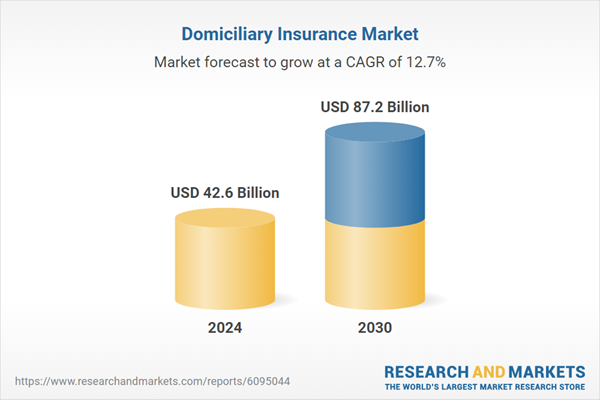

Global 'Domiciliary Insurance' Market - Key Trends & Drivers Summarized

Why Is Domiciliary Insurance Gaining Ground in a Post-Pandemic Healthcare Landscape?

Domiciliary insurance, which covers medical treatment provided at home in lieu of hospitalization, is witnessing unprecedented growth, catalyzed by changing healthcare paradigms in the wake of the COVID-19 pandemic. The pandemic exposed the limitations of hospital infrastructure and simultaneously demonstrated the viability and necessity of home-based care for non-critical yet resource-intensive treatments. As a result, insurers across the globe began expanding domiciliary cover to include a wider range of treatments, such as intravenous therapies, dialysis, chemotherapy, and physiotherapy, which previously necessitated hospitalization. This shift is also being supported by healthcare providers who are developing at-home service models, complete with visiting nurses, portable diagnostic kits, and telemedicine integration. Consumers are now more aware of the cost-efficiency, comfort, and reduced infection risk associated with home care, making domiciliary cover an increasingly valued feature in health insurance plans. This trend is especially prominent in aging societies like Japan and parts of Europe, where demand for eldercare at home is accelerating, and in emerging economies where urban hospital bed availability remains constrained.How Are Insurers and Healthtech Innovators Collaborating to Expand Coverage?

Insurers are entering strategic partnerships with healthtech startups, homecare service providers, and diagnostic labs to make domiciliary insurance more holistic and operationally feasible. These collaborations enable real-time monitoring, digital claim processing, and seamless service delivery without requiring patients to leave their homes. Some insurance firms have developed proprietary platforms or apps that connect policyholders with certified homecare providers, enabling bookings for doctors, nurses, physiotherapists, and even oxygen delivery or ICU setup within residential premises. Artificial intelligence and remote diagnostics tools are being deployed to validate treatments, assess medical necessity, and eliminate fraudulent claims, helping insurers manage costs without compromising service quality. Bundled health insurance packages now frequently include domiciliary services as standard rather than optional, a stark contrast to their limited inclusion a decade ago. Additionally, these partnerships are allowing insurers to gather health data for predictive risk analysis, which in turn enables more personalized premium pricing and targeted health interventions.Why Are Shifting Demographics and Economic Pressures Increasing Domiciliary Adoption?

Demographic shifts and rising medical inflation are making domiciliary insurance not just a convenience but a necessity. The growing elderly population across developed nations, along with the rise of nuclear family structures and solo living, is creating a strong need for at-home medical support. In countries like India, Brazil, and Indonesia, the middle class is expanding and aging simultaneously, leading to increased demand for affordable alternatives to prolonged hospitalization. Domiciliary care provides a practical solution, especially for chronic illness management, post-operative recovery, and palliative care, where hospitalization can be prohibitively expensive or logistically burdensome. Meanwhile, private hospitals - especially in metro areas - are becoming increasingly expensive, pushing both patients and insurers toward cost-effective domiciliary options. Employers are also revising group health policies to include domiciliary coverage, recognizing its role in reducing absenteeism and speeding up employee recovery. For younger policyholders, domiciliary coverage appeals as a flexible, tech-integrated alternative to conventional inpatient setups, aligning with their expectations for digital health services and on-demand access.The Growth in the Domiciliary Insurance Market Is Driven by Several Factors…

The growth in the domiciliary insurance market is driven by several factors rooted in shifting healthcare delivery models, evolving consumer expectations, and systemic cost pressures. Technological advancements enabling at-home diagnosis, treatment, and monitoring have made domiciliary care logistically feasible and clinically reliable. End-use dynamics have changed significantly, with elderly patients, chronic disease sufferers, and post-surgery cases increasingly opting for home treatment over hospitalization. The global rise in healthcare costs and hospital overcrowding has further pushed insurers to promote home-based care as a cost-containment strategy. Consumer behavior, too, has shifted - people now prefer the familiarity, privacy, and reduced risk of home environments for non-emergency treatment. Employers and group policy providers are integrating domiciliary benefits to enhance workforce health resilience, while governments in several regions are encouraging decentralization of healthcare to reduce pressure on public hospitals. Collectively, these technological, demographic, economic, and behavioral factors are making domiciliary insurance a cornerstone of modern health policy architecture across both developed and developing economies.Report Scope

The report analyzes the Domiciliary Insurance market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Insurance Type (Disease Insurance, Medical Insurance, Income Protection Insurance, Other Insurance Types); Coverage Type (Lifetime Coverage, Term Coverage); Service Provider (Private Service Provider, Public Service Provider).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Disease Insurance segment, which is expected to reach US$43.9 Billion by 2030 with a CAGR of a 14.6%. The Medical Insurance segment is also set to grow at 10.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $11.6 Billion in 2024, and China, forecasted to grow at an impressive 17.3% CAGR to reach $18.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Domiciliary Insurance Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Domiciliary Insurance Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Domiciliary Insurance Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ancol Pet Products Limited, Blueberry Pet, Chai's Choice, Coastal Pet Products Inc., Co-Leash Co Inc and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Domiciliary Insurance market report include:

- Aetna Inc.

- AIA Group Limited

- Allianz SE

- Assicurazioni Generali S.p.A.

- Assurant, Inc.

- Aviva plc

- AXA SA

- Blue Cross Blue Shield Association

- Centene Corporation

- Cigna Corporation

- Edelweiss General Insurance Company Limited

- Gothaer Group

- HDFC ERGO General Insurance Company Limited

- Health Care Service Corporation

- Humana Inc.

- ICICI Lombard General Insurance Company Limited

- Kaiser Foundation Health Plan Inc.

- Munich Re Group

- Ping An Insurance (Group) Company of China, Ltd.

- Religare Health Insurance Company Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aetna Inc.

- AIA Group Limited

- Allianz SE

- Assicurazioni Generali S.p.A.

- Assurant, Inc.

- Aviva plc

- AXA SA

- Blue Cross Blue Shield Association

- Centene Corporation

- Cigna Corporation

- Edelweiss General Insurance Company Limited

- Gothaer Group

- HDFC ERGO General Insurance Company Limited

- Health Care Service Corporation

- Humana Inc.

- ICICI Lombard General Insurance Company Limited

- Kaiser Foundation Health Plan Inc.

- Munich Re Group

- Ping An Insurance (Group) Company of China, Ltd.

- Religare Health Insurance Company Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 373 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 42.6 Billion |

| Forecasted Market Value ( USD | $ 87.2 Billion |

| Compound Annual Growth Rate | 12.7% |

| Regions Covered | Global |