Global Commercial Solar PV Inverter Market - Key Trends & Drivers Summarized

Why Are Commercial Solar PV Inverters the Heart of Scalable Solar Infrastructure?

Commercial solar PV inverters are an indispensable component in the transformation of solar energy from raw photovoltaic output into usable alternating current (AC) electricity suitable for commercial operations. Inverters not only manage the DC-to-AC conversion process but also provide voltage regulation, grid synchronization, power quality control, and safety disconnection. Within commercial-scale installations - such as those on factories, warehouses, malls, hospitals, data centers, and office buildings - these inverters serve as both the technological and operational backbone of solar energy generation.The growing cost-efficiency of solar modules, coupled with rising electricity tariffs and sustainability mandates, has led commercial enterprises to actively pursue on-site solar installations. These setups require robust, high-capacity, and intelligent inverters capable of managing larger and more variable loads than their residential counterparts. As distributed generation becomes mainstream, commercial solar PV inverters are no longer just hardware components - they are integrated systems for power conditioning, analytics, and energy optimization across diverse commercial landscapes.

How Are Advanced Inverter Architectures and Smart Grid Integration Driving Innovation?

The commercial inverter market is undergoing rapid technological evolution, driven by the integration of smart features, modular design, and real-time monitoring. Three-phase string inverters dominate the segment due to their scalability, ease of maintenance, and cost-efficiency. However, central inverters are still preferred for very large rooftop or ground-mounted commercial installations due to their high power ratings and compatibility with high-voltage systems. Innovations such as multi-MPPT (maximum power point tracking), anti-islanding protection, and arc fault detection have become standard across modern commercial inverter platforms.Smart inverters are emerging as a pivotal advancement, enabling interaction with the grid and energy management systems. These inverters support functions such as reactive power control, voltage regulation, and frequency response - essential for grid stability as solar penetration rises. IoT-enabled systems now allow remote diagnostics, firmware updates, and yield forecasting, helping facility managers and EPC contractors reduce downtime and maximize system ROI. Additionally, hybrid inverters capable of integrating battery storage are gaining traction among commercial users seeking greater energy independence and peak-shaving capabilities.

Which End-Use Segments and Regional Markets Are Fueling the Rise of Commercial PV Inverters?

Key end-users of commercial solar PV inverters span industries where energy costs and sustainability are high priorities. Manufacturing units, data centers, corporate campuses, universities, and hospital complexes are leading adopters due to large roof areas and continuous energy demand. Retail chains, shopping malls, hospitality venues, and agricultural farms are also deploying rooftop PV systems, benefiting from modular inverter setups that cater to varied load profiles and building footprints.Geographically, Asia-Pacific leads the global market in volume, driven by aggressive solar deployment in China, India, Japan, and Australia. These countries are prioritizing commercial and industrial solar adoption through incentives, mandates, and energy transition policies. North America is a high-growth market due to rising corporate ESG commitments, favorable net-metering policies, and advanced grid infrastructure in the U.S. and Canada. Europe shows steady demand supported by high electricity costs, decarbonization goals, and evolving energy performance directives. Emerging growth pockets are visible in Latin America, the Middle East, and Africa, where commercial PV projects are overcoming grid constraints and helping companies stabilize energy supply.

What Is Driving the Growth of the Commercial Solar PV Inverter Market?

The growth in the commercial solar PV inverter market is driven by increasing investment in decentralized, clean energy generation by businesses seeking cost savings, resilience, and environmental compliance. A major growth catalyst is the global decarbonization agenda, which is pushing corporations to integrate solar PV into their sustainability strategies. Inverters are a vital enabler of this shift, ensuring the efficient and safe operation of every commercial-scale solar plant.Additionally, digitalization trends are reshaping commercial energy management, with inverters now acting as data nodes in a broader smart energy ecosystem. The emergence of microgrids, energy trading platforms, and time-of-use pricing models is encouraging commercial operators to deploy smart inverters capable of advanced control and analytics. The market is also being propelled by declining inverter costs, improvements in conversion efficiency, and favorable policy frameworks supporting net-zero targets. As the commercial sector intensifies its pursuit of energy self-reliance, the demand for high-performance, intelligent, and grid-compliant solar PV inverters is set to grow steadily worldwide.

Report Scope

The report analyzes the Commercial Solar PV Inverter market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Central Inverters, String Inverters, Micro Inverters); Phase (Single-Phase, Three-Phase, Hybrid Phase); Connection (On-Grid Connection, Off-Grid Connection).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Central Inverters segment, which is expected to reach US$2.3 Billion by 2030 with a CAGR of a 4.8%. The String Inverters segment is also set to grow at 3.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $766.1 Million in 2024, and China, forecasted to grow at an impressive 7.8% CAGR to reach $741.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Commercial Solar PV Inverter Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Commercial Solar PV Inverter Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Commercial Solar PV Inverter Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aksa Power Generation, Acciona Energy, Adani Power, American Electric Power (AEP), Bechtel Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Commercial Solar PV Inverter market report include:

- ABB (FIMER)

- Alencon Systems

- APsystems

- Beny New Energy

- Delta Electronics

- Enphase Energy

- FIMER (formerly ABB Solar)

- Fronius International

- General Electric (GE)

- Ginlong Technologies (Solis)

- GoodWe Power Supply Technology

- Growatt New Energy

- Huawei Technologies Co., Ltd.

- KACO new energy

- KSTAR

- Power Electronics

- Schneider Electric

- Siemens (KACO)

- SMA Solar Technology AG

- Sungrow Power Supply Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB (FIMER)

- Alencon Systems

- APsystems

- Beny New Energy

- Delta Electronics

- Enphase Energy

- FIMER (formerly ABB Solar)

- Fronius International

- General Electric (GE)

- Ginlong Technologies (Solis)

- GoodWe Power Supply Technology

- Growatt New Energy

- Huawei Technologies Co., Ltd.

- KACO new energy

- KSTAR

- Power Electronics

- Schneider Electric

- Siemens (KACO)

- SMA Solar Technology AG

- Sungrow Power Supply Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 378 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

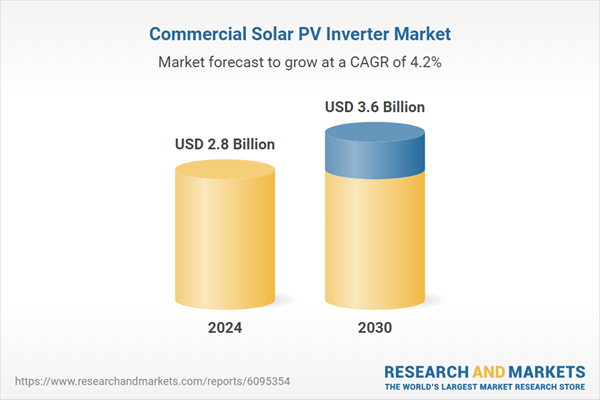

| Estimated Market Value ( USD | $ 2.8 Billion |

| Forecasted Market Value ( USD | $ 3.6 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |