Global Faux Leather Market - Key Trends & Drivers Summarized

Why Is Faux Leather Gaining Ground in Diverse Consumer Segments?

The global faux leather market is experiencing a transformative surge in demand across multiple industries, ranging from fashion and furniture to automotive and electronics. The increased adoption of faux leather is not merely a response to shifting material preferences, but rather a reflection of broader consumer trends, especially within ethical purchasing behavior and eco-conscious consumption. Consumers are becoming increasingly vocal about animal welfare and environmental sustainability, prompting brands to re-evaluate their material portfolios. As a result, synthetic alternatives such as polyurethane (PU) and polyvinyl chloride (PVC) based faux leather are finding mainstream acceptance.Additionally, the evolving aesthetic and tactile quality of faux leather is eliminating long-held perceptions about it being inferior to genuine leather. Advances in embossing, printing, and lamination technologies now allow for hyper-realistic finishes that mimic the grain, texture, and feel of animal hide. This fidelity has made faux leather a preferred choice for mid-range and premium product lines across handbags, jackets, footwear, car seat upholstery, and consumer electronics casings. Importantly, this shift is not limited to developed economies - emerging markets across Asia, Latin America, and the Middle East are witnessing a similar transition driven by growing middle-class populations, urbanization, and aspirational lifestyle shifts.

What Technological Innovations Are Reshaping the Market for Synthetic Leather?

The faux leather landscape has evolved dramatically due to the rise of bio-based feedstocks, waterborne polyurethane chemistry, and solvent-free manufacturing processes. One of the most significant technological shifts has been the development of non-toxic, biodegradable alternatives to conventional petroleum-derived polymers. Innovations in bio-PU and bio-PVC are enabling manufacturers to create environmentally responsible faux leather while maintaining strength, flexibility, and durability. Furthermore, manufacturers are adopting closed-loop production methods that minimize emissions, eliminate hazardous solvents, and recycle water during processing. These green manufacturing protocols are becoming critical differentiators in procurement decisions by B2B buyers.Another noteworthy trend is the infusion of smart materials and functional additives into faux leather. Developments in antimicrobial coatings, UV-resistant finishes, flame-retardant treatments, and breathable layered composites are enabling faux leather to penetrate markets where performance requirements were previously a barrier. In the automotive sector, for instance, temperature-regulating faux leather is being incorporated into climate-controlled seating systems. Likewise, smart furniture designs are leveraging stretchable, touch-sensitive faux leather for integrated control interfaces. These enhancements are expanding the addressable use cases beyond traditional categories.

Digital printing and laser-cutting technologies are also accelerating the customization and design innovation cycle in faux leather manufacturing. Design software integrated with CNC equipment enables precise patterns, embossing, and texture simulations on synthetic leather substrates, facilitating fast prototyping and low-volume production for boutique and artisanal applications. With mass customization gaining traction among consumers and retailers, these advanced fabrication techniques are enhancing the flexibility and responsiveness of faux leather supply chains.

How Are End-Use Applications and Industry Players Restructuring Demand Patterns?

The faux leather market is deeply entwined with shifting dynamics across its key end-use sectors. In fashion, brands are aggressively integrating faux leather into seasonal collections and accessories, responding to consumer demand for cruelty-free and sustainable options. This move is visible across apparel, handbags, belts, and even millinery products. Luxury brands, once staunch proponents of authentic leather, are also introducing vegan lines, leveraging faux leather's improved aesthetics and performance. In footwear, durability, breathability, and styling flexibility have made faux leather a go-to choice for both sports and casual categories.In automotive and transportation interiors, OEMs and aftermarket providers are increasing their preference for PU-based synthetic leather to comply with sustainability metrics while also meeting evolving safety and comfort standards. Faux leather is now commonly used in dashboards, gear knobs, armrests, and seating - especially in electric and hybrid vehicle platforms where weight reduction and eco-materials are emphasized. Similarly, the furniture sector is utilizing faux leather for residential and commercial seating, office furniture, and recliners, capitalizing on its abrasion resistance and design versatility.

Corporate strategies within the faux leather industry are increasingly shaped by vertical integration, localized production, and regional diversification. Major manufacturers such as Kuraray Co., Ltd., Mayur Uniquoters, Nan Ya Plastics, and Teijin Limited are investing in multi-location production hubs, in-house R&D centers, and forward integration with consumer product brands. Meanwhile, collaborations between chemical companies and design studios are yielding composite materials that balance aesthetics, functionality, and sustainability. Retail channels are also evolving with greater online availability of faux leather goods, supported by AR/VR-based visualization tools and AI-powered personalization.

What Is Driving the Market's Accelerated Expansion Worldwide?

The growth in the faux leather market is driven by several factors that span sustainability imperatives, technological enhancements, and changing consumer psychographics. One of the most influential drivers is the increasing consumer inclination toward cruelty-free and environmentally sustainable products. This trend is forcing brands to embrace synthetic alternatives that align with ethical sourcing standards and green material directives. Many fashion and automotive companies are setting sustainability milestones, thereby institutionalizing faux leather as a standard material option.Another crucial growth driver is cost efficiency across the value chain. Faux leather's price stability, predictable supply, and scalability in manufacturing give it a competitive edge over fluctuating natural leather markets. This financial advantage becomes particularly significant for high-volume industries such as footwear and car interiors. Additionally, regional regulatory pressures - especially in the EU and North America - on animal-derived and chemical-intensive materials are further nudging industries toward faux leather adoption.

Rapid urbanization, expanding middle-class populations, and fashion-conscious youth demographics in developing markets are also fueling growth. In these regions, faux leather offers a blend of affordability, style, and social appeal, making it a preferred material across gender, age, and income segments. Furthermore, the material's adaptability across multiple product categories - ranging from travel accessories and apparel to gadgets and furniture - ensures sustained demand from a diverse industrial base. With rising awareness and eco-labeling certifications, faux leather continues to solidify its role as a mainstream material in the global manufacturing and consumer landscape.

Report Scope

The report analyzes the Faux Leather market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (PU Type, PVC Type, Bio-based Type); Application (Footwear Application, Clothing Application, Furnishing Application, Automotive Application, Wallets Application, Bags & Purses Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the PU Material segment, which is expected to reach US$30.1 Billion by 2030 with a CAGR of a 9%. The PVC Material segment is also set to grow at 5.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $9.3 Billion in 2024, and China, forecasted to grow at an impressive 11.9% CAGR to reach $11.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Faux Leather Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Faux Leather Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Faux Leather Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Anheuser-Busch InBev, Colgate-Palmolive, Danone, Diageo, General Mills and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Faux Leather market report include:

- Alfatex Italia Srl

- Anli Group Co., Ltd.

- Asahi Kasei Corporation

- BASF SE

- DuPont de Nemours, Inc.

- Favini S.r.l.

- Filwel Co., Ltd.

- Hexin Group Co., Ltd.

- H.R. Polycoats Pvt. Ltd.

- Kuraray Co., Ltd.

- Lectra S.A.

- Mayur Uniquoters Ltd.

- Nan Ya Plastics Corporation

- San Fang Chemical Industry Co., Ltd.

- SEKISUI Polymer Innovations, LLC

- SIMNU

- Teijin Limited

- Toray Industries, Inc.

- Ultrafabrics Holdings Co., Ltd.

- von Holzhausen

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alfatex Italia Srl

- Anli Group Co., Ltd.

- Asahi Kasei Corporation

- BASF SE

- DuPont de Nemours, Inc.

- Favini S.r.l.

- Filwel Co., Ltd.

- Hexin Group Co., Ltd.

- H.R. Polycoats Pvt. Ltd.

- Kuraray Co., Ltd.

- Lectra S.A.

- Mayur Uniquoters Ltd.

- Nan Ya Plastics Corporation

- San Fang Chemical Industry Co., Ltd.

- SEKISUI Polymer Innovations, LLC

- SIMNU

- Teijin Limited

- Toray Industries, Inc.

- Ultrafabrics Holdings Co., Ltd.

- von Holzhausen

Table Information

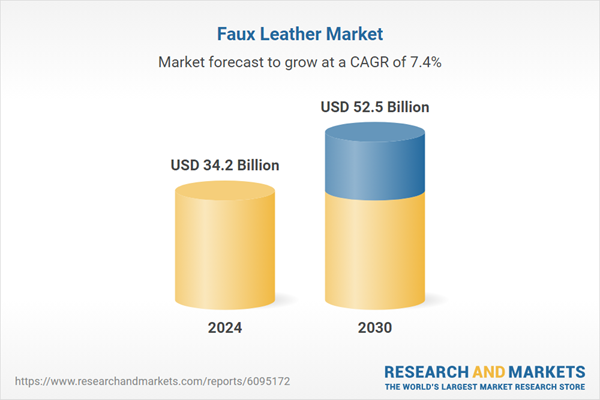

| Report Attribute | Details |

|---|---|

| No. of Pages | 293 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 34.2 Billion |

| Forecasted Market Value ( USD | $ 52.5 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |