Global Cargo Transportation Insurance Market - Key Trends & Drivers Summarized

Why Is Cargo Transportation Insurance Gaining Critical Importance in Global Trade?

Cargo transportation insurance is emerging as a vital instrument in the risk management strategies of businesses involved in global trade, particularly as supply chains become more complex and vulnerable to disruption. With the exponential rise in cross-border e-commerce, globalized manufacturing, and intermodal freight movements, the exposure to risks such as theft, damage, loss, piracy, and natural disasters has grown significantly. From multimillion-dollar shipments of electronics to time-sensitive pharmaceuticals and perishable goods, cargo is routinely moved across oceans, air routes, and land corridors, often involving multiple handlers and jurisdictions. This fragmentation increases the potential for unforeseen losses at various points in the logistics chain. Cargo insurance provides financial protection and operational resilience, ensuring that businesses can recover from disruptions without catastrophic losses. The recent years have underscored its importance: incidents such as port congestions, vessel blockages, warehouse fires, and cyberattacks on logistics systems have highlighted vulnerabilities in even the most sophisticated supply networks. Regulatory changes in shipping laws, growing environmental uncertainties, and geopolitical tensions further underscore the need for comprehensive cargo insurance coverage. For importers, exporters, freight forwarders, and logistics companies alike, having insurance is no longer optional but essential to comply with trade requirements, secure financing, and meet contractual obligations. As supply chains grow in both complexity and scale, the importance of cargo transportation insurance will continue to expand as a safeguard for global commerce.How Are Technological Advancements Transforming Risk Assessment and Claims Management?

The cargo transportation insurance market is undergoing a digital transformation, driven by advancements in real-time tracking, data analytics, and automation that are enhancing underwriting accuracy and claims efficiency. Traditionally, cargo insurance was based on static data - route risk assessments, weather patterns, and historical loss records - but today, insurers are incorporating live data from IoT sensors, GPS trackers, and blockchain-enabled shipping records to assess risk more dynamically. These technologies provide insights into cargo location, temperature conditions, vibration exposure, and handling practices throughout the journey, allowing for proactive risk mitigation and tiered insurance premiums based on real-time behavior. Claims processing, historically known for being time-consuming and paperwork-heavy, is being streamlined through AI-powered platforms that automate documentation review, fraud detection, and damage assessment using image recognition. Insurtech firms are entering the market with digital-first policies that can be purchased, monitored, and claimed through mobile or web apps, offering flexibility and speed for small and medium-sized shippers. Blockchain technology is also gaining traction, allowing for immutable records of cargo handovers and condition status, which significantly reduces disputes and accelerates settlements. Additionally, machine learning algorithms are helping insurers price policies more accurately, using predictive models that consider shipment type, origin-destination pairs, carrier history, and geopolitical risk. These technological shifts are not only improving the customer experience but also reducing administrative overhead and loss ratios for insurers. As global trade becomes increasingly digitized, the role of technology in refining and redefining cargo insurance practices will only grow more central.What Market Dynamics and Industry Trends Are Shaping the Demand for Cargo Insurance?

A combination of shifting trade dynamics, regulatory frameworks, and evolving customer expectations is reshaping the global cargo transportation insurance market. The expansion of global trade corridors - such as China's Belt and Road Initiative and new routes in Latin America and Africa - is exposing cargo to regions with differing regulatory standards, political instability, and infrastructural limitations, all of which elevate the importance of insurance coverage. Concurrently, rising demand for just-in-time and high-value shipments, particularly in the automotive, pharmaceutical, and electronics sectors, is increasing the need for highly customized and responsive insurance products. Trade agreements, customs reforms, and increased scrutiny over sustainability practices are also influencing the types and terms of coverage required by governments, ports, and international bodies. In the logistics sector, value-added services are becoming key differentiators, with freight forwarders and 3PLs offering embedded cargo insurance to improve service appeal and customer retention. Another emerging trend is the rise of parametric insurance, which pays out based on predefined triggers - such as delays or environmental thresholds - without requiring traditional claims assessments. Climate change and extreme weather events, such as hurricanes, floods, and wildfires, are becoming more frequent and severe, forcing insurers to reassess risk zones and reprice coverage accordingly. Simultaneously, the growth of ESG (Environmental, Social, and Governance) investing is pushing insurance providers to offer greener, more socially responsible cargo coverage options. This confluence of factors is redefining the expectations of what cargo transportation insurance should deliver - not just financial restitution but also proactive risk management, compliance assurance, and operational peace of mind.What's Driving the Growth of the Global Cargo Transportation Insurance Market?

The growth in the cargo transportation insurance market is driven by a convergence of global trade expansion, increased logistical complexity, heightened risk awareness, and innovations in digital risk assessment. The continued rise of international shipping volumes - bolstered by e-commerce, globalized supply chains, and demand for high-value goods - has created a substantial and growing base of insurable cargo. From an end-use standpoint, industries such as pharmaceuticals, energy, consumer electronics, and agriculture are transporting sensitive or regulated materials that necessitate specialized and often mandatory insurance protection. The adoption of intermodal transportation - combining sea, air, road, and rail - has further expanded the scope and complexity of coverage needed, as each leg of the journey introduces unique vulnerabilities. Technological innovation plays a critical role, with insurers leveraging advanced tracking, analytics, and AI to develop bespoke, usage-based policies that offer competitive pricing and responsive claims services. Regulatory trends are also supportive: international mandates, trade facilitation agreements, and financial compliance rules are increasingly requiring insured shipments, particularly for customs clearance and international financing. Consumer and business behavior is shifting toward a “risk-averse” mindset, with more companies seeing cargo insurance not as an overhead cost but as a strategic tool for continuity and customer assurance. Additionally, the growth of third-party logistics providers and integrated shipping platforms is making it easier for even small-scale shippers to access comprehensive, affordable insurance products bundled into logistics solutions. Combined, these drivers ensure that cargo transportation insurance is no longer a passive afterthought but a core component of global trade infrastructure, experiencing robust and sustained growth across markets.Report Scope

The report analyzes the Cargo Transportation Insurance market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Land Cargo Insurance Type, Air Cargo Insurance Type, Marine Cargo Insurance Type); Transport Form (Sea Transport, Air Transport, Other Transport Forms); Policy Type (Open Cover Cargo Policy, Specific Cargo Policy, Other Policy Types).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Land Cargo Insurance segment, which is expected to reach US$40.4 Billion by 2030 with a CAGR of a 2.5%. The Air Cargo Insurance segment is also set to grow at 3.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $14.8 Billion in 2024, and China, forecasted to grow at an impressive 5% CAGR to reach $12.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cargo Transportation Insurance Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cargo Transportation Insurance Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cargo Transportation Insurance Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

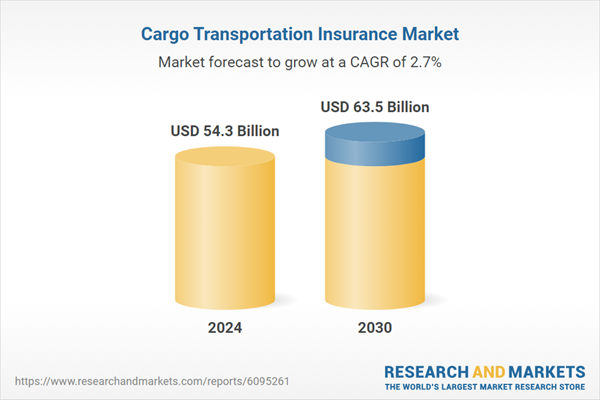

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as A. Monforts Textilmaschinen GmbH, Andritz AG, Autefa Solutions, Bräcker AG, C. F. Nielsen and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Cargo Transportation Insurance market report include:

- Allianz SE

- AXA XL

- Berkshire Hathaway Specialty Insurance

- Chubb Limited

- CNA Financial Corporation

- Generali Group

- Great American Insurance Group

- HDI Global SE

- Hiscox Ltd

- Liberty Mutual Insurance

- Lloyd's of London

- Munich Re

- QBE Insurance Group

- RSA Insurance Group

- SCOR SE

- Sompo Holdings

- Starr Companies

- Swiss Re

- Tokio Marine Holdings

- Zurich Insurance Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Allianz SE

- AXA XL

- Berkshire Hathaway Specialty Insurance

- Chubb Limited

- CNA Financial Corporation

- Generali Group

- Great American Insurance Group

- HDI Global SE

- Hiscox Ltd

- Liberty Mutual Insurance

- Lloyd's of London

- Munich Re

- QBE Insurance Group

- RSA Insurance Group

- SCOR SE

- Sompo Holdings

- Starr Companies

- Swiss Re

- Tokio Marine Holdings

- Zurich Insurance Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 376 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 54.3 Billion |

| Forecasted Market Value ( USD | $ 63.5 Billion |

| Compound Annual Growth Rate | 2.7% |

| Regions Covered | Global |