Global Emission Control Technology Market - Key Trends & Drivers Summarized

What Makes Emission Control Technologies Central to Future Industrial and Automotive Compliance?

The increasing global push for stringent environmental regulations has thrust emission control technologies into the spotlight, transforming them into indispensable components of modern industrial, power generation, and transportation systems. These technologies encompass a wide spectrum of equipment and methodologies - including catalytic converters, diesel particulate filters (DPFs), selective catalytic reduction (SCR) systems, scrubbers, thermal oxidizers, and activated carbon filtration units - each designed to minimize the release of harmful pollutants such as nitrogen oxides (NOx), sulfur oxides (SOx), carbon monoxide (CO), hydrocarbons (HC), and particulate matter.With regulatory bodies such as the U.S. Environmental Protection Agency (EPA), the European Environment Agency (EEA), and China's Ministry of Ecology and Environment tightening permissible limits for emissions, the adoption of emission control systems has become mandatory across both new installations and retrofit applications. This is particularly evident in sectors such as automotive manufacturing, heavy industries, maritime shipping, and coal-fired power plants, where non-compliance leads to substantial penalties and operational shutdowns.

Moreover, global decarbonization goals underpinned by frameworks like the Paris Agreement and the EU Green Deal have expanded the relevance of emission control beyond just pollutants to include carbon capture, utilization, and storage (CCUS). As a result, emission control is no longer viewed solely as a regulatory compliance issue but also as a strategic enabler for achieving sustainability and ESG (Environmental, Social, and Governance) benchmarks. The expanding focus on net-zero targets by 2050 has given a fresh impetus to innovation and adoption in this space.

How Are Emerging Technologies and Hybrid Systems Redefining Efficiency and Scope?

Recent advancements in material science, artificial intelligence, and system integration are reshaping the performance, scalability, and adaptability of emission control technologies. For example, SCR systems are being optimized through real-time NOx sensor feedback and adaptive dosing algorithms that use AI-driven calibration to ensure minimal ammonia slip and maximum NOx conversion efficiency. Similarly, ceramic and silicon carbide-based DPFs now feature self-regenerating surfaces that allow continuous operation even in highly loaded engine conditions.The convergence of multiple emission control methods into hybrid systems is another breakthrough trend. In industrial furnaces and marine engines, combinations of SCR and oxidation catalysts are now integrated with wet scrubbers and particulate traps to deliver multistage emission abatement within a single compact unit. This hybridization reduces the system's physical footprint, simplifies maintenance, and ensures compliance with multi-pollutant regulatory mandates.

Additionally, the deployment of low-temperature catalysts has extended emission control capabilities into applications that previously posed thermal limitations, such as start-stop engines and idling industrial burners. Innovations such as plasma-assisted catalysis and UV-activated scrubbers are also being piloted to handle volatile organic compounds (VOCs) and emerging contaminants in specialty manufacturing and semiconductor fabs.

In parallel, digitalization is enabling predictive maintenance and intelligent diagnostics through IoT-enabled emission sensors and cloud-based data analytics. These smart monitoring systems not only help track real-time emissions but also optimize system performance, flag component degradation, and provide automated compliance reporting - a vital requirement in both highly regulated and decentralized industrial settings.

Which Industries and Regions Are Shaping the Competitive Landscape for Emission Controls?

The automotive sector has historically been the largest adopter of emission control technologies, accounting for a significant share of global revenue due to the sheer volume of vehicles produced annually. With the rollout of Euro 7 standards, Corporate Average Fuel Economy (CAFE) regulations, and China 6b norms, OEMs are integrating complex exhaust aftertreatment systems including lean NOx traps, urea dosing systems, and close-coupled catalysts even in smaller passenger vehicles.Heavy-duty diesel engines used in mining, rail, and construction are also significant consumers of emission control hardware, with Tier 4 and Stage V regulations necessitating advanced SCR and DPF combinations. In power generation, particularly coal and biomass plants, flue gas desulfurization (FGD) and selective non-catalytic reduction (SNCR) units dominate, though there is a growing shift toward CCUS technologies in pilot-scale and demonstration projects.

Geographically, Europe and North America lead in technology maturity and regulatory stringency, while Asia-Pacific represents the most lucrative growth opportunity due to rapid industrialization and urbanization. China's National Blue Sky Defense campaign and India's National Clean Air Programme (NCAP) are examples of regional initiatives driving retrofitting demand for industrial emission controls. Emerging economies in Southeast Asia, Africa, and Latin America are also increasingly mandating emission compliance in transportation and construction sectors, albeit with slower implementation curves.

Furthermore, the maritime sector, driven by IMO 2020 regulations, has become a major buyer of scrubbers and low-NOx technologies to manage emissions from bunker fuel combustion. Retrofitting of large ocean-going vessels is creating robust aftermarket opportunities, particularly in Singapore, the Middle East, and Northern Europe.

What Is Fueling the Market's Long-Term Expansion Amid Sustainability Pressures?

The growth in the emission control technology market is driven by several factors including evolving emissions legislation, expansion of pollution-intensive industrial bases in emerging markets, integration of digital monitoring systems, and intensifying global focus on ESG compliance and sustainability.Tightening emissions regulations across multiple sectors is the single most powerful growth catalyst. New mandates often require the addition of or upgrades to emission control systems across fleets and facilities, fostering both replacement and retrofit sales. For instance, diesel gensets and legacy power plants in the Middle East and Africa are being equipped with SCR and oxidation catalysts in response to rising environmental scrutiny.

Rapid urbanization in developing nations is further fueling industrial expansion, which in turn necessitates robust emission control infrastructure. Cement, steel, textile, and petrochemical plants are actively investing in baghouses, scrubbers, and continuous emission monitoring systems (CEMS) to meet both local regulations and international export standards. These investments are increasingly supported by multilateral green financing programs and carbon credit initiatives.

Digital transformation is playing a complementary role. The inclusion of emission control within Industry 4.0 frameworks allows for better energy-emissions tradeoffs, precise environmental reporting, and lower total cost of ownership. Vendors are bundling emission hardware with cloud-based analytics platforms that support compliance documentation, predictive maintenance, and carbon footprint calculation - particularly valuable for large-scale manufacturing and logistics operations.

Finally, the long-term transition to clean energy and sustainable manufacturing will not eliminate the need for emission control - rather, it will expand its scope. As hydrogen, ammonia, and synthetic fuels are integrated into industrial and transport systems, new types of emissions and byproducts will emerge. The industry will need to develop next-gen controls to manage these, opening up new opportunities for R&D-driven growth.

Report Scope

The report analyzes the Emission Control Technology market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Technology (Gasoline Technology, Diesel Technology); End-Use (Automotive End-Use, Marine End-Use, Aerospace End-Use, Off-highway End-Use, Rolling Stock End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Gasoline Technology segment, which is expected to reach US$115.2 Billion by 2030 with a CAGR of a 8.5%. The Diesel Technology segment is also set to grow at 4.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $30.4 Billion in 2024, and China, forecasted to grow at an impressive 11.5% CAGR to reach $36 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Emission Control Technology Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Emission Control Technology Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Emission Control Technology Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB, Autotalks, Bosch Mobility Solutions, Continental AG, Delphi Technologies and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 37 companies featured in this Emission Control Technology market report include:

- Aisin Seiki Co., Ltd.

- BASF SE

- BorgWarner Inc.

- Caterpillar Inc.

- Clariant AG

- Corning Incorporated

- Cummins Inc.

- Denso Corporation

- Eberspächer Group

- Faurecia SE

- Gentherm Incorporated

- Honeywell International Inc.

- Johnson Matthey plc

- NGK Insulators, Ltd.

- Robert Bosch GmbH

- Tenneco Inc.

- Umicore

- Valeo SA

- W.R. Grace & Co.

- ZF Friedrichshafen AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aisin Seiki Co., Ltd.

- BASF SE

- BorgWarner Inc.

- Caterpillar Inc.

- Clariant AG

- Corning Incorporated

- Cummins Inc.

- Denso Corporation

- Eberspächer Group

- Faurecia SE

- Gentherm Incorporated

- Honeywell International Inc.

- Johnson Matthey plc

- NGK Insulators, Ltd.

- Robert Bosch GmbH

- Tenneco Inc.

- Umicore

- Valeo SA

- W.R. Grace & Co.

- ZF Friedrichshafen AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 277 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

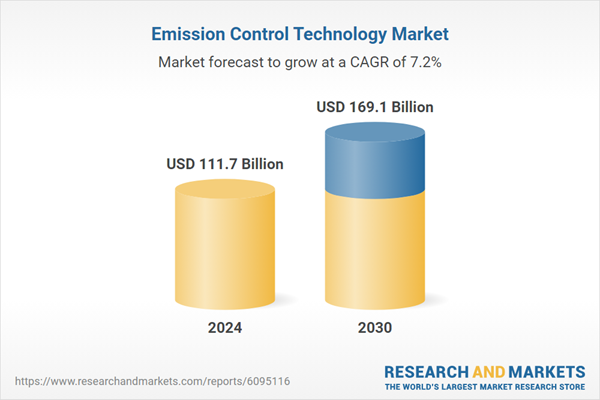

| Estimated Market Value ( USD | $ 111.7 Billion |

| Forecasted Market Value ( USD | $ 169.1 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |