Global Diagnostic Contract Manufacturing Market - Key Trends & Drivers Summarized

Why Is Contract Manufacturing Becoming Essential in the Diagnostics Industry?

Contract manufacturing has become a pivotal component of the diagnostics industry, enabling diagnostic companies to rapidly scale production, reduce time-to-market, and optimize operational costs. As diagnostic technologies diversify - ranging from point-of-care (PoC) and molecular diagnostics to immunoassays and rapid antigen tests - the complexity and volume of production have increased significantly. Outsourcing manufacturing allows diagnostic developers to focus on core competencies such as assay development, regulatory approvals, and commercialization while leveraging the technical, regulatory, and supply chain expertise of specialized contract manufacturing organizations (CMOs).The surge in demand for diagnostic kits and devices - particularly in the wake of global public health emergencies - has intensified reliance on CMOs for high-capacity, scalable, and quality-controlled production. Smaller diagnostic startups, as well as established in-vitro diagnostics (IVD) companies, are increasingly partnering with contract manufacturers to access advanced infrastructure, reduce capital investment, and maintain regulatory compliance in multiple geographies. This outsourcing model also supports rapid response to emerging disease outbreaks and ensures manufacturing continuity across fluctuating demand cycles.

How Are Technological Capabilities and Regulatory Expertise Enhancing CMO Value Propositions?

Modern CMOs offer end-to-end diagnostic manufacturing services that span reagent formulation, lyophilization, kit assembly, device fabrication, packaging, sterilization, and logistics. These services are supported by advanced technologies such as microfluidics integration, automated filling and sealing systems, lab-on-a-chip platform assembly, and cleanroom-based production environments. Such capabilities enable the production of highly sensitive and complex diagnostic tools, including lateral flow assays, PCR-based test kits, and digital diagnostic devices.In addition to technical capabilities, regulatory compliance is a critical advantage provided by leading CMOs. Manufacturers with ISO 13485 certification and FDA-registered facilities ensure adherence to Good Manufacturing Practices (GMP), Quality System Regulations (QSR), and country-specific regulatory protocols. Their familiarity with CE marking, EUA procedures, and IVD regulatory frameworks across global markets reduces the burden on diagnostic companies and helps accelerate time-to-market. Integrated quality assurance, validation, and documentation services also support product audits and clinical trial material production.

What Market Trends Are Shaping Demand for Diagnostic Contract Manufacturing Services?

The rise of decentralized diagnostics - driven by trends such as at-home testing, wearable diagnostics, and mobile-connected PoC solutions - is expanding the complexity of manufacturing requirements. Diagnostic firms are now outsourcing the production of compact, user-friendly, and digitally integrated testing kits that require specialized expertise in electronics, biosensors, and packaging engineering. Additionally, the expansion of multiplex diagnostics and combination testing (e.g., flu-COVID panels) is pushing CMOs to handle intricate reagent formulations and multi-analyte test formats.Pharma-diagnostics collaborations are also driving demand, particularly for companion diagnostics (CDx) that must be co-developed and co-manufactured alongside therapeutic agents. These require stringent coordination, precision manufacturing, and regulatory alignment. Furthermore, global supply chain disruptions have highlighted the need for geographically diversified and risk-resilient manufacturing networks, prompting diagnostic companies to adopt multi-site and dual-sourcing strategies - frequently supported through CMO partnerships.

What Are the Key Drivers Accelerating Growth in the Diagnostic Contract Manufacturing Market?

The growth in the diagnostic contract manufacturing market is driven by several factors, including rising demand for scalable and compliant manufacturing solutions, rapid advancements in diagnostic technologies, and the increasing outsourcing of non-core functions by diagnostic companies. As the global IVD and PoC testing markets continue to expand - fueled by infectious disease surveillance, chronic disease monitoring, and personalized medicine - the need for high-throughput, quality-assured manufacturing infrastructure is growing.Cost optimization, faster product deployment, and reduced regulatory risks are prompting diagnostic firms to outsource development and production processes. The emergence of small and mid-sized diagnostic innovators, supported by venture funding and technology accelerators, further expands the addressable market for CMOs. Additionally, regulatory tightening across major markets has increased the importance of specialized manufacturing partners with proven compliance records. As diagnostics become more integrated into public health, disease prevention, and precision medicine, the diagnostic contract manufacturing sector is poised for robust, sustained growth globally.

Report Scope

The report analyzes the Diagnostic Contract Manufacturing market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (In-Vitro Diagnostic Devices, Diagnostics Imaging Devices, Other Products); Service (Device Development & Manufacturing Service, Quality management Services, Packing & Assembly Services, Other Services); Application (Infectious Disease Application, Diabetes Application, Oncology Application, Cardiology Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the In-Vitro Diagnostic Devices segment, which is expected to reach US$25.5 Billion by 2030 with a CAGR of a 8.8%. The Diagnostics Imaging Devices segment is also set to grow at 6.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7.6 Billion in 2024, and China, forecasted to grow at an impressive 12.7% CAGR to reach $9.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Diagnostic Contract Manufacturing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Diagnostic Contract Manufacturing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Diagnostic Contract Manufacturing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott, Almatica Pharma LLC, Astellas Pharma Inc., AstraZeneca, Bayer AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Diagnostic Contract Manufacturing market report include:

- Abbott Laboratories

- Abingdon Health

- Almac Group

- ANP Technologies

- Argonaut Manufacturing Services

- Avioq Inc.

- Becton Dickinson and Company (BD)

- Bio-Rad Laboratories

- Biokit S.A.

- Celestica Inc.

- Cenogenics Corporation

- Flex Ltd.

- Fujirebio Inc.

- Invetech Pty. Ltd.

- Jabil Inc.

- KMC Systems

- Meridian Bioscience Inc.

- Nolato AB

- Philips-Medisize Corporation

- Thermo Fisher Scientific Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- Abingdon Health

- Almac Group

- ANP Technologies

- Argonaut Manufacturing Services

- Avioq Inc.

- Becton Dickinson and Company (BD)

- Bio-Rad Laboratories

- Biokit S.A.

- Celestica Inc.

- Cenogenics Corporation

- Flex Ltd.

- Fujirebio Inc.

- Invetech Pty. Ltd.

- Jabil Inc.

- KMC Systems

- Meridian Bioscience Inc.

- Nolato AB

- Philips-Medisize Corporation

- Thermo Fisher Scientific Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 376 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

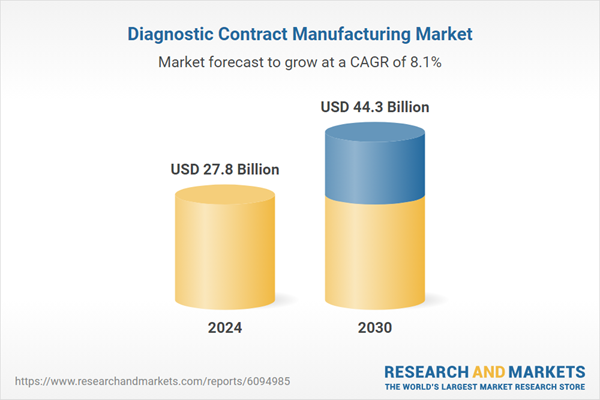

| Estimated Market Value ( USD | $ 27.8 Billion |

| Forecasted Market Value ( USD | $ 44.3 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |