal spray, for example, offers fast symptom relief in treatment-resistant depression. Meanwhile, drugs modulating melatonin receptors and other neuropeptides are under investigation to address circadian rhythm disruptions associated with depressive states. These innovations mark a significant shift from monoamine-targeting therapies to neurocircuitry modulation, promising more personalized and fast-acting treatment options.

What Are the Regulatory and Commercial Trends Influencing Market Competition?

Patent expiries of major antidepressants have created a robust generic drug landscape, particularly in mature markets, intensifying price competition and improving affordability. However, this has also pushed pharmaceutical companies to invest in differentiated therapies targeting unmet needs, such as treatment-resistant depression, adolescent and pediatric depression, and depression with co-morbid anxiety or substance abuse. Fast-track regulatory approvals, orphan designations, and breakthrough therapy statuses are being granted to innovative drugs that demonstrate clinical value in hard-to-treat populations.Pharma companies are also leveraging lifecycle management strategies, including extended-release formulations, combination therapies, and novel delivery systems to sustain brand exclusivity. Partnerships between biotech firms and mental health startups are facilitating drug development using digital biomarkers and AI-based patient monitoring. These tools are helping identify more responsive subgroups, monitor adherence, and measure real-time outcomes, making depression drug development increasingly data-driven and patient-centric.

What Are the Primary Forces Propelling Growth in the Depression Drugs Market?

The growth in the depression drugs market is driven by several factors, including rising mental health burden across age groups, expanding diagnosis rates, and the continued shift toward pharmacological intervention as a first-line treatment. The integration of mental health services into primary and telehealth care platforms is making antidepressants more accessible, while broader insurance coverage for mental health conditions is removing cost-related treatment barriers. This is especially critical in emerging economies where infrastructure is improving and cultural stigma around psychiatric care is gradually diminishing.Scientific advancements in neurobiology are enabling the discovery of faster-acting and more targeted therapies, appealing to both physicians and patients seeking quicker symptom resolution. Additionally, the growing focus on individualized treatment pathways is fostering demand for diversified drug classes and delivery systems. As public health systems prioritize early intervention and continuity of care for depression, pharmaceutical innovation, digital therapeutics integration, and expanded treatment guidelines will continue to drive market expansion in both developed and emerging regions.

Report Scope

The report analyzes the Depression Drugs market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Drug Class (Atypical Antipsychotics, Serotonin-Norepinephrine Reuptake Inhibitors, Selective Serotonin Reuptake Inhibitors, Central Nervous System Stimulants, Tricyclic Antidepressants, Monoamine Oxidase Inhibitors, Other Drug Classes); Drug Type (Generic Drugs, Branded Drugs); Disorder (Major Depressive Disorder, Obsessive-Compulsive Disorder, Generalized Anxiety Disorder, Panic Disorder, Other Disorders).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Atypical Antipsychotics segment, which is expected to reach US$4.5 Billion by 2030 with a CAGR of a 1.8%. The Serotonin-Norepinephrine Reuptake Inhibitors segment is also set to grow at 1.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.9 Billion in 2024, and China, forecasted to grow at an impressive 3.6% CAGR to reach $3.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Depression Drugs Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Depression Drugs Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Depression Drugs Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 42 North Dental, Affordable Care LLC, Apollo White Dental, Aspen Dental Management, Inc., Benevis and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Depression Drugs market report include:

- AbbVie Inc.

- Alkermes plc

- AstraZeneca plc

- Bausch Health Companies Inc.

- Bristol Myers Squibb Company

- Cipla Limited

- Dr. Reddy's Laboratories Ltd.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd.

- GlaxoSmithKline plc

- H. Lundbeck A/S

- Johnson & Johnson

- Lupin Limited

- Luye Pharma Group Ltd.

- Novartis International AG

- Otsuka Holdings Co., Ltd.

- Pfizer Inc.

- Sanofi S.A.

- Takeda Pharmaceutical Company Ltd.

- Teva Pharmaceutical Industries Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AbbVie Inc.

- Alkermes plc

- AstraZeneca plc

- Bausch Health Companies Inc.

- Bristol Myers Squibb Company

- Cipla Limited

- Dr. Reddy's Laboratories Ltd.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd.

- GlaxoSmithKline plc

- H. Lundbeck A/S

- Johnson & Johnson

- Lupin Limited

- Luye Pharma Group Ltd.

- Novartis International AG

- Otsuka Holdings Co., Ltd.

- Pfizer Inc.

- Sanofi S.A.

- Takeda Pharmaceutical Company Ltd.

- Teva Pharmaceutical Industries Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 380 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

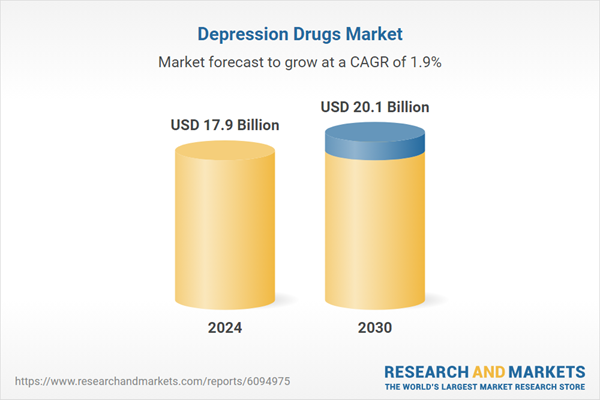

| Estimated Market Value ( USD | $ 17.9 Billion |

| Forecasted Market Value ( USD | $ 20.1 Billion |

| Compound Annual Growth Rate | 1.9% |

| Regions Covered | Global |