Global Fire Detection Equipment Market - Key Trends & Drivers Summarized

How Is Sensor Innovation Redefining the Capabilities of Fire Detection Equipment?

The evolution of fire detection equipment is being driven by substantial innovation in sensor technologies. Traditional smoke detectors, which once relied heavily on ionization and photoelectric sensors, are now giving way to advanced multi-criteria detection systems. These systems integrate multiple sensing parameters - such as heat, optical smoke, carbon monoxide, and even gas concentration - into a single unit, enhancing both detection speed and accuracy. Optical sensors with dual-wavelength capabilities are proving effective in differentiating between real fire events and nuisance triggers such as dust or steam, thereby reducing false alarms. Technologies like aspirating smoke detectors (ASDs) are gaining popularity in mission-critical environments such as data centers and cleanrooms due to their ability to detect fire at its incipient stage through continuous air sampling.Furthermore, artificial intelligence and machine learning are increasingly being applied to fire detection systems to interpret sensor data in real time. These intelligent algorithms help adapt the sensitivity thresholds based on environmental patterns and occupancy behavior, minimizing false positives while ensuring rapid response in the event of an actual fire. The integration of AI with video analytics is another transformative trend, where cameras combined with thermal sensors can recognize fire signatures in vast or open areas, such as warehouses or public transport hubs. This shift toward predictive detection powered by smart sensor arrays is redefining the efficiency and reliability of modern fire safety infrastructure.

Why Are Deployment Trends Shifting Across Industrial and Commercial Segments?

The demand for fire detection equipment is expanding rapidly across various verticals, with significant deployment diversification between industrial and commercial environments. In commercial spaces such as offices, retail, and hospitality, the emphasis is on networked systems that combine centralized control with intelligent zoning. These systems support automatic alerts, remote diagnostics, and real-time communication with emergency response teams, especially when integrated with building management systems (BMS). The growing adoption of smart buildings is further reinforcing the demand for scalable and IoT-enabled fire detectors that support seamless integration into existing safety and automation networks.In contrast, industrial facilities such as oil refineries, manufacturing plants, and chemical processing units require explosion-proof and ruggedized detection systems that comply with stringent regulatory standards. Here, detection equipment must be resilient to high temperatures, corrosive environments, and electromagnetic interference. Specialized detectors such as flame detectors using ultraviolet (UV), infrared (IR), or combined UV/IR technologies are being installed in areas with highly flammable materials. Industrial demand is also being bolstered by mandates from insurance firms, which require high-spec fire detection as a prerequisite for coverage. Additionally, with growing concern over factory safety and the potential for litigation, manufacturers are investing in real-time analytics and redundancy-based detection frameworks.

How Are Connectivity and Cloud Platforms Enhancing Fire Detection Ecosystems?

The integration of connectivity features and cloud-based platforms is emerging as a fundamental pillar in next-generation fire detection systems. With the proliferation of smart sensors, the ability to transmit fire incident data in real-time to centralized platforms - either cloud-hosted or on-premise - is reshaping how facility managers monitor and respond to potential threats. Cloud connectivity enables predictive analytics, remote diagnostics, and lifecycle management of detection equipment, significantly reducing downtime and operational risks. It also empowers multi-site organizations to monitor all facilities from a single command center, streamlining decision-making and incident reporting.Moreover, cloud platforms are enhancing compliance tracking and historical data management. Facility operators can generate audit trails, incident reports, and maintenance logs with precision, aiding in regulatory inspections and insurance claims. Mobile access through apps allows technicians to receive alerts and respond from remote locations, enhancing operational agility. Interoperability is also a growing trend, where fire detection systems can communicate with other safety mechanisms like access control, HVAC shutdown, and sprinkler activation. The convergence of IoT, cloud, and edge computing is facilitating the creation of intelligent ecosystems where fire detection is no longer a siloed function but an integrated component of holistic risk management frameworks.

What Is Fueling the Escalating Global Demand for Fire Detection Equipment?

The growth in the fire detection equipment market is driven by several factors that collectively underscore the escalating need for enhanced safety infrastructure. One of the most prominent growth drivers is the tightening of fire safety regulations and building codes across major economies. Governments and international bodies such as NFPA (National Fire Protection Association), EN (European Norms), and ISO are continuously revising compliance benchmarks, mandating the deployment of certified and high-performance fire detection systems. These regulatory shifts are particularly influencing new construction projects and urban redevelopment plans where smart and responsive fire safety solutions are prioritized.Another strong demand driver is the increased frequency of fire incidents in both residential and industrial zones, often linked to climate change, electrical faults, and aging infrastructure. This has prompted both public and private sector stakeholders to invest heavily in advanced detection technologies to safeguard lives and assets. Urbanization and high-rise construction in developing countries further contribute to the market's expansion, as centralized detection and response systems become critical for occupant safety. Moreover, the post-pandemic focus on infrastructure resilience and business continuity planning has made fire detection an integral part of risk mitigation strategies across sectors.

Additionally, consumer behavior is shifting towards proactive safety investments. Awareness campaigns, coupled with real-time news coverage of fire disasters, are increasing the uptake of residential detectors and smart alarms. Technological advancements such as wireless detectors, app-based monitoring, and battery-operated systems with extended life cycles are enabling broader market penetration. The combined momentum from regulatory enforcement, technological innovation, and heightened risk perception is propelling the global fire detection equipment market into a phase of accelerated growth and sustained investment.

Report Scope

The report analyzes the Fire Detection Equipment market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Flame Detectors, Smoke Detector, Heat Detectors); Connectivity (Wired Connectivity, Wireless Connectivity); End-Use (Banking End-Use, Financial Services & Insurance End-Use, Hospitality & Travel End-Use, Healthcare End-Use, Transportation & Logistics End-Use, Manufacturing End-Use, Retail End-Use, Mining End-Use, Oil & Gas End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Flame Detectors segment, which is expected to reach US$9.3 Billion by 2030 with a CAGR of a 8.8%. The Smoke Detector segment is also set to grow at 12.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.8 Billion in 2024, and China, forecasted to grow at an impressive 14.1% CAGR to reach $3.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Fire Detection Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Fire Detection Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Fire Detection Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd, AirSense Technology, AMETEK, Inc., ASCO Numatics, Bacharach, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Fire Detection Equipment market report include:

- Aico

- Apollo Fire Detectors

- Bosch Security Systems

- Carrier Fire & Security

- Cooper Notification

- Delta Fire

- Eaton Corporation

- Edwards (UTC Climate, Controls & Security)

- Fike Corporation

- Fire & Safety Australia

- Firetrace International

- FLIR Systems (Teledyne)

- Gentex Corporation

- Hochiki Corporation

- Honeywell International

- Johnson Controls

- Kidde (Carrier)

- L&J Technologies

- Mircom Group

- Notifier (Honeywell)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aico

- Apollo Fire Detectors

- Bosch Security Systems

- Carrier Fire & Security

- Cooper Notification

- Delta Fire

- Eaton Corporation

- Edwards (UTC Climate, Controls & Security)

- Fike Corporation

- Fire & Safety Australia

- Firetrace International

- FLIR Systems (Teledyne)

- Gentex Corporation

- Hochiki Corporation

- Honeywell International

- Johnson Controls

- Kidde (Carrier)

- L&J Technologies

- Mircom Group

- Notifier (Honeywell)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 393 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

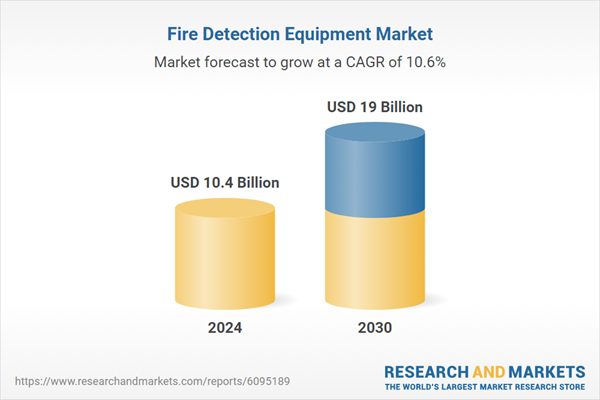

| Estimated Market Value ( USD | $ 10.4 Billion |

| Forecasted Market Value ( USD | $ 19 Billion |

| Compound Annual Growth Rate | 10.6% |

| Regions Covered | Global |