Global Commercial Vehicle Fasteners Market - Key Trends & Drivers Summarized

Why Are Fasteners So Critical to the Structural Integrity of Commercial Vehicles?

Fasteners are the unsung backbone of commercial vehicle manufacturing and maintenance, ensuring the mechanical stability of assemblies ranging from the chassis and powertrain to suspension, brakes, and interior components. In commercial vehicles - where safety, performance, and uptime are paramount - fasteners play a crucial role in securing both static and dynamic load-bearing components. These include bolts, nuts, rivets, studs, screws, washers, and specialty clips used across engine blocks, wheel hubs, drivetrain couplings, fuel tanks, and cargo enclosures.Unlike passenger vehicles, commercial vehicles operate under significantly harsher conditions, often carrying heavy loads across long distances and rough terrains. This places fasteners under extreme mechanical stress, thermal fluctuations, and vibrational loads. Inadequate or worn fasteners can lead to system failures, safety hazards, and costly downtime. As such, the reliability, precision, and material quality of fasteners are critical to ensuring operational durability and compliance with global safety regulations in heavy-duty transportation.

How Are Innovations in Material Science and Manufacturing Enhancing Fastener Performance?

The commercial vehicle fasteners market is seeing rapid advancements driven by the need for high-strength, corrosion-resistant, and lightweight solutions. Manufacturers are increasingly adopting high-grade alloy steels, aluminum, titanium, and composite-based materials to meet stringent strength-to-weight ratio requirements in both ICE and electric vehicle platforms. Coatings such as zinc-nickel plating, phosphate finishes, and fluoropolymer sealing are commonly used to improve corrosion resistance and extend fastener life in environments exposed to road salt, moisture, and chemical contaminants.Precision manufacturing processes like cold forging, roll threading, and CNC machining are being employed to ensure dimensional accuracy, consistent torque tolerance, and high fatigue resistance. Additionally, pre-coated or self-locking fasteners are gaining popularity in applications where vibration and temperature cycling are frequent. The trend toward modular vehicle architectures is also driving demand for quick-assembly fasteners that reduce installation time and support platform standardization across vehicle models.

Which Vehicle Systems and Global Markets Are Fueling Fastener Demand?

Commercial vehicle fasteners are used extensively across various subsystems - such as engine and transmission assemblies, suspension systems, braking modules, electrical harnesses, interior panels, and aerodynamic body structures. In electric commercial vehicles, fasteners also play a critical role in securing battery enclosures, cooling systems, and electronic control units, where heat management and insulation become critical.Regionally, Asia-Pacific leads global demand due to its high concentration of commercial vehicle production in China, India, Japan, and Southeast Asia. Growth in this region is driven by expanding infrastructure, logistics, and construction sectors. North America and Europe maintain strong demand in both OEM and aftermarket channels, supported by advanced vehicle designs, lightweighting initiatives, and electrification roadmaps. Emerging markets in Africa, Latin America, and the Middle East are witnessing a rise in fleet deployment and vehicle servicing activities, which are translating into steady growth in fastener consumption.

What Is Driving the Growth of the Commercial Vehicle Fasteners Market?

The growth in the commercial vehicle fasteners market is driven by the increasing production of commercial vehicles, heightened focus on vehicular safety and reliability, and rising demand for high-performance fastening solutions in next-generation drivetrains. One key driver is the electrification of commercial vehicles, which requires specialized fasteners for high-voltage assemblies, EMI shielding, and thermally sensitive zones. The transition to electric trucks and buses has introduced new fastening requirements that emphasize insulation, vibration damping, and light weight.Additionally, the growing complexity of commercial vehicle architectures - due to emission controls, telematics integration, and ADAS hardware - has expanded the need for custom fasteners with precise torque specifications and compatibility with composite materials. The surge in aftermarket servicing and repair activities, particularly in aging fleets across developing countries, is further supporting market expansion. Lastly, as OEMs focus on reducing production time and cost, demand for pre-assembled, reusable, and modular fastening systems is gaining traction - setting the stage for sustained innovation and growth across global markets.

Report Scope

The report analyzes the Commercial Vehicle Fasteners market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Fastener (Threaded Fastener, Non-Threaded Fastener); Material (Iron Material, Steel Material, Aluminum Material, Brass Material, Plastic Material); End-Use (Light Commercial Vehicles End-Use, Medium & Heavy Commercial Vehicles End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Threaded Fastener segment, which is expected to reach US$15.6 Billion by 2030 with a CAGR of a 6.4%. The Non-Threaded Fastener segment is also set to grow at 3.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.9 Billion in 2024, and China, forecasted to grow at an impressive 8.6% CAGR to reach $4.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Commercial Vehicle Fasteners Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Commercial Vehicle Fasteners Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Commercial Vehicle Fasteners Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aisin Seiki Co., Ltd., Anand Group, AP Racing, ASK Automotive Pvt. Ltd., Ayase Seimitsu Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Commercial Vehicle Fasteners market report include:

- Agrati Group

- Aoyama Seisakusho Co., Ltd.

- Bulten AB

- Böllhoff Group

- Boltun Corporation

- Fastenal Company

- Fontana Gruppo S.p.A.

- KAMAX Holding GmbH & Co. KG

- Keller & Kalmbach GmbH

- LISI Group

- Meidoh Co., Ltd.

- Meira Group

- Nedschroef Holding B.V.

- Nifco Inc.

- Norma Group SE

- Piolax, Inc.

- SFS Group AG

- Stanley Black & Decker

- Sundram Fasteners Limited

- Würth Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Agrati Group

- Aoyama Seisakusho Co., Ltd.

- Bulten AB

- Böllhoff Group

- Boltun Corporation

- Fastenal Company

- Fontana Gruppo S.p.A.

- KAMAX Holding GmbH & Co. KG

- Keller & Kalmbach GmbH

- LISI Group

- Meidoh Co., Ltd.

- Meira Group

- Nedschroef Holding B.V.

- Nifco Inc.

- Norma Group SE

- Piolax, Inc.

- SFS Group AG

- Stanley Black & Decker

- Sundram Fasteners Limited

- Würth Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 377 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

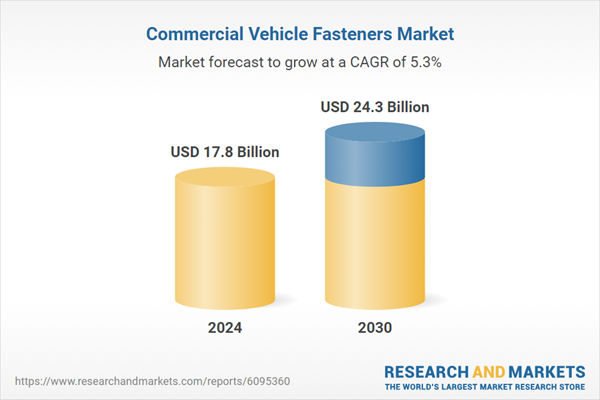

| Estimated Market Value ( USD | $ 17.8 Billion |

| Forecasted Market Value ( USD | $ 24.3 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |