Global 'Clindamycin Phosphate Injections' Market - Key Trends & Drivers Summarized

Why Is Clindamycin Phosphate Injection Still a Critical Tool in Antimicrobial Therapy?

Clindamycin phosphate injection remains a vital antibiotic option, especially in the management of serious bacterial infections caused by anaerobic organisms, streptococci, and staphylococci - including methicillin-resistant strains. As an injectable lincosamide, it plays a central role in hospital settings for patients unable to take oral medications or those needing immediate systemic intervention. The drug's ability to penetrate tissues and bone effectively has made it a preferred treatment for deep-seated infections such as intra-abdominal abscesses, pelvic infections, osteomyelitis, and septicemia. Its relevance has grown in response to rising antimicrobial resistance (AMR), where it is often used as a second-line agent or in combination therapies. The injectable format ensures controlled dosing and predictable bioavailability, making it indispensable in emergency and intensive care scenarios.How Are Regulatory Policies and Hospital Protocols Shaping Demand for This Antibiotic?

Global health authorities have been increasingly emphasizing antibiotic stewardship programs to combat resistance, and this has both constrained and clarified the use of injectable clindamycin. Its use is being prioritized for cases where bacterial cultures confirm susceptibility, or where first-line antibiotics have failed. Hospital formularies in the U.S., Europe, and Asia-Pacific continue to include clindamycin phosphate as a critical reserve drug, especially in cases involving polymicrobial infections or penicillin allergies. In regions with poor access to advanced antibiotics, clindamycin serves as a primary parenteral option. WHO's inclusion of injectable clindamycin in the Essential Medicines List (EML) continues to support its widespread adoption in national procurement policies, especially in low- and middle-income countries.What Are the Market Challenges and Regional Dynamics Affecting Supply and Distribution?

The market for clindamycin phosphate injections is tightly linked to pharmaceutical manufacturing capabilities, API supply chain stability, and regional health infrastructure. Regulatory compliance, particularly around Good Manufacturing Practice (GMP) standards, influences supplier eligibility - especially for injectable drugs that require aseptic processing. Pricing controls, reimbursement policies, and centralized government procurement systems in countries like India, Brazil, and parts of Africa heavily influence demand volume and vendor competition. In contrast, North America and Western Europe present a more consolidated market dominated by hospital group purchasing organizations (GPOs) and branded generic players. Shortages caused by raw material disruption or manufacturing quality lapses have at times affected availability, emphasizing the need for multiple sourcing strategies. Furthermore, awareness campaigns about AMR and initiatives to restrict unnecessary injectable use have also impacted prescribing trends in select markets.What Factors Are Driving Growth in the Injectable Clindamycin Market Globally?

The growth in the clindamycin phosphate injection market is driven by several factors including the increasing incidence of hospital-acquired infections (HAIs), growing surgical volumes, and the sustained need for effective treatments for anaerobic and gram-positive bacterial infections. The expanding base of immunocompromised patients, such as those undergoing cancer therapy or organ transplants, has further fueled demand for broad-spectrum, injectable antimicrobials. Rising resistance to other antibiotic classes, particularly beta-lactams and macrolides, is pushing clinicians to rely more on clindamycin as part of combination therapies or in specialized cases. Additionally, the drug's inclusion in emergency medical kits and essential drugs lists across multiple countries ensures consistent procurement. The push for healthcare access in developing regions, along with increased hospital infrastructure investments, is expected to maintain demand for injectable antibiotics like clindamycin phosphate, reinforcing its position in the global antimicrobial arsenal.Report Scope

The report analyzes the Clindamycin Phosphate Injections market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (2ml Vial, 4ml Vial, 6ml Vial); End-Use (Hospitals End-Use, Clinics End-Use, Ambulatory Surgery Centers End-Use, Homecare Settings End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the 2ml Vial Injections segment, which is expected to reach US$392.9 Million by 2030 with a CAGR of a 5.3%. The 4ml Vial Injections segment is also set to grow at 4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $126.2 Million in 2024, and China, forecasted to grow at an impressive 8.7% CAGR to reach $128.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Clindamycin Phosphate Injections Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Clindamycin Phosphate Injections Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Clindamycin Phosphate Injections Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

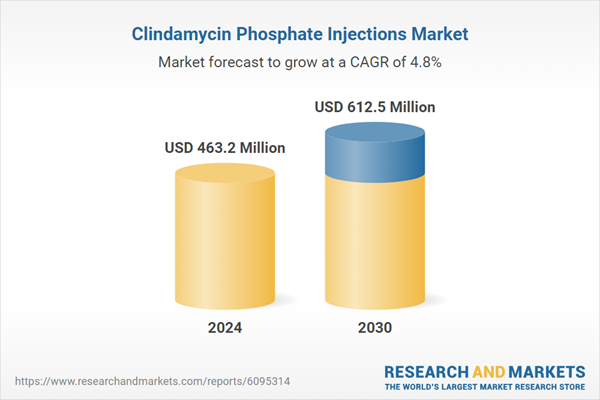

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Beal, Black Diamond Equipment, BlueWater Ropes, Cousin Trestec, Edelrid and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Clindamycin Phosphate Injections market report include:

- AbbVie Inc.

- Akorn, Inc.

- Alvogen

- Amgen Inc.

- Aurobindo Pharma

- Baxter International Inc.

- Bayer AG

- Cipla Limited

- Dr. Reddy's Laboratories

- Eli Lilly and Company

- Fangming Pharmaceutical Group

- Fresenius Kabi

- GlaxoSmithKline plc

- Hikma Pharmaceuticals PLC

- Johnson & Johnson

- Lupin Limited

- Mylan N.V.

- Novartis AG

- Pfizer Inc.

- Sandoz International GmbH

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AbbVie Inc.

- Akorn, Inc.

- Alvogen

- Amgen Inc.

- Aurobindo Pharma

- Baxter International Inc.

- Bayer AG

- Cipla Limited

- Dr. Reddy's Laboratories

- Eli Lilly and Company

- Fangming Pharmaceutical Group

- Fresenius Kabi

- GlaxoSmithKline plc

- Hikma Pharmaceuticals PLC

- Johnson & Johnson

- Lupin Limited

- Mylan N.V.

- Novartis AG

- Pfizer Inc.

- Sandoz International GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 285 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 463.2 Million |

| Forecasted Market Value ( USD | $ 612.5 Million |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |