Global Equine Veterinary Therapeutics Market - Key Trends & Drivers Summarized

How Are Advancements in Clinical Interventions Transforming Equine Healthcare?

The field of equine veterinary therapeutics has advanced significantly in recent years, underpinned by innovations in pharmacology, regenerative medicine, and precision diagnostics. Traditional treatment protocols centered on pain management, antiparasitics, and antibiotics are being rapidly supplemented - and in some cases, replaced - by biologic and molecular therapies aimed at addressing chronic conditions at the cellular level. In particular, musculoskeletal disorders such as osteoarthritis, tendonitis, and navicular disease have seen a shift from reliance on corticosteroids and NSAIDs to biologics like platelet-rich plasma (PRP), autologous conditioned serum (ACS), and stem cell therapies that stimulate tissue repair and modulate inflammation more effectively over time.Respiratory conditions, which are highly prevalent in sport and performance horses, are also receiving focused therapeutic attention. New classes of bronchodilators, mucolytics, and immunomodulators are now being tailored to manage equine asthma and recurrent airway obstruction (RAO) with greater precision and fewer side effects. Additionally, hormonal and metabolic imbalances - particularly equine metabolic syndrome (EMS) and pituitary pars intermedia dysfunction (PPID) - are being treated with advanced formulations that incorporate long-acting agonists, metabolic regulators, and insulin-sensitizing compounds. These developments are enabling more sustained disease management with improved compliance from owners and caretakers.

What Role Are Regenerative and Gene-Based Therapies Playing in Equine Recovery and Performance?

The integration of regenerative medicine into equine therapeutics is altering the trajectory of injury recovery, especially in elite equine athletes where performance longevity is critical. Stem cell therapy, particularly using mesenchymal stem cells (MSCs) derived from bone marrow or adipose tissue, is becoming increasingly routine in the treatment of tendon injuries, cartilage damage, and joint degeneration. These cells possess immunomodulatory properties and tissue-specific regenerative capabilities, significantly reducing re-injury rates in high-performance horses. Veterinary practitioners are also experimenting with exosomes and growth factor-rich extracellular vesicles to enhance cell signaling and accelerate healing at the injury site.Gene therapy is another emerging frontier, albeit still in the research and trial phase for widespread equine use. Experimental approaches involve the use of viral vectors to deliver anti-inflammatory cytokines or cartilage-protective genes directly into affected joints or tissues. While regulatory and cost barriers persist, the potential for long-acting or even permanent therapeutic effects could redefine chronic care in equine medicine. Adjunct technologies such as shockwave therapy, laser therapy, and pulsed electromagnetic field therapy are also being used in conjunction with regenerative treatments to improve outcomes, reduce healing times, and support rehabilitation programs. The convergence of these biologically advanced therapies with improved diagnostic tools - such as thermal imaging and ultrasonography - is enabling earlier intervention and more precise treatment monitoring.

Where Are Treatment Protocols Evolving to Meet Market-Specific and End-Use Needs?

The global market for equine veterinary therapeutics is not uniform in its demand profile - regional needs, equestrian disciplines, and economic capacity all influence therapeutic development and adoption. In North America and Europe, where racing, showjumping, and dressage dominate the competitive landscape, treatment protocols are heavily aligned with regulatory compliance, anti-doping standards, and proactive wellness strategies. Veterinary hospitals in these regions are well-equipped with diagnostic imaging, endoscopy suites, and surgical units, enabling complex interventions such as arthroscopic surgery, orthopedic fixation, and advanced wound management. In these markets, there is a growing emphasis on prophylactic treatments and longitudinal monitoring of joint health, metabolic status, and immune markers.Conversely, in emerging equine markets such as Brazil, India, and the Middle East, demand is more focused on cost-effective therapeutics that can be deployed in field settings. Common conditions such as colic, parasitic infestations, and wound infections drive demand for oral anthelmintics, antimicrobial powders, and electrolyte therapies. However, rising income levels and increased participation in international competitions are also spurring interest in performance-enhancing therapeutics, injectable joint supplements, and pre-race conditioning agents. Additionally, therapeutic approaches are evolving to meet the demands of non-competitive segments, such as therapy horses and recreational equines, where behavioral wellness and chronic pain management are critical concerns. Behavioral therapeutics - especially anxiolytics and natural calming agents - are gaining traction in facilities that use horses for equine-assisted therapy or rehabilitation.

What Forces Are Driving Growth in the Global Equine Veterinary Therapeutics Market?

The growth in the equine veterinary therapeutics market is driven by several factors that reflect the increasing medicalization of horse care, the professionalization of equestrian sports, and the rising expectations of owners and trainers regarding equine health outcomes. One of the most prominent growth drivers is the expanded use of horses across diverse sectors - including competitive sports, therapy, leisure, and ceremonial use - all of which demand tailored, high-quality therapeutic interventions. The economic value of performance horses, often running into hundreds of thousands or even millions of dollars, justifies the investment in advanced diagnostics, preventive care, and novel therapeutics that can extend performance longevity and reduce the likelihood of catastrophic injuries.Another powerful growth catalyst is the strengthening regulatory and clinical infrastructure that supports evidence-based veterinary practice. Veterinary associations, pharmaceutical firms, and equestrian regulatory bodies are working collaboratively to standardize treatment protocols, improve drug approval pathways, and encourage innovation in therapeutic development. The growing acceptance of off-label use of human pharmaceuticals in veterinary contexts - paired with advances in equine-specific formulations - is enabling access to a broader therapeutic arsenal. Telemedicine platforms and mobile veterinary units are expanding therapeutic access to rural and remote regions, while AI-assisted diagnostic tools are making it easier for practitioners to identify and treat early-stage conditions before they escalate into performance-limiting issues.

Moreover, increased public awareness and owner education are contributing to more proactive and preventive approaches to equine health. Owners are seeking second opinions, using wearable sensors to track movement abnormalities, and demanding more transparency from veterinarians regarding treatment efficacy. These behavioral shifts are driving demand for high-efficacy, quick-onset, and easily administered therapeutics across all dosage forms. Simultaneously, pharmaceutical companies are investing in long-acting injectables, palatable oral pastes, and rapid-dissolve tablets to improve dosing compliance and treatment outcomes. With the convergence of high-performance demand, technological innovation, and growing economic participation in equine care, the equine veterinary therapeutics market is well-positioned for sustained, multi-tiered growth globally.

Report Scope

The report analyzes the Equine Veterinary Therapeutics market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Drugs (Anti-Inflammatory Drugs, Anti-Infective Drugs, Parasiticides Drugs, Other Drugs); Administration Route (Oral, Parenteral, Topical); Distribution Channel (Veterinary Hospital Distribution Channel, Veterinary Clinics Distribution Channel, Pharmacies & Drug Stores Distribution Channel, Online Distribution Channel, Other Distribution Channels).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Anti-Inflammatory Drugs segment, which is expected to reach US$844.1 Million by 2030 with a CAGR of a 7.9%. The Anti-Infective Drugs segment is also set to grow at 4.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $314.3 Million in 2024, and China, forecasted to grow at an impressive 10.4% CAGR to reach $350.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Equine Veterinary Therapeutics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Equine Veterinary Therapeutics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Equine Veterinary Therapeutics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alltech Inc., ARK Equine, Bayer AG, Boehringer Ingelheim International, Ceva Santé Animale and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Equine Veterinary Therapeutics market report include:

- Addison Biological Laboratory

- Animart LLC

- Arthrex Inc.

- Aurora Pharmaceutical, Inc.

- Bayer Animal Health

- Bharat Serums and Vaccines Ltd.

- Bimeda Inc.

- Boehringer Ingelheim

- Ceva Santé Animale

- Covetrus Inc.

- Dechra Pharmaceuticals PLC

- Elanco Animal Health

- Equine Products UK Ltd.

- Esaote S.p.A.

- Hallmarq Veterinary Imaging

- Heska Corporation

- IDEXX Laboratories, Inc.

- InGeneron Inc.

- Kyoritsu Seiyaku Corporation

- Merck Animal Health

- Neogen Corporation

- Norbrook Laboratories Ltd.

- Panav Bio Tech

- Vetoquinol S.A.

- Virbac

- W.F. Young, Inc.

- Zoetis Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Addison Biological Laboratory

- Animart LLC

- Arthrex Inc.

- Aurora Pharmaceutical, Inc.

- Bayer Animal Health

- Bharat Serums and Vaccines Ltd.

- Bimeda Inc.

- Boehringer Ingelheim

- Ceva Santé Animale

- Covetrus Inc.

- Dechra Pharmaceuticals PLC

- Elanco Animal Health

- Equine Products UK Ltd.

- Esaote S.p.A.

- Hallmarq Veterinary Imaging

- Heska Corporation

- IDEXX Laboratories, Inc.

- InGeneron Inc.

- Kyoritsu Seiyaku Corporation

- Merck Animal Health

- Neogen Corporation

- Norbrook Laboratories Ltd.

- Panav Bio Tech

- Vetoquinol S.A.

- Virbac

- W.F. Young, Inc.

- Zoetis Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 378 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

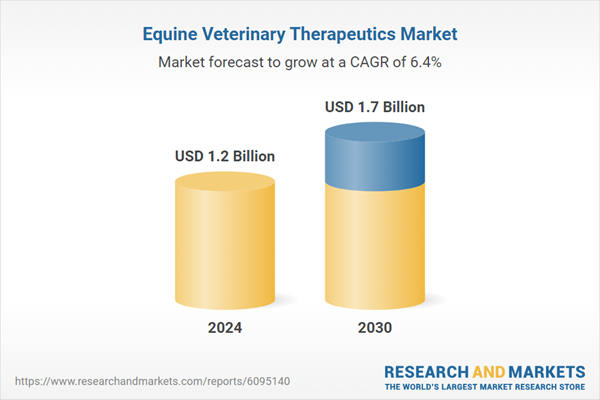

| Estimated Market Value ( USD | $ 1.2 Billion |

| Forecasted Market Value ( USD | $ 1.7 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |