Global Commercial Vehicle Bearings Market - Key Trends & Drivers Summarized

Why Are Bearings Indispensable to the Performance and Durability of Commercial Vehicles?

Bearings serve as foundational mechanical components in commercial vehicles, facilitating smooth rotation, load distribution, and the reduction of friction across a range of systems - including wheels, engines, transmissions, steering columns, drive shafts, and alternators. In the demanding operational context of commercial vehicles - such as freight trucks, transit buses, heavy-duty construction equipment, and delivery vans - bearings are exposed to high loads, continuous operation, and challenging environments, making performance and durability non-negotiable. Their failure can lead to catastrophic system breakdowns, increased maintenance costs, and operational downtimes.Given the complexity and performance expectations of commercial fleets, bearings must withstand extreme temperatures, contamination, shock loads, and prolonged stress cycles. They must also contribute to fuel efficiency and reduced emissions by minimizing mechanical resistance. The industry's increasing focus on energy efficiency, sustainability, and electrification has placed additional performance demands on bearings, requiring advanced designs, superior materials, and smart lubrication technologies. As a result, bearings have evolved from basic rotating components into high-precision, engineered parts optimized for endurance, efficiency, and integration with connected vehicle systems.

How Are Innovations in Materials, Design, and Sensor Integration Shaping the Market?

The commercial vehicle bearings market is undergoing notable transformation through innovations in materials science and manufacturing processes. Advanced alloys, ceramic hybrids, and corrosion-resistant coatings are being used to develop bearings with enhanced load capacity, thermal resistance, and fatigue life. Sealed-for-life and maintenance-free bearing systems are gaining popularity, especially in wheel hubs and transmission assemblies, where frequent lubrication or replacement is impractical in fleet operations.Moreover, the adoption of sensor-integrated bearings is unlocking new dimensions of value in fleet maintenance and reliability management. Smart bearings equipped with temperature, vibration, and load sensors provide real-time data on operating conditions, allowing predictive diagnostics and early detection of wear or misalignment. These solutions are particularly valuable for long-haul freight and mission-critical service fleets, helping reduce unscheduled downtime and optimize maintenance schedules. Additionally, customized bearing designs - such as tapered roller bearings for heavy-duty axle systems or angular contact bearings for electric drivetrains - are being developed to meet specific commercial vehicle architecture and performance requirements.

Which Vehicle Classes and Global Regions Are Driving Commercial Bearing Demand?

Bearings are integral to all classes of commercial vehicles, from light-duty delivery vans and mid-size buses to heavy-duty trucks, construction equipment, and agricultural transporters. Each category presents unique load, speed, and environmental challenges that demand tailored bearing solutions. For example, wheel-end bearings in heavy-duty trucks must handle high radial and axial loads, while engine and turbocharger bearings must maintain precision under high temperatures and lubrication variability.Geographically, Asia-Pacific dominates the market due to its vast commercial vehicle production base, high aftermarket demand, and ongoing infrastructure growth in countries like China and India. The North American market benefits from a well-established logistics sector and rising demand for smart and fuel-efficient bearing solutions. In Europe, regulatory pressure on emissions and fuel economy is prompting adoption of low-friction and lightweight bearings. Emerging markets in Latin America, Africa, and the Middle East are also witnessing increased bearing demand as commercial vehicle fleets expand to support urbanization, e-commerce, and industrial activities.

What Is Driving the Growth of the Commercial Vehicle Bearings Market?

The growth in the commercial vehicle bearings market is driven by the rising demand for vehicle durability, fleet uptime optimization, and enhanced powertrain performance in both traditional and electrified vehicle platforms. One of the key drivers is the increased adoption of high-performance and long-life bearings, which reduce maintenance frequency and improve total cost of ownership - an important metric for fleet operators. The expanding use of connected vehicle diagnostics is also reinforcing demand for sensor-enabled smart bearings, which support condition monitoring and preventive maintenance.Another major driver is the shift toward electrification, where bearings must adapt to higher RPMs, quieter operation, and tighter thermal constraints in electric motors and e-axles. In parallel, global supply chain digitization and aftermarket expansion are increasing bearing demand for both OE and replacement applications. As commercial vehicles grow more technologically advanced and application-specific, the role of bearings is becoming more central to performance, safety, and lifecycle management. This confluence of technical, economic, and regulatory forces is positioning commercial vehicle bearings as a critical enabler of next-generation mobility solutions.

Report Scope

The report analyzes the Commercial Vehicle Bearings market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Bearing Type (Ball Bearing, Roller Bearing, Plain Bearing); Application (Engine Application, Transmission Application, Wheel Steering Application, Other Applications); End-Use (Light Commercial Vehicles End-Use, Medium & Heavy Commercial Vehicles End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Ball Bearing segment, which is expected to reach US$15 Billion by 2030 with a CAGR of a 3.5%. The Roller Bearing segment is also set to grow at 4.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.4 Billion in 2024, and China, forecasted to grow at an impressive 6.9% CAGR to reach $5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Commercial Vehicle Bearings Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Commercial Vehicle Bearings Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Commercial Vehicle Bearings Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aeva, Aptiv, Autoliv, Baidu Apollo, Bosch and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Commercial Vehicle Bearings market report include:

- ABC Bearings Ltd.

- C&U Group

- Changzhou NRB Corporation

- Federal-Mogul Holdings LLC

- Fersa Bearings

- GKN plc

- Harbin Bearing Manufacturing Co., Ltd.

- ILJIN Group

- JTEKT Corporation

- KG International FZCO

- Luoyang LYC Bearing Co., Ltd.

- MAHLE GmbH

- Meritor, Inc.

- NBC Bearings

- NKE Austria GmbH

- NRB Bearings Ltd.

- NTN Corporation

- NSK Ltd.

- RBC Bearings Incorporated

- Schaeffler Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABC Bearings Ltd.

- C&U Group

- Changzhou NRB Corporation

- Federal-Mogul Holdings LLC

- Fersa Bearings

- GKN plc

- Harbin Bearing Manufacturing Co., Ltd.

- ILJIN Group

- JTEKT Corporation

- KG International FZCO

- Luoyang LYC Bearing Co., Ltd.

- MAHLE GmbH

- Meritor, Inc.

- NBC Bearings

- NKE Austria GmbH

- NRB Bearings Ltd.

- NTN Corporation

- NSK Ltd.

- RBC Bearings Incorporated

- Schaeffler Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 365 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

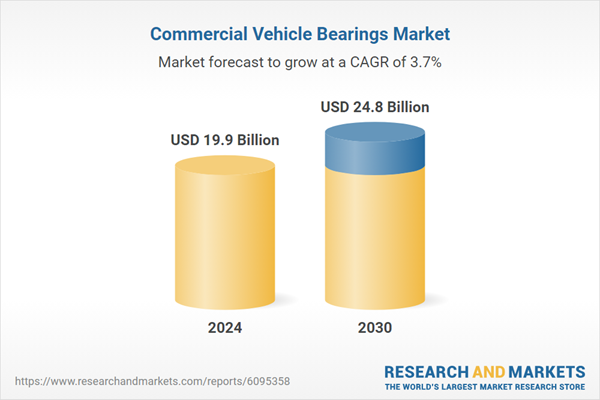

| Estimated Market Value ( USD | $ 19.9 Billion |

| Forecasted Market Value ( USD | $ 24.8 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Global |