Global Commercial Vehicle Clutch Pressure Plates Market - Key Trends & Drivers Summarized

Why Are Clutch Pressure Plates Still Essential in Modern Commercial Vehicle Powertrains?

Clutch pressure plates remain a fundamental component in commercial vehicle drivetrains, especially in regions and vehicle classes where manual and semi-automated transmissions continue to dominate. These pressure plates are vital for engaging and disengaging the power flow between the engine and transmission, allowing smooth gear transitions and torque management under variable load conditions. In commercial vehicles - such as freight trucks, buses, construction machinery, and heavy-duty trailers - the clutch pressure plate endures immense mechanical stress and thermal load due to prolonged operational hours, higher torque levels, and frequent clutch cycling.This component's integrity is critical to vehicle performance, fuel economy, and transmission reliability. A properly functioning clutch pressure plate minimizes driveline shock, reduces transmission wear, and supports better drivability under demanding environments such as hilly terrains, crowded urban roads, or heavy-haul operations. As fleet operators increasingly focus on minimizing unscheduled maintenance and improving total cost of ownership, the demand for long-lasting, high-performance pressure plates continues to grow - both in original equipment and aftermarket channels.

How Are Advanced Designs and Materials Reinventing Clutch Pressure Plates for Next-Gen Fleets?

The technological evolution of clutch pressure plates is driven by the need for enhanced durability, heat resistance, and lightweight construction. Modern pressure plates are being developed using high-tensile steel, forged alloys, and advanced friction materials to ensure resilience under high-temperature and high-torque applications. Diaphragm-type pressure plates are widely preferred in commercial vehicles today due to their compact structure, consistent clamping force, and reduced pedal effort - traits that are crucial in minimizing driver fatigue during long hauls.In addition to mechanical improvements, design innovations now include centrifugal load-assist features, allowing higher clamping force at elevated engine speeds without compromising smooth disengagement. Pressure plates are also being optimized for integration with dual-mass flywheels and self-adjusting clutch systems to accommodate modern powertrains and emission control strategies. As telematics and vehicle diagnostics penetrate commercial fleets, pressure plate systems are also evolving with wear indicators and sensor-enabled monitoring features that facilitate proactive maintenance and reduce the risk of breakdowns.

Which Vehicle Segments and Regional Markets Are Shaping Pressure Plate Demand?

Commercial vehicle clutch pressure plates are deployed across a wide array of applications - from light-duty delivery vans and urban buses to heavy trucks, agricultural tractors, and construction equipment. Each of these vehicle classes demands pressure plates with tailored specifications to match torque loads, duty cycles, and driver usage patterns. For instance, long-haul trucks need thermal-stable and wear-resistant pressure plates, while construction equipment demands shock-absorbing designs that can withstand off-road stresses.Geographically, Asia-Pacific leads in terms of volume, supported by large-scale production of commercial vehicles in China, India, and Southeast Asia, where manual transmissions dominate due to cost and serviceability. North America and Europe are key aftermarket hubs, driven by replacement demand and a growing preference for self-adjusting clutch systems in medium and heavy-duty fleets. The Middle East, Africa, and Latin America are emerging regions witnessing rapid urbanization and freight growth, thus fueling demand for reliable driveline components including clutch pressure plates in both new builds and aftermarket servicing.

What Is Driving the Growth of the Commercial Vehicle Clutch Pressure Plates Market?

The growth in the commercial vehicle clutch pressure plates market is driven by the continued dominance of manual and semi-automated transmissions across a significant portion of the global commercial vehicle fleet. One of the primary drivers is the expansion of freight and construction activity in developing economies, which sustains demand for cost-effective, robust clutch systems. In these regions, commercial vehicles often operate in rugged conditions with minimal downtime tolerance - requiring components like pressure plates that deliver consistent performance and minimal wear.Another key driver is the increased focus on clutch durability and lifecycle cost management among fleet operators. As companies seek to reduce repair intervals and improve driveline efficiency, OEMs and suppliers are investing in advanced material science, precision engineering, and self-adjusting designs that extend pressure plate service life. The gradual shift toward hybridized and automated transmissions also supports demand for clutch pressure plates that can integrate seamlessly with AMT and DCT platforms. Combined with rising aftermarket activity and vehicle replacement cycles, these factors are expected to propel steady growth in the global commercial vehicle clutch pressure plates market.

Report Scope

The report analyzes the Commercial Vehicle Clutch Pressure Plates market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (Coil Spring Type, Diaphragm Type); Distribution Channel (OEM Distribution Channel, Replacement Distribution Channel); End-Use (Light Commercial Vehicles End-Use, Medium & Heavy Commercial Vehicles End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Coil Spring segment, which is expected to reach US$20.7 Billion by 2030 with a CAGR of a 4.4%. The Diaphragm segment is also set to grow at 2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7 Billion in 2024, and China, forecasted to grow at an impressive 6.8% CAGR to reach $6.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Commercial Vehicle Clutch Pressure Plates Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Commercial Vehicle Clutch Pressure Plates Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Commercial Vehicle Clutch Pressure Plates Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABC Bearings Ltd., C&U Group, Changzhou NRB Corporation, Federal-Mogul Holdings LLC, Fersa Bearings and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Commercial Vehicle Clutch Pressure Plates market report include:

- Aisin Seiki Co., Ltd.

- Anand Group

- AP Racing

- ASK Automotive Pvt. Ltd.

- Ayase Seimitsu Co., Ltd.

- BorgWarner Inc.

- California Custom Clutch Corporation

- Centerforce Clutches

- Clutch Auto Limited

- Dynax Corporation

- Eaton Corporation

- ElringKlinger AG

- EXEDY Corporation

- F.C.C. Co., Ltd.

- FPT Industrial

- GKN Automotive

- Hermann Peters GmbH & Co. KG

- Hitachi Automotive Systems, Ltd.

- Makino Auto Industries Pvt. Ltd.

- Miba AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aisin Seiki Co., Ltd.

- Anand Group

- AP Racing

- ASK Automotive Pvt. Ltd.

- Ayase Seimitsu Co., Ltd.

- BorgWarner Inc.

- California Custom Clutch Corporation

- Centerforce Clutches

- Clutch Auto Limited

- Dynax Corporation

- Eaton Corporation

- ElringKlinger AG

- EXEDY Corporation

- F.C.C. Co., Ltd.

- FPT Industrial

- GKN Automotive

- Hermann Peters GmbH & Co. KG

- Hitachi Automotive Systems, Ltd.

- Makino Auto Industries Pvt. Ltd.

- Miba AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 358 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

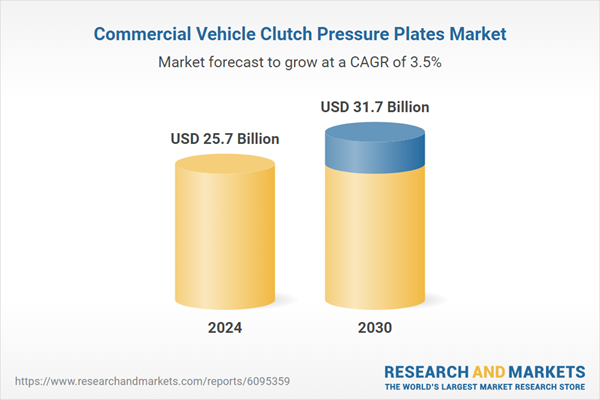

| Estimated Market Value ( USD | $ 25.7 Billion |

| Forecasted Market Value ( USD | $ 31.7 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |