Global Commercial Vehicle Powertrain Systems Market - Key Trends & Drivers Summarized

How Are Evolving Powertrain Architectures Transforming the Commercial Vehicle Sector?

The commercial vehicle powertrain systems market is undergoing a fundamental transformation, driven by mounting regulatory pressures, efficiency demands, and technological convergence. Traditionally dominated by internal combustion engine (ICE)-based architectures, the market is shifting toward more modular, integrated, and flexible configurations. Innovations such as hybrid-electric and fully electric powertrains are gaining traction, not merely for their environmental benefits, but for their capacity to lower total cost of ownership through fuel savings and reduced maintenance needs. These newer powertrain systems integrate advanced components like electric motors, inverters, and battery packs alongside digital control units, creating a more connected and intelligent driveline ecosystem.In parallel, the integration of smart sensors and digital diagnostics into powertrain systems is redefining fleet management efficiency. Real-time data on torque delivery, fuel consumption, thermal loads, and component wear allows predictive maintenance and dynamic performance optimization. OEMs are investing heavily in electronic control units (ECUs) and software-defined architectures that can update performance algorithms remotely. This transition from mechanical to mechatronic systems marks a critical evolution in commercial vehicle design, aimed at achieving lower emissions, reduced downtime, and enhanced drivability across varied terrain and load conditions.

Is Electrification the Ultimate Gamechanger for Powertrain Innovation?

The electrification of commercial vehicle fleets is accelerating globally, spurred by decarbonization targets and urban mobility policies. As a result, OEMs are increasingly deploying battery-electric and fuel-cell electric systems in both light and heavy commercial vehicles. Electric powertrains eliminate the need for gearboxes, clutches, and other conventional components, thereby simplifying vehicle design and minimizing mechanical losses. These systems also offer superior torque characteristics and near-silent operation, making them especially suitable for last-mile delivery and urban transit applications. Battery pack design, thermal management systems, and high-efficiency traction motors are becoming focal points of innovation in this segment.Moreover, hybrid powertrains continue to serve as a transitional bridge, particularly in long-haul and off-highway applications where full electrification remains constrained by infrastructure limitations. Parallel and series hybrid configurations are enabling fuel efficiency improvements without compromising power delivery. Manufacturers are also exploring range-extender technologies and dual-power configurations to maximize operational flexibility. Furthermore, energy recuperation systems such as regenerative braking and engine start-stop mechanisms are being fine-tuned to extract maximum energy efficiency from every phase of the driving cycle. These hybrid systems are increasingly optimized using AI-driven controls, allowing adaptive energy management based on route, load, and traffic conditions.

What Role Do End-Use Demands and Application-Specific Configurations Play?

The diversity of applications in the commercial vehicle segment - ranging from logistics and construction to mining and public transportation - requires a tailored approach to powertrain development. For instance, long-haul trucks demand powertrains optimized for sustained torque delivery, cooling performance, and fuel economy at cruising speeds. In contrast, intra-city buses and delivery vans prioritize frequent stop-start functionality, low emissions, and high energy regeneration capacity. This divergence in end-use needs is prompting OEMs and Tier-1 suppliers to develop modular platforms that can be customized for specific duty cycles and regulatory environments.Additionally, the rise in autonomous and connected vehicle functions is influencing powertrain design. Systems now need to interface seamlessly with advanced driver assistance systems (ADAS), automated gearshifting mechanisms, and vehicle-to-everything (V2X) communication protocols. This convergence has led to the development of integrated powertrain control modules that act as the nerve center of the vehicle's propulsion system. The result is a growing synergy between drivetrain, braking, and energy management systems - all coordinated in real-time for optimal performance, safety, and energy utilization. Increasingly, powertrain strategies are also being influenced by total lifecycle cost analytics, prompting fleet operators to prioritize systems that offer long-term ROI over conventional upfront savings.

What Are the Technology and Application Factors Fueling Market Growth?

The growth in the commercial vehicle powertrain systems market is driven by several factors closely tied to technology innovation, application evolution, and end-use diversification. One of the core drivers is the proliferation of electric propulsion technologies, bolstered by falling battery costs, improved charging infrastructure, and stringent emission norms. Enhanced battery energy density and motor efficiency are enabling electric powertrains to compete with ICE systems in terms of performance and reliability. Additionally, the increasing adoption of hydrogen fuel cells in heavy-duty commercial vehicles - especially in regions with green hydrogen initiatives - is unlocking new opportunities in long-range and high-load applications.Technological advancements in software-defined powertrain systems are another significant growth catalyst. Cloud-integrated control platforms, AI-based energy routing, and predictive diagnostics are enhancing the overall value proposition of next-generation powertrains. Simultaneously, the growing emphasis on application-specific system design is creating demand for custom-built powertrains that align with unique operational requirements - from refrigerated freight delivery to rugged construction equipment. This trend is being reinforced by digital twin modeling and simulation tools, which allow powertrain architectures to be optimized before deployment. Lastly, the emergence of integrated supplier ecosystems, where powertrain and control system components are co-developed with OEMs, is expediting the commercialization of advanced and efficient solutions across a range of commercial vehicle categories.

Report Scope

The report analyzes the Commercial Vehicle Powertrain Systems market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Component (Engine Component, Transmission Component, Differentials Component, Driveshaft Component); Drive Type (Front-Wheel Drive, Rear-Wheel Drive, All-Wheel Drive); End-Use (Light Commercial Vehicles End-Use, Medium & Heavy Commercial Vehicles End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Engine Component segment, which is expected to reach US$168.2 Billion by 2030 with a CAGR of a 5.4%. The Transmission Component segment is also set to grow at 5.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $78.9 Billion in 2024, and China, forecasted to grow at an impressive 8.8% CAGR to reach $80.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Commercial Vehicle Powertrain Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Commercial Vehicle Powertrain Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Commercial Vehicle Powertrain Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Afton Chemical, BP (Castrol), Chevron Corporation, China National Petroleum Corporation (CNPC), China Petroleum & Chemical Corporation (Sinopec) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Commercial Vehicle Powertrain Systems market report include:

- Aisin Seiki Co., Ltd.

- Allison Transmission Holdings Inc.

- BorgWarner Inc.

- Continental AG

- Cummins Inc.

- Dana Incorporated

- Denso Corporation

- Eaton Corporation

- FPT Industrial

- GKN Automotive Limited

- Hyundai Transys

- JATCO Ltd.

- JTEKT Corporation

- Knorr-Bremse AG

- Magna International Inc.

- Robert Bosch GmbH

- Schaeffler AG

- Valeo SA

- Volkswagen AG

- Weichai Power Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aisin Seiki Co., Ltd.

- Allison Transmission Holdings Inc.

- BorgWarner Inc.

- Continental AG

- Cummins Inc.

- Dana Incorporated

- Denso Corporation

- Eaton Corporation

- FPT Industrial

- GKN Automotive Limited

- Hyundai Transys

- JATCO Ltd.

- JTEKT Corporation

- Knorr-Bremse AG

- Magna International Inc.

- Robert Bosch GmbH

- Schaeffler AG

- Valeo SA

- Volkswagen AG

- Weichai Power Co., Ltd.

Table Information

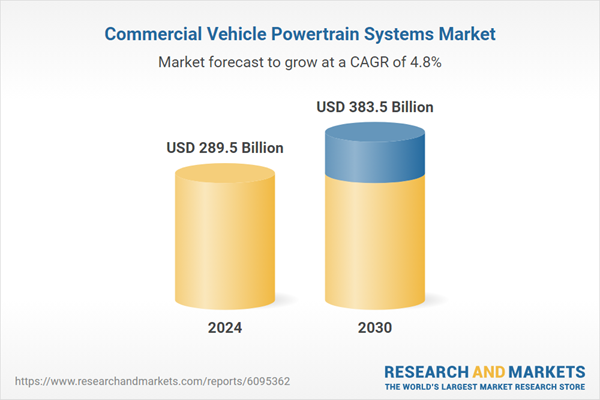

| Report Attribute | Details |

|---|---|

| No. of Pages | 369 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 289.5 Billion |

| Forecasted Market Value ( USD | $ 383.5 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |