Global Cell Culture Consumables and Equipment Market - Key Trends & Drivers Summarized

How Is the Expanding Biopharmaceutical Industry Shaping the Cell Culture Market?

The cell culture consumables and equipment market is witnessing unprecedented growth, largely fueled by the rapid expansion of the biopharmaceutical industry. As demand surges for vaccines, monoclonal antibodies, and cell-based therapies, so too does the need for reliable and scalable cell culture systems. Biopharmaceutical manufacturers rely on high-quality culture media, reagents, and equipment to cultivate living cells under optimal conditions, ensuring consistent product yield and quality. Cell culture forms the backbone of drug development, toxicology studies, and production pipelines, especially in therapeutic areas such as oncology, immunology, and infectious diseases.In addition to therapeutic applications, the rise of biologics has made upstream cell culture processes more complex, requiring precise environmental control and high-performance equipment. Single-use bioreactors, automated culture platforms, and high-throughput screening tools are becoming indispensable across laboratories and manufacturing plants. As more biologic drugs progress through clinical trials, the need for process standardization and scalability is escalating, driving demand for next-generation equipment. Moreover, emerging economies are ramping up their biomanufacturing capabilities, thereby widening the global footprint of cell culture infrastructure and further catalyzing market expansion.

What Role Does Innovation Play in Advancing Consumables and Equipment?

Technological innovation is significantly influencing the evolution of cell culture products, with manufacturers developing specialized consumables and intelligent systems to improve reproducibility, efficiency, and scalability. Recent advances include serum-free and chemically defined media that provide consistent performance while minimizing variability and contamination risks. These media are increasingly preferred in both academic and industrial settings, especially when regulatory requirements call for xeno-free or animal-origin-free components. Innovations in 3D culture systems and organoids are also enabling more physiologically relevant models for research, offering deeper insights into disease mechanisms and drug responses.Meanwhile, equipment used in culturing cells has advanced with the introduction of automated incubators, closed-system bioreactors, and integrated monitoring solutions. Smart culture systems now allow for real-time tracking of temperature, pH, oxygen levels, and cell density, reducing manual intervention and improving data accuracy. In parallel, microfluidic platforms and lab-on-chip technologies are helping researchers conduct miniaturized and high-throughput experiments. Such innovations are not only enhancing research capabilities but also reducing operational costs, contamination risks, and labor demands, making them highly attractive to both small-scale labs and large-scale manufacturers.

Why Are Quality Control and Standardization Growing in Importance?

As cell culture applications diversify and scale up, quality control and standardization are emerging as critical factors in ensuring reproducibility and regulatory compliance. For therapeutic products such as biologics and cell therapies, strict regulatory frameworks demand traceable and validated culture conditions. Deviations in cell line performance, media composition, or environmental parameters can lead to batch failures, regulatory penalties, and significant financial losses. As a result, pharmaceutical companies and research institutions are placing heightened emphasis on sourcing consumables from GMP-certified suppliers and deploying validated equipment with rigorous calibration protocols.Furthermore, the globalization of biomedical research and manufacturing has increased the need for harmonized standards across geographies. Consistency in cell culture processes is vital not only for product development but also for technology transfer between research sites, contract manufacturers, and regulatory jurisdictions. Institutions are thus investing in SOP-driven workflows, digital tracking systems, and training programs to uphold uniform practices. These shifts reflect a maturing market that prioritizes product quality, safety, and compliance alongside scientific advancement, cementing quality assurance as a central pillar of market evolution.

What Forces Are Propelling the Market Toward Rapid Expansion?

The growth in the cell culture consumables and equipment market is driven by several factors. The surge in biologics and personalized medicine has led to an increasing reliance on cell culture systems for both R&D and commercial manufacturing. Advances in cell line engineering and the development of high-yield production systems are pushing demand for precise, scalable culture environments. The global expansion of biopharma manufacturing facilities, particularly in Asia-Pacific and Latin America, is also generating new demand for affordable, high-quality culture consumables and lab infrastructure. Increasing funding in life sciences research, coupled with the rise in stem cell and regenerative medicine applications, is further broadening the market's scope. In addition, the industry-wide shift toward single-use technologies and automation is driving the adoption of new formats and smart culture tools. These trends, along with growing regulatory pressures for standardization and traceability, are accelerating the uptake of sophisticated cell culture solutions and reshaping the market landscape at a rapid pace.Report Scope

The report analyzes the Cell Culture Consumables and Equipment market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (Cell Culture Consumables, Cell Culture Instruments); Application (Vaccination Application, Toxicity Testing Application, Cancer Research Application, Drug Screening & Development Application, Recombinant Products Application, Stem Cell Technology Application, Regenerative Medicine Application); End-Use (Industrial End-Use, Biotechnology End-Use, Agriculture End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Cell Culture Consumables segment, which is expected to reach US$17.4 Billion by 2030 with a CAGR of a 11.3%. The Cell Culture Instruments segment is also set to grow at 7.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.6 Billion in 2024, and China, forecasted to grow at an impressive 14.1% CAGR to reach $4.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cell Culture Consumables and Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cell Culture Consumables and Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cell Culture Consumables and Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Almac Group, AmerisourceBergen Corporation, Arvato Supply Chain Solutions, Biocair, BioLife Solutions and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Cell Culture Consumables and Equipment market report include:

- Agilent Technologies Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories Inc.

- CellGenix GmbH

- Corning Incorporated

- Cytiva

- Danaher Corporation

- Eppendorf AG

- FUJIFILM Irvine Scientific

- GE Healthcare Life Sciences

- Greiner Bio-One GmbH

- HiMedia Laboratories Pvt. Ltd.

- Lonza Group AG

- Merck KGaA

- Miltenyi Biotec GmbH

- PromoCell GmbH

- Sartorius AG

- STEMCELL Technologies Inc.

- Thermo Fisher Scientific Inc.

- VWR International

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Agilent Technologies Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories Inc.

- CellGenix GmbH

- Corning Incorporated

- Cytiva

- Danaher Corporation

- Eppendorf AG

- FUJIFILM Irvine Scientific

- GE Healthcare Life Sciences

- Greiner Bio-One GmbH

- HiMedia Laboratories Pvt. Ltd.

- Lonza Group AG

- Merck KGaA

- Miltenyi Biotec GmbH

- PromoCell GmbH

- Sartorius AG

- STEMCELL Technologies Inc.

- Thermo Fisher Scientific Inc.

- VWR International

Table Information

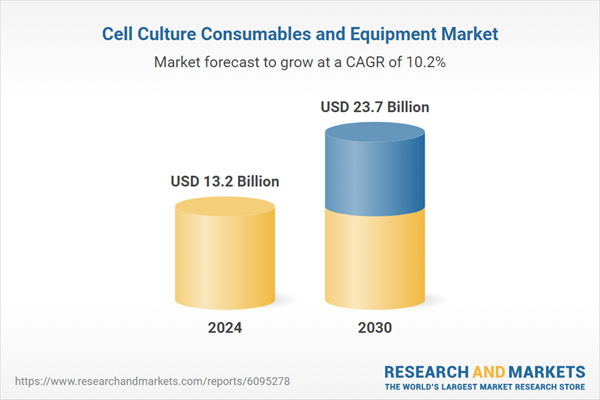

| Report Attribute | Details |

|---|---|

| No. of Pages | 385 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 13.2 Billion |

| Forecasted Market Value ( USD | $ 23.7 Billion |

| Compound Annual Growth Rate | 10.2% |

| Regions Covered | Global |