Global End Mills Market - Key Trends & Drivers Summarized

How Are End Mills Evolving to Meet the Complexities of Next-Gen Manufacturing?

The end mills market is undergoing significant transformation as precision machining becomes more complex, materials become harder to cut, and production environments demand higher throughput and reliability. The evolution of end mills from simple two-flute tools to multi-flute, coated, micro-grain carbide instruments represents a response to increasing demands in aerospace, automotive, medical, and mold-making industries. With parts now being machined from titanium, Inconel, and hardened steels, the tooling must not only survive but perform consistently under extreme loads.Modern end mills are being manufactured with advanced substrate compositions such as ultra-fine carbide or cermet bases that significantly enhance tool life and reduce chipping in high-speed applications. Cutting-edge geometries, including variable helix angles and corner radius design, are tailored to mitigate vibrations, reduce cutting forces, and improve surface finishes - particularly in dynamic milling processes. The demand for 5-axis machining has also led to specialized end mills that facilitate complex contours and deep cavities without compromising rigidity.

Tool manufacturers are now integrating additive manufacturing with subtractive processes to create hybrid geometries for chip evacuation in challenging materials. Additionally, multi-functional end mills are being developed to combine drilling, slotting, and profiling in one pass - streamlining operations and improving toolpath efficiency. The growing focus on digital twins in manufacturing has further opened the market for digitally optimized end mills with defined wear data and cutting force simulations.

What Role Are Coatings, Flute Geometry, and Smart Tooling Playing in Performance Differentiation?

The rise in adoption of physical vapor deposition (PVD) coatings such as TiAlN (Titanium Aluminum Nitride), AlTiN, and diamond-like carbon (DLC) is transforming the lifecycle and productivity of end mills. These coatings offer superior thermal resistance, low friction coefficients, and extended wear resistance when cutting hardened metals or composites. For instance, TiAlN-coated end mills are preferred in dry machining and high-speed cutting due to their ability to maintain cutting edge sharpness under high thermal stress.Flute geometry remains a crucial determinant of tool performance. Variants with irregular flute spacing, variable helix, and chip breakers are designed specifically for difficult-to-machine materials such as stainless steel and aerospace alloys. Higher flute counts are increasingly being used for finishing operations, especially in die and mold industries, where surface quality is critical. Conversely, roughing end mills are evolving with serrated and knuckle-type geometries to break chips efficiently and reduce spindle loads in heavy stock removal.

Sensor-based smart tooling is emerging as the next innovation frontier. End mills equipped with embedded sensors or RFID chips allow for real-time monitoring of cutting forces, tool temperature, and vibration profiles. These smart tools are essential in predictive maintenance regimes in Industry 4.0-enabled factories. Tool wear patterns can be tracked digitally, enabling operators to proactively change out tools before catastrophic failure occurs. This level of insight also enhances CNC programming accuracy, supports automated tool changes, and reduces unplanned downtimes.

Which Sectors Are Accelerating the Commercialization of Advanced End Mills?

The aerospace and defense sectors remain primary drivers of demand for high-performance end mills due to the growing complexity of aircraft structures, increasing use of lightweight alloys, and high precision tolerances required. Machining of structural titanium components, engine housings, and landing gear involves continuous engagement with tough materials - making coated carbide and multi-flute end mills indispensable.In the automotive sector, electrification is reshaping end-use patterns. Machining needs for electric motor components, battery trays, and gearbox housings are increasing. Aluminum and composite-intensive structures demand end mills that minimize burr formation and deliver high surface finishes without secondary operations. OEMs and Tier 1 suppliers are investing in specialized tooling solutions to reduce cycle times while maintaining tight tolerances in lightweight vehicle platforms.

Medical device manufacturing is another area witnessing high uptake of micro-end mills and specialized tools. As implants, orthopedic devices, and surgical instruments move toward miniaturization and complex geometries, the need for micro tools with 0.1 mm diameters and diamond coatings is growing. These tools are expected to operate in stainless steels, cobalt-chrome, and titanium with ultra-fine finishes and zero tolerance for thermal distortion.

Mold and die manufacturers also form a significant customer base. The need for deep cavity milling, contouring, and finishing hardened tool steels requires rigid end mills with low deflection and heat resistance. High-speed milling strategies are becoming mainstream in die shops, particularly in Asia, where competitiveness is based on fast turnaround and high tool reliability. Custom ground tools and modular end mills with replaceable heads are also gaining traction to reduce tool changeover times in small-lot, high-mix environments.

What Key Factors Are Powering the Global Surge in End Mills Demand?

The growth in the end mills market is driven by several factors including the proliferation of CNC machining centers, rising demand for lightweight and complex-shaped components, advances in tool coatings and geometries, and increased focus on high-precision and high-speed operations across industries.One of the most important drivers is the global expansion of precision CNC machine tools. As 3-, 4-, and 5-axis machining becomes the industry norm, demand for high-performance tooling such as end mills has surged. Advanced machining centers can fully exploit modern end mills' capabilities - be it in high-speed finishing or heavy-duty roughing - enabling higher throughput per spindle hour.

Secondly, the increasing complexity of manufactured parts, especially in aerospace, EV, and medical sectors, requires tool geometries that are both versatile and application-specific. End mills tailored to unique requirements - such as corner radii, neck reliefs, or chip thinning geometries - allow manufacturers to achieve desired part accuracy while minimizing tool vibration and thermal stress.

Third, growing pressure on manufacturers to improve tool change efficiencies, reduce scrap, and extend tool life is pushing adoption of premium coated and modular end mills. Vendors offering predictive wear analytics, tool customization, and digital tool libraries are gaining traction among smart factories focused on lean operations and just-in-time production.

In addition, cost pressures in high-volume sectors such as automotive and consumer electronics are accelerating the shift toward long-life, low-maintenance tooling that minimizes unplanned downtimes. Multitasking tools and multi-function end mills are gaining popularity in these sectors, as they consolidate multiple operations into a single pass - reducing setup time and machine idling.

As sustainability becomes a boardroom concern, the adoption of dry machining and minimum quantity lubrication (MQL) strategies is favoring the use of advanced coated end mills capable of operating without coolant. This trend is expected to drive further innovation in high-performance coatings, particularly in environmentally regulated markets like the EU, Japan, and California.

Overall, the convergence of digital machining, new material adoption, and sustainability goals is not only expanding the global end mills market but also redefining the role of tooling as a strategic enabler of next-generation manufacturing.

Report Scope

The report analyzes the End Mills market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Square Nose End Mills, Ball Nose End Mills); Material (Carbide Material, Steel Material); Diameter Size (Up to 4 mm Diameter, 4-6 mm Diameter, 6-8 mm Diameter, 8-12 mm Diameter, Above 12 mm Diameter); End-Use (Automotive End-Use, Heavy Machinery End-Use, Semiconductors & Electronics End-Use, Medical & Healthcare End-Use, Energy End-Use, Aviation End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Square Nose End Mills segment, which is expected to reach US$1.6 Billion by 2030 with a CAGR of a 2.8%. The Ball Nose End Mills segment is also set to grow at 4.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $525.1 Million in 2024, and China, forecasted to grow at an impressive 6.3% CAGR to reach $467.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global End Mills Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global End Mills Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global End Mills Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Archer Daniels Midland Company, Ashland Global Holdings Inc., Aveka Group, Balchem Corporation, BASF SE and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this End Mills market report include:

- ANCA Pty Ltd

- CERATIZIT Group

- Dormer Pramet

- Emuge Corporation

- Garr Tool Company

- Guhring KG

- IMCO Carbide Tool Inc.

- ISCAR Ltd.

- Kennametal Inc.

- Kyocera Corporation

- Mapal Group

- Melin Tool Company

- Mitsubishi Materials Corp.

- OSG Corporation

- Sandvik Coromant

- Seco Tools AB

- Sumitomo Electric Industries

- Tungaloy Corporation

- Union Tool Co.

- Walter AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ANCA Pty Ltd

- CERATIZIT Group

- Dormer Pramet

- Emuge Corporation

- Garr Tool Company

- Guhring KG

- IMCO Carbide Tool Inc.

- ISCAR Ltd.

- Kennametal Inc.

- Kyocera Corporation

- Mapal Group

- Melin Tool Company

- Mitsubishi Materials Corp.

- OSG Corporation

- Sandvik Coromant

- Seco Tools AB

- Sumitomo Electric Industries

- Tungaloy Corporation

- Union Tool Co.

- Walter AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 470 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

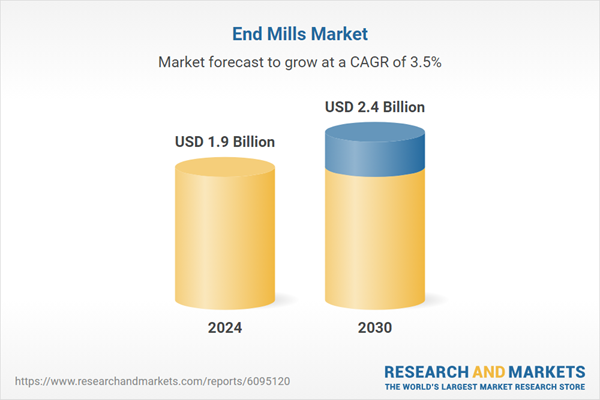

| Estimated Market Value ( USD | $ 1.9 Billion |

| Forecasted Market Value ( USD | $ 2.4 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |