Global Energy Measurement ICs Market - Key Trends & Drivers Summarized

What Are the Most Advanced Functionalities Reshaping Energy Measurement IC Design?

The design landscape for energy measurement integrated circuits (ICs) has rapidly evolved beyond basic power monitoring, driven by demand for high-accuracy, multi-phase, and multi-parameter energy analytics. These ICs, central to modern metering systems, now include capabilities such as real-time power factor correction, harmonic analysis, tamper detection, and support for high-speed communication protocols. Precision is paramount - new-generation energy measurement ICs routinely achieve Class 0.1 or better accuracy as defined by IEC 62053-22 and ANSI C12.20 standards. This level of granularity is essential for applications such as utility metering, where billing integrity and load profiling are mission-critical.To accommodate increasingly complex energy infrastructures, many ICs now feature built-in analog-to-digital converters (ADCs), programmable gain amplifiers (PGAs), and embedded digital signal processors (DSPs). These components enable real-time processing of current and voltage waveforms, thereby supporting detailed diagnostics of load behavior, voltage fluctuations, and waveform distortions. Additionally, advancements in phase correction algorithms and dynamic calibration functionalities allow these ICs to maintain accuracy across varying temperatures and supply voltages, which is particularly valuable in industrial environments with challenging operating conditions. Embedded flash memory, flexible configuration registers, and self-diagnostic features are also being adopted to enhance lifecycle management and firmware upgradeability.

Where Are Energy Measurement ICs Being Deployed and What's Driving Their Diversification?

The applications of energy measurement ICs extend well beyond traditional smart meters. In the utility sector, these ICs are embedded within both residential and commercial meters to support net metering, demand response programs, and peak load management strategies. Three-phase ICs are extensively used in industrial and commercial complexes where load balancing and power quality monitoring are integral to operational efficiency. As microgrids, distributed generation systems, and net-zero buildings become more mainstream, the use of multi-channel ICs capable of isolating and aggregating consumption across sources - including solar inverters, battery storage systems, and electric vehicle chargers - is accelerating.Consumer electronics and IoT devices are also increasingly integrating energy measurement ICs to enable real-time energy tracking and power optimization. Smart plugs, connected appliances, and home energy monitors rely on compact, low-power ICs with wireless communication capabilities to inform users about energy consumption trends. In data centers, energy measurement ICs are essential in rack-level and server-level power monitoring, contributing to thermal management and workload optimization. Similarly, in industrial automation systems, these ICs are used to track machine-level power draw, supporting predictive maintenance and energy audits.

Automotive applications are another emerging frontier, especially within electric vehicle (EV) charging stations and powertrain systems. In EV chargers, precise energy measurement ensures billing transparency and load management, while in onboard applications, ICs help optimize energy flow across drive, battery, and auxiliary systems. This diverse range of use cases underscores the growing importance of adaptable, application-specific ICs designed with flexibility in form factor, interface compatibility, and environmental robustness.

How Are Global Regulations and Efficiency Standards Influencing IC Innovation?

Global efforts to decarbonize energy systems and enforce grid reliability have had a direct impact on the functional and compliance requirements of energy measurement ICs. Regulatory mandates such as the European Union's Energy Efficiency Directive, the U.S. Energy Policy Act, and China's national metering standards are shaping the accuracy classes, safety certifications, and communication protocols embedded in modern ICs. These requirements are prompting chipmakers to design ICs that comply with multiple international standards simultaneously, thereby facilitating global deployment and supply chain uniformity.In smart grid ecosystems, the push toward interoperability and real-time data exchange is leading to the integration of standardized communication protocols such as Modbus, M-Bus, DLMS/COSEM, and Zigbee within energy measurement IC platforms. Secure firmware architecture and hardware-level encryption are increasingly included to support data integrity and resistance to cyberattacks - an essential feature for utility-scale deployments. Moreover, compliance with the IEEE 1451 standard for smart transducers and IEC 61850 for substation automation is influencing the adoption of modular IC designs with flexible interfacing capabilities.

Environmental regulations are also steering product innovation. With the growing emphasis on RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) compliance, manufacturers are moving toward lead-free, halogen-free packaging and environmentally friendly production processes. Additionally, ICs are being optimized for ultra-low power consumption to support battery-operated and energy harvesting systems, aligning with broader goals of energy conservation and carbon neutrality.

What Forces Are Driving the Acceleration of the Energy Measurement ICs Market?

The growth in the energy measurement ICs market is driven by several factors that converge at the intersection of global electrification, smart grid modernization, and decentralized energy systems. One of the most powerful growth engines is the proliferation of smart meters, driven by utility-scale digital transformation initiatives in North America, Europe, and Asia-Pacific. Governments and utilities are rolling out advanced metering infrastructure (AMI) to support dynamic pricing, outage management, and grid balancing - each of which depends on highly accurate and programmable measurement ICs. This momentum is mirrored in commercial and industrial sectors where energy benchmarking and environmental, social, and governance (ESG) reporting require robust data acquisition at the point of use.Rapid urbanization, growing electricity demand, and the expansion of renewable energy projects are also fueling the adoption of energy measurement ICs in solar inverters, energy storage systems, and distributed energy management platforms. These use cases demand precision, responsiveness, and seamless communication between local and cloud-based control systems. Furthermore, the evolution of Industry 4.0 and the Internet of Things (IoT) is accelerating demand for smart, compact ICs that can be embedded in a wide range of connected devices to track energy efficiency in real time.

Another critical driver is the intensifying global focus on energy efficiency and carbon emissions reduction. Commercial buildings, factories, and data centers are under pressure to optimize energy consumption and prove regulatory compliance, creating sustained demand for granular, chip-level energy monitoring solutions. Simultaneously, advancements in semiconductor fabrication and the transition toward mixed-signal and system-on-chip (SoC) designs are reducing production costs while expanding performance thresholds. As a result, the energy measurement ICs market is not only expanding in size but also diversifying in scope, making it a pivotal component of the evolving global energy intelligence framework.

Report Scope

The report analyzes the Energy Measurement ICs market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Function (Active Energy, Apparent Energy, Reactive Energy); Application (Smart-Plugs Application, Industrial Application, Smart Appliances Application, Smart-Homes Application); Type (Single-Channel Type, Multi-Channel Type).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Active Energy Function segment, which is expected to reach US$5.1 Billion by 2030 with a CAGR of a 7.2%. The Apparent Energy Function segment is also set to grow at 5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.6 Billion in 2024, and China, forecasted to grow at an impressive 10.4% CAGR to reach $1.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Energy Measurement ICs Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Energy Measurement ICs Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Energy Measurement ICs Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ariston Group, Bosch Thermotechnik GmbH, Carrier Global Corporation, Carel Industries S.p.A., Climaveneta S.p.A. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Energy Measurement ICs market report include:

- Analog Devices, Inc.

- Atmel Corporation

- Broadcom Inc.

- Cirrus Logic, Inc.

- Cypress Semiconductor Corp.

- Dialog Semiconductor PLC

- EM Microelectronic

- Holtek Semiconductor Inc.

- Infineon Technologies AG

- Linear Technology Corporation

- Maxim Integrated Products, Inc.

- Microchip Technology Inc.

- NXP Semiconductors N.V.

- ON Semiconductor Corporation

- Renesas Electronics Corporation

- Rohm Semiconductor

- Semtech Corporation

- Silicon Laboratories Inc.

- STMicroelectronics N.V.

- Texas Instruments Incorporated

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Analog Devices, Inc.

- Atmel Corporation

- Broadcom Inc.

- Cirrus Logic, Inc.

- Cypress Semiconductor Corp.

- Dialog Semiconductor PLC

- EM Microelectronic

- Holtek Semiconductor Inc.

- Infineon Technologies AG

- Linear Technology Corporation

- Maxim Integrated Products, Inc.

- Microchip Technology Inc.

- NXP Semiconductors N.V.

- ON Semiconductor Corporation

- Renesas Electronics Corporation

- Rohm Semiconductor

- Semtech Corporation

- Silicon Laboratories Inc.

- STMicroelectronics N.V.

- Texas Instruments Incorporated

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 375 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

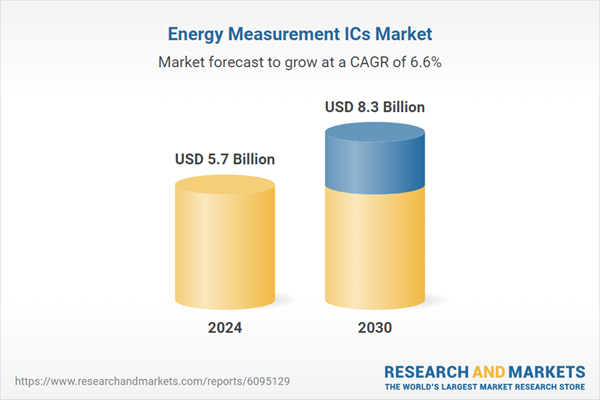

| Estimated Market Value ( USD | $ 5.7 Billion |

| Forecasted Market Value ( USD | $ 8.3 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |