Global Building Applied Photovoltaics Market - Key Trends & Drivers Summarized

Why Are Building Applied Photovoltaics Reshaping the Future of Sustainable Architecture?

Building Applied Photovoltaics (BAPV) are increasingly at the forefront of sustainable construction, integrating clean energy generation directly into architectural elements without compromising structural design. Unlike Building Integrated Photovoltaics (BIPV), which replace building materials like glass or facades, BAPV systems are mounted onto existing surfaces - such as rooftops or walls - making them particularly attractive for retrofitting existing structures. This flexibility allows for rapid adoption across a wide range of building types, from commercial offices and warehouses to residential homes and public infrastructure. The rising urgency of climate change, coupled with escalating energy costs and growing regulatory pressure to decarbonize buildings, has catapulted BAPV from a niche innovation to a mainstream solution. Municipal building codes and national climate policies are increasingly requiring new developments and renovations to meet net-zero energy standards, and BAPV serves as a cost-effective and scalable path to compliance. Architects and developers appreciate that BAPV solutions do not demand fundamental changes to the building's design, enabling faster permitting and easier engineering integration. Additionally, with global urbanization accelerating, rooftops and vertical building surfaces are being reclaimed as productive assets rather than wasted space. The ability of BAPV to add energy value while maintaining the structural integrity of the original building makes it a compelling proposition for developers and investors. As cities evolve into smarter, greener, and more self-sufficient entities, BAPV is positioning itself as a key enabler of the built environment's transition to clean energy.What Technological Advancements Are Driving Performance and Adoption of BAPV Systems?

Technological innovation is playing a central role in accelerating the adoption and efficiency of Building Applied Photovoltaics, transforming them into high-performance, aesthetically compatible, and economically viable solutions for modern construction. Over the past decade, BAPV systems have evolved from basic solar panel mounts to sophisticated energy-producing units with smart capabilities and integrated monitoring systems. Advances in photovoltaic cell technology - such as monocrystalline silicon, PERC (passivated emitter rear cell) architecture, and heterojunction technologies - have significantly improved energy conversion efficiency, allowing for greater energy yield even from limited rooftop space. Lightweight, flexible PV modules are also entering the market, making it easier to install BAPV systems on structures that cannot support the weight of traditional panels. Meanwhile, innovations in mounting systems, such as ballasted racks and rail-less mounts, are reducing installation time and cost while improving aerodynamics and resistance to wind uplift. Smart inverters and digital control systems are enabling real-time performance monitoring, grid interaction, and optimized energy storage integration. Some BAPV systems are now bundled with battery storage and EV charging stations, creating complete energy ecosystems for buildings. Integration with IoT and AI allows for predictive maintenance, fault detection, and enhanced energy management, increasing overall reliability and return on investment. Additionally, manufacturers are responding to the need for architectural harmony by offering a variety of color, texture, and size options that complement various design aesthetics. Collectively, these technological enhancements are breaking traditional barriers to adoption and allowing BAPV systems to serve as both energy infrastructure and a seamless extension of architectural form.How Are Policy, Economics, and Market Trends Accelerating Global Demand for BAPV?

The global demand for Building Applied Photovoltaics is being fueled by a powerful convergence of public policy, economic incentives, and evolving market expectations for sustainable development. Governments around the world are implementing stricter energy efficiency and renewable energy mandates for buildings, often including rooftop solar requirements for new construction and major renovations. These regulations are creating a fertile policy environment for BAPV adoption, especially in urban centers where vertical development and high energy consumption prevail. Financial incentives - such as tax credits, feed-in tariffs, green building certifications, and carbon credit schemes - are further improving the financial feasibility of BAPV investments for developers and property owners. Concurrently, the rapidly falling cost of solar technology has made photovoltaic systems more accessible than ever, narrowing the cost premium between conventional and solar-enabled construction. Additionally, the growing pressure from institutional investors for ESG (Environmental, Social, Governance) compliance has led real estate portfolios and REITs to embrace renewable energy solutions like BAPV to improve environmental performance metrics. In the commercial sector, corporate sustainability commitments and the desire for energy independence are prompting businesses to adopt BAPV not just for cost savings but also for brand positioning and climate accountability. In parallel, consumer demand for energy-efficient homes is pushing residential developers to integrate rooftop solar as a default offering, making BAPV a marketing differentiator in competitive real estate markets. Cities and municipalities, too, are embracing BAPV for public buildings, schools, and transit facilities as part of broader urban sustainability goals. This alignment of public and private sector interests - combined with supportive financial instruments and scalable deployment models - is propelling the BAPV market from pilot projects into large-scale adoption globally.What Are the Key Growth Drivers Shaping the Future Trajectory of the BAPV Market?

The growth in the Building Applied Photovoltaics market is driven by several factors rooted in energy policy evolution, urbanization dynamics, technological maturation, and changing stakeholder behavior. A key growth driver is the global push for decarbonization, where buildings - which account for nearly 40% of global energy-related emissions - are being targeted as a critical intervention point. BAPV solutions offer a relatively low-barrier entry into clean energy generation, especially for retrofitting older buildings that were not designed with energy efficiency in mind. Another major driver is the scarcity of land in densely populated areas, where rooftop and vertical surface applications of BAPV unlock underutilized real estate for renewable energy production. As energy self-sufficiency becomes a national security issue in many countries, BAPV presents a decentralized, resilient energy source that reduces dependency on large grids. Furthermore, energy cost volatility and peak demand pricing structures are making self-generation via BAPV financially compelling, particularly when paired with energy storage and smart grid integration. The real estate and construction sectors are also under growing pressure to adopt green building certifications such as LEED, BREEAM, and EDGE, where on-site renewable energy generation earns high point values and can significantly enhance project valuations. Insurance and financing institutions are beginning to favor properties with built-in energy resilience, further incentivizing BAPV adoption. Technological readiness - combined with growing installation expertise, standardization of components, and streamlined permitting - is reducing execution risk and making BAPV a viable choice for both developers and end-users. As climate risks, urban density, and energy transition converge, BAPV is emerging as not only a technical solution but a strategic imperative in the future of buildings and energy systems worldwide.Report Scope

The report analyzes the Building Applied Photovoltaics market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (Rooftop Building Applied Photovoltaic, Facades Building Applied Photovoltaic, Other Products); Type (OPV Type, DSC Type, Other Types); Application (Residential Application, Commercial Application, Industrial Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Rooftop Building Applied Photovoltaic segment, which is expected to reach US$329.7 Million by 2030 with a CAGR of a 1%. The Facades Building Applied Photovoltaic segment is also set to grow at 1.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $142.6 Million in 2024, and China, forecasted to grow at an impressive 2.4% CAGR to reach $101.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Building Applied Photovoltaics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Building Applied Photovoltaics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Building Applied Photovoltaics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Anderson Greenwood Crosby, Apollo Valves, Armstrong International Inc., BS&B Safety Systems, CIRCOR International, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Building Applied Photovoltaics market report include:

- AGC Inc.

- BIPV Solutions GmbH

- Canadian Solar Inc.

- Conserval Engineering Inc.

- Dow Inc.

- First Solar, Inc.

- Hanergy Holding Group Ltd.

- Heliatek GmbH

- Hunter Douglas

- JA Solar Holdings Co., Ltd

- LG Electronics

- Onyx Solar Group

- Panasonic Corporation

- Q CELLS (Hanwha Q CELLS)

- Saint-Gobain Solar

- Sharp Corporation

- SolarWindow Technologies

- SunPower Corporation

- Tesla, Inc.

- Ubiquitous Energy

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AGC Inc.

- BIPV Solutions GmbH

- Canadian Solar Inc.

- Conserval Engineering Inc.

- Dow Inc.

- First Solar, Inc.

- Hanergy Holding Group Ltd.

- Heliatek GmbH

- Hunter Douglas

- JA Solar Holdings Co., Ltd

- LG Electronics

- Onyx Solar Group

- Panasonic Corporation

- Q CELLS (Hanwha Q CELLS)

- Saint-Gobain Solar

- Sharp Corporation

- SolarWindow Technologies

- SunPower Corporation

- Tesla, Inc.

- Ubiquitous Energy

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 377 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

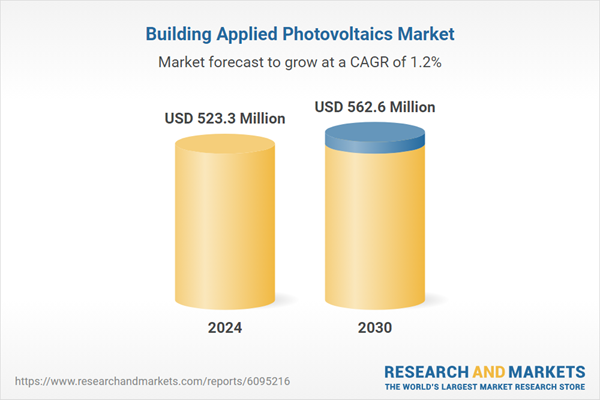

| Estimated Market Value ( USD | $ 523.3 Million |

| Forecasted Market Value ( USD | $ 562.6 Million |

| Compound Annual Growth Rate | 1.2% |

| Regions Covered | Global |