Global Display Integrated Circuits Market - Key Trends & Drivers Summarized

What's Behind the Expanding Role of Display ICs in Smart and Connected Devices?

Display Integrated Circuits (ICs) have emerged as essential enablers in a world increasingly reliant on visual interfaces. These ICs are critical for managing the performance of digital screens, which are now ubiquitous across consumer electronics, industrial applications, and smart environments. As screens become more prevalent - not just in phones and televisions, but also in wearable devices, automotive dashboards, industrial controls, and household appliances - the demand for high-performance, energy-efficient, and compact display ICs has surged. In recent years, the concept of the “smart interface” has expanded dramatically, with users expecting immersive, responsive, and vivid display experiences. From ultra-thin laptops and foldable smartphones to smart refrigerators and interactive kiosks, the display IC has become central to how technology is consumed and interacted with. This growing dependency on screens for information, entertainment, and productivity is a major factor driving the rapid growth of the global display IC market.How Are Technology Transitions Shaping the Competitive Landscape of Display ICs?

As display technologies evolve from TFT-LCDs to OLED, AMOLED, micro-LED, and quantum dot displays, display ICs must keep pace with new performance standards. OLED and AMOLED displays require more complex voltage control and finer current management, demanding ICs that offer superior stability, power efficiency, and miniaturization. Furthermore, emerging innovations such as flexible and transparent displays are presenting engineering challenges that require highly adaptive and lightweight ICs capable of operating in non-traditional form factors. The rise of high refresh rate displays, particularly in gaming devices and premium smartphones, has increased the need for ICs that can handle faster signal processing with minimal latency. In response, IC designers are leveraging advancements in semiconductor node scaling, packaging technologies, and integration capabilities. Manufacturers are also developing multifunctional display ICs that integrate touch sensing, power management, and backlight control, simplifying device architecture while enhancing performance. These technology shifts are intensifying competition among key players, pushing the market toward faster innovation cycles and strategic partnerships in materials and design.What Applications Are Redefining Market Boundaries for Display ICs?

The scope of display IC applications is rapidly expanding beyond traditional domains, creating new market frontiers. While smartphones and televisions remain the dominant platforms, display ICs are now being heavily integrated into smart home devices, automotive electronics, medical equipment, and industrial control panels. In the automotive sector, digital instrument clusters, infotainment systems, and advanced driver-assistance displays rely on robust ICs to ensure real-time performance under variable conditions. In healthcare, portable diagnostic devices and wearable monitors incorporate compact display ICs to power high-contrast, energy-efficient displays that ensure usability and battery longevity. In industrial environments, ruggedized display ICs are being deployed in machinery, logistics trackers, and factory automation interfaces. The growing relevance of these applications is fueling demand for specialized ICs that can operate in extreme temperatures, handle electromagnetic interference, and ensure long lifecycle durability. With the rise of IoT ecosystems, display ICs are increasingly being integrated into connected devices where screen clarity and responsiveness directly impact user experience and operational efficiency.What Are the Major Forces Driving Growth in the Display Integrated Circuits Market?

The growth in the display integrated circuits market is driven by several factors. The explosion in consumer electronics, particularly smartphones, tablets, and televisions, continues to be a primary catalyst, demanding ICs that support higher resolutions, better color accuracy, and slimmer device designs. The rapid adoption of advanced display technologies such as OLED, AMOLED, and micro-LED has created a need for ICs with improved current handling, dynamic range, and form factor adaptability. The proliferation of smart and connected devices - ranging from wearables to home appliances - has expanded the market's breadth, requiring ICs with low power consumption and multifunctional integration. The automotive industry is contributing significantly to demand growth as vehicles evolve into digital ecosystems, requiring durable and responsive display ICs across multiple interface touchpoints. Additionally, technological advancements in chip design, including System-on-Chip (SoC) integration and AI-assisted display optimization, are enhancing IC capabilities while reducing component count. As device manufacturers strive for greater energy efficiency, visual performance, and product compactness, the demand for versatile, high-performance display ICs will continue to escalate across verticals.Report Scope

The report analyzes the Display Integrated Circuits market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Technology (LCD Driver ICs Technology, OLED Driver ICs Technology, LED Driver ICs Technology, MicroLED Driver ICs Technology, E-Paper Driver ICs Technology); Display Type (Small & Medium-Sized Displays, Large Displays, Flexible Displays, Transparent Displays); End-Use (Industrial & Manufacturing End-Use, Electronics & Semiconductor End-Use, Telecommunications End-Use, Healthcare End-Use, Aerospace & Defense End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the LCD Driver ICs segment, which is expected to reach US$500.2 Billion by 2030 with a CAGR of a 14.6%. The OLED Driver ICs segment is also set to grow at 9.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $165.2 Billion in 2024, and China, forecasted to grow at an impressive 17% CAGR to reach $261.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Display Integrated Circuits Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Display Integrated Circuits Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Display Integrated Circuits Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Analog Devices, Inc., BOE Technology Group Co., Ltd., Himax Technologies, Inc., Infineon Technologies AG, LX Semicon Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 37 companies featured in this Display Integrated Circuits market report include:

- BOE Technology Group

- Chipone Technology

- FocalTech Systems

- Himax Technologies

- ILITEK

- MagnaChip Semiconductor

- Novatek Microelectronics

- Orise Tech

- Panasonic Corporation

- Raydium Semiconductor

- Renesas Electronics

- Rohm Semiconductor

- Samsung Electronics

- Silicon Works

- Sitronix Technology

- Solomon Systech

- Synaptics Incorporated

- Texas Instruments

- THine Electronics

- Toshiba Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BOE Technology Group

- Chipone Technology

- FocalTech Systems

- Himax Technologies

- ILITEK

- MagnaChip Semiconductor

- Novatek Microelectronics

- Orise Tech

- Panasonic Corporation

- Raydium Semiconductor

- Renesas Electronics

- Rohm Semiconductor

- Samsung Electronics

- Silicon Works

- Sitronix Technology

- Solomon Systech

- Synaptics Incorporated

- Texas Instruments

- THine Electronics

- Toshiba Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 388 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

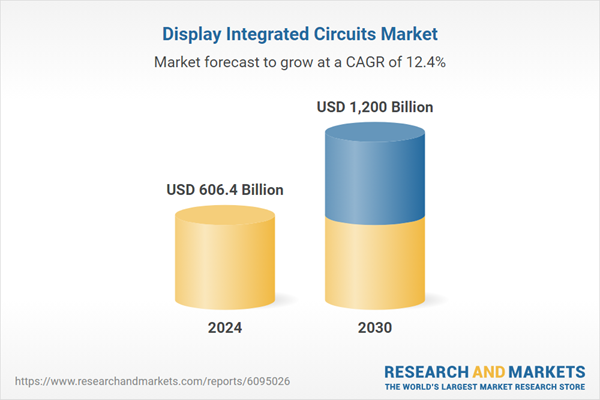

| Estimated Market Value ( USD | $ 606.4 Billion |

| Forecasted Market Value ( USD | $ 1200 Billion |

| Compound Annual Growth Rate | 12.4% |

| Regions Covered | Global |