Global 'Client Solid-State Drive (SSD)' Market - Key Trends & Drivers Summarized

How Are Client SSDs Transforming Everyday Digital Experiences?

Client Solid-State Drives (SSDs) have moved from being premium storage solutions to standard components in personal computing, thanks to consistent advancements in performance, affordability, and form factors. These drives now power a wide array of devices, including laptops, ultrabooks, tablets, and desktops, providing users with faster data access, reduced boot times, and lower power consumption. The increasing digitalization of work, education, and entertainment has intensified demand for high-speed and reliable storage, propelling SSD adoption among individual consumers, students, gamers, and remote professionals. Their noiseless operation, better durability compared to HDDs, and compact size make SSDs particularly suitable for sleek, portable devices.A significant push has also come from changing consumer expectations for responsiveness and performance. With web applications, streaming services, gaming platforms, and cloud integrations becoming heavier and more interactive, SSDs are critical to ensure seamless multitasking. Operating systems and software are increasingly optimized for SSD usage, amplifying their performance advantage further. OEMs across all pricing tiers now bundle SSDs as default offerings, recognizing that users value the performance boost more than additional hard drive capacity. Moreover, widespread e-commerce availability and online tech literacy have accelerated consumer upgrade cycles, with many users opting to retrofit older systems with SSDs for a significant speed revival.

What Technological Trends Are Pushing SSD Performance Boundaries?

The rapid evolution of interface technologies has propelled client SSD performance to unprecedented levels. While SATA SSDs once dominated the consumer market, NVMe SSDs leveraging the PCIe interface have now become the gold standard, offering multi-gigabit per second transfer rates and enabling real-time processing of large data files. PCIe Gen4 and Gen5 SSDs are particularly favored by gamers, content creators, and engineers who require high-speed data workflows. These developments have shifted the competitive landscape toward innovation in controller design, NAND layering, and thermal management systems.High-density 3D NAND technology allows more data to be stored in smaller physical spaces, driving down per-gigabyte costs and making larger capacity SSDs (1TB and above) more accessible to mainstream users. DRAM-less SSDs using Host Memory Buffer (HMB) technology are also carving out a niche in value segments by offering high speeds at lower prices. Meanwhile, innovations in error correction, wear leveling, and over-provisioning are extending SSD lifespan and reliability, making them viable for long-term usage. Compact M.2 and soldered BGA SSDs are increasingly integrated into ultra-slim laptops, supporting the consumer trend toward minimalist and portable computing devices.

Where Is Consumer Demand Concentrated, and How Are Markets Evolving?

Demand for client SSDs is expanding across geographies, but usage patterns vary by region. North America and Western Europe remain mature markets with strong replacement cycles and high-end gaming and professional usage driving SSD upgrades. Asia-Pacific, particularly China, India, and South Korea, represents the fastest-growing market segment due to rising disposable incomes, aggressive digital adoption, and government-led digitization initiatives. Budget-conscious consumers in these regions are increasingly opting for SSDs in affordable computing devices and DIY PC builds. Latin America, the Middle East, and parts of Africa are witnessing rising SSD penetration, mainly through refurbished PCs and local assembly ecosystems.E-commerce platforms have played a pivotal role in democratizing access to SSDs, providing consumers with transparent comparisons, competitive pricing, and abundant user reviews. Seasonal promotions and bundled deals with memory kits or operating systems also encourage SSD adoption. Additionally, educational institutions and small businesses upgrading IT infrastructure post-pandemic are creating bulk demand for client SSDs. Regional consumer behavior is also shifting as people become more aware of the long-term advantages of SSDs in terms of performance, energy efficiency, and productivity, often prioritizing SSD capacity over legacy HDD storage in purchasing decisions.

What Is Fueling the Accelerated Growth of the Client SSD Market?

The growth in the client SSD market is driven by several factors related to technology trends, end-use patterns, and evolving consumer expectations. The single largest catalyst is the widespread shift to digital platforms for work, learning, entertainment, and social interaction, which has created a need for faster and more reliable computing hardware. SSDs deliver the performance enhancements required for these activities, making them indispensable in modern personal computing. The proliferation of high-speed internet and cloud computing has increased user dependency on storage systems that can keep up with high I/O demands, further boosting SSD relevance.On the technological front, continuous improvements in NAND flash memory density, controller intelligence, and power efficiency are enabling OEMs to offer larger and faster SSDs at lower prices. Interface transitions from SATA to NVMe and now to PCIe Gen4/Gen5 are raising performance benchmarks, particularly among gamers and creative professionals. Meanwhile, thin-and-light laptop designs have necessitated the adoption of compact SSD form factors like M.2 and BGA, supporting ultra-portability without compromising storage speed. Consumer behavior is also evolving - users now value system responsiveness and load times over sheer storage size, leading to increased willingness to invest in SSD-equipped devices even in entry-level price brackets.

In addition, post-pandemic remote work setups and hybrid educational models have fueled PC and laptop sales, many of which are pre-configured with SSDs. Regional policies that encourage digital inclusion, along with stimulus-led tech purchases in emerging economies, have added to SSD demand. E-waste reduction and device longevity trends are influencing upgrade decisions, with SSDs being a popular retrofit option for aging hardware. The collective impact of these factors - from form factor innovation to consumer behavior and global digitization - is driving sustained and multifaceted growth in the client SSD market.

Report Scope

The report analyzes the Client Solid-State Drive (SSD) market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (TLC NAND, MLC NAND, 3D NAND); End-Use (Laptops End-Use, PCs End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the TLC NAND segment, which is expected to reach US$43.8 Billion by 2030 with a CAGR of a 38.5%. The MLC NAND segment is also set to grow at 33.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.8 Billion in 2024, and China, forecasted to grow at an impressive 47.1% CAGR to reach $17.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Client Solid-State Drive (SSD) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Client Solid-State Drive (SSD) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Client Solid-State Drive (SSD) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Albion Co., Ltd., Amorepacific Corporation, Avon Products, Inc., Beiersdorf AG, Brihans Natural Products Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Client Solid-State Drive (SSD) market report include:

- ADATA Technology Co., Ltd.

- Apacer Technology Inc.

- Corsair Memory, Inc.

- Crucial (Micron Technology, Inc.)

- Intel Corporation

- Kingston Technology Corporation

- Kioxia Corporation

- Lexar (Longsys)

- Micron Technology, Inc.

- Mushkin Enhanced

- Netac Technology Co., Ltd.

- Patriot Memory LLC

- Phison Electronics Corporation

- Plextor (Lite-On Technology Corp.)

- PNY Technologies Inc.

- Samsung Electronics Co., Ltd.

- Seagate Technology Holdings PLC

- Silicon Power Computer & Communications Inc.

- SK hynix Inc.

- Western Digital Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ADATA Technology Co., Ltd.

- Apacer Technology Inc.

- Corsair Memory, Inc.

- Crucial (Micron Technology, Inc.)

- Intel Corporation

- Kingston Technology Corporation

- Kioxia Corporation

- Lexar (Longsys)

- Micron Technology, Inc.

- Mushkin Enhanced

- Netac Technology Co., Ltd.

- Patriot Memory LLC

- Phison Electronics Corporation

- Plextor (Lite-On Technology Corp.)

- PNY Technologies Inc.

- Samsung Electronics Co., Ltd.

- Seagate Technology Holdings PLC

- Silicon Power Computer & Communications Inc.

- SK hynix Inc.

- Western Digital Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 281 |

| Published | January 2026 |

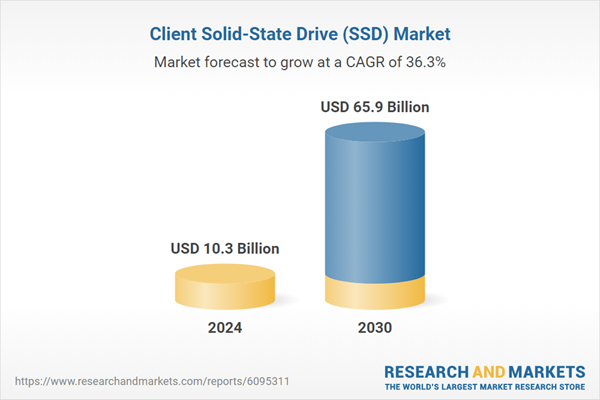

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 10.3 Billion |

| Forecasted Market Value ( USD | $ 65.9 Billion |

| Compound Annual Growth Rate | 36.3% |

| Regions Covered | Global |