Global Chocolate Ingredients Market - Key Trends & Drivers Summarized

What's Behind the Surge in Demand for Artisanal and Functional Chocolate Formulations?

The global chocolate ingredients market is undergoing a dynamic transformation, fueled by changing consumer preferences toward premium, artisanal, and health-enhancing chocolate products. Ingredients such as cocoa liquor, cocoa butter, cocoa powder, sweeteners, emulsifiers, dairy components, and flavor enhancers are seeing diversified demand profiles depending on product positioning - be it indulgent, organic, or functional. A strong shift in global consumer behavior towards “clean label” and nutrient-rich indulgences has elevated the importance of high-quality, traceable chocolate ingredients. Many consumers now scrutinize ingredient lists for fair-trade cocoa, non-GMO emulsifiers like lecithin, and natural sweeteners including stevia or coconut sugar. This change is especially visible in premium and boutique chocolate segments, where ingredients are positioned as central to the brand story. Furthermore, the rise in plant-based diets has encouraged chocolate producers to reformulate products with non-dairy milk powders, vegan fat replacers, and allergen-free compounds - requiring reformulation at the ingredient level. Chocolate has evolved from a simple comfort snack to a wellness-enriched product, thereby expanding the ingredient mix and quality requirements globally.Are Technological Innovations Reshaping Ingredient Composition and Sustainability?

Yes, innovations in food processing and ingredient science are playing a decisive role in shaping the future of chocolate manufacturing. Key among these is the development of advanced cocoa fermentation and drying techniques that improve flavor retention and bean quality, enabling superior cocoa liquor and butter extraction. Enzyme technology is being employed to reduce sugar content while maintaining texture and sweetness, directly impacting the formulation of low-sugar and diabetic-friendly chocolates. Meanwhile, food scientists are developing heat-resistant chocolate ingredients for markets with warmer climates, ensuring product integrity throughout the supply chain. Sustainability is another critical area of innovation - ingredient sourcing is increasingly tied to regenerative agricultural practices, and blockchain technology is being utilized to provide transparent supply chain verification, particularly for cocoa beans. Upcycling is gaining traction as well, where ingredients like cocoa husks and pulp are being repurposed into fiber-rich or antioxidant-rich additives, helping to reduce food waste. These developments are not only increasing the functionality of chocolate ingredients but are also redefining their role in supporting ethical and environmental brand narratives.How Are Regional Preferences and Localized Palates Driving Ingredient Choices?

Different regions demand unique chocolate formulations, directly impacting ingredient procurement and usage. In Europe, there's a pronounced preference for rich, high-cocoa-content dark chocolates that require refined cocoa butter and minimal additives. The European market also shows strong demand for organic and ethically sourced ingredients, driven by mature consumer awareness. North America, by contrast, is embracing a wave of functional chocolate - think fortified bars with collagen, protein, adaptogens, and probiotics - which requires a complex matrix of stabilizers, emulsifiers, and bioactive ingredients. Asia-Pacific consumers lean toward milder, creamier chocolates with innovative inclusions such as matcha, sesame, or fruit-based infusions, influencing ingredient trends like flavored cocoa powders and specialty oils. In Latin America, where cacao is native, traditional ingredients such as panela sugar or cinnamon are used in local chocolates, creating a demand for regional flavor enhancers. African nations, while being primary cocoa suppliers, are also witnessing rising domestic chocolate production, prompting growth in localized sourcing and small-batch ingredient blending. This geographical diversification in taste and formulation necessitates a highly adaptive and regionally nuanced approach to ingredient supply and innovation.The Growth in the Chocolate Ingredients Market Is Driven by Several Factors

The expansion of the chocolate ingredients market is propelled by an intricate web of sector-specific, technological, and behavioral developments. Foremost, the rise in health-conscious consumption is prompting manufacturers to adopt low-sugar, high-cocoa, and additive-free ingredients, directly influencing sourcing and formulation strategies. In the technology space, innovations in cocoa bean processing, natural sweetener integration, and clean emulsification have enabled ingredient developers to create sophisticated, multi-functional blends tailored to specific dietary or sensory requirements. End-use dynamics are also key - ranging from gourmet chocolates and protein bars to plant-based confectionery and nutraceutical products - each necessitating distinct ingredient profiles. Consumer preferences for traceability, sustainability, and fair-trade practices are influencing the demand for certified ingredients and ethical sourcing models. In addition, the premiumization of chocolate across global markets has triggered the use of exotic flavors, nut inclusions, and floral or botanical infusions, spurring demand for specialty flavor compounds and natural additives. E-commerce and digital branding have empowered artisanal and small-scale producers to access global ingredient suppliers, increasing both competition and diversity in product offerings. Together, these forces are reshaping the chocolate ingredients market into a highly responsive and innovation-driven domain.Report Scope

The report analyzes the Chocolate Ingredients market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Cocoa Butter, Cocoa Powder, Cocoa Liquor); Distribution Channel (Traditional Trade Distribution Channel, Modern Trade Distribution Channel, Industrial Distribution Channel, Foodservice Distribution Channel); Application (Food & Beverages Application, Pharmaceuticals Application, Nutraceuticals Application, Cosmetics & Personal Care Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Cocoa Butter segment, which is expected to reach US$11.4 Billion by 2030 with a CAGR of a 2.5%. The Cocoa Powder segment is also set to grow at 3.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.4 Billion in 2024, and China, forecasted to grow at an impressive 5% CAGR to reach $3.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Chocolate Ingredients Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Chocolate Ingredients Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Chocolate Ingredients Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AB Chem Technologies, AstaTech (Chengdu) Biopharmaceutical, Capot Chemical Co., Ltd., Central Drug House Pvt. Ltd., Clinivex Enterprises Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Chocolate Ingredients market report include:

- ADM (Archer Daniels Midland)

- Barry Callebaut AG

- Blommer Chocolate Company

- Cargill, Incorporated

- Cemoi Group

- Chocoladefabriken Lindt & Sprüngli AG

- Crown of Holland (Tradin Organic)

- ECOM Agroindustrial Corp.

- Ferrero International S.A.

- Fuji Oil Holdings Inc.

- Guan Chong Berhad

- Guittard Chocolate Company

- Hershey Company

- JB Cocoa

- Mars, Incorporated

- Meiji Holdings Co., Ltd.

- Mondelez International

- Nestlé S.A.

- Olam Food Ingredients (ofi)

- Valrhona

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ADM (Archer Daniels Midland)

- Barry Callebaut AG

- Blommer Chocolate Company

- Cargill, Incorporated

- Cemoi Group

- Chocoladefabriken Lindt & Sprüngli AG

- Crown of Holland (Tradin Organic)

- ECOM Agroindustrial Corp.

- Ferrero International S.A.

- Fuji Oil Holdings Inc.

- Guan Chong Berhad

- Guittard Chocolate Company

- Hershey Company

- JB Cocoa

- Mars, Incorporated

- Meiji Holdings Co., Ltd.

- Mondelez International

- Nestlé S.A.

- Olam Food Ingredients (ofi)

- Valrhona

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 375 |

| Published | February 2026 |

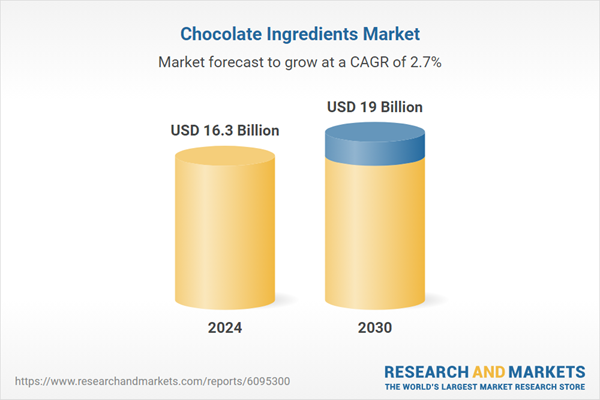

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 16.3 Billion |

| Forecasted Market Value ( USD | $ 19 Billion |

| Compound Annual Growth Rate | 2.7% |

| Regions Covered | Global |