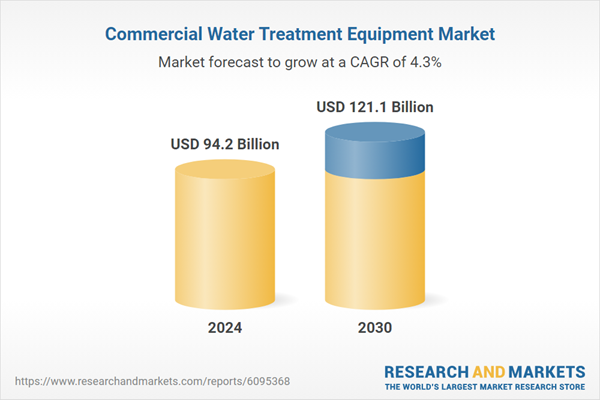

Global Commercial Water Treatment Equipment Market - Key Trends & Drivers Summarized

Why Is Commercial Water Treatment Gaining Unprecedented Strategic Importance?

The growing significance of water as a critical operational resource across industries has accelerated the demand for commercial water treatment equipment. From hospitality and healthcare to food services and manufacturing, enterprises are increasingly investing in advanced treatment systems to ensure water safety, operational continuity, and compliance with regulatory norms. This has spurred adoption of technologies such as reverse osmosis (RO), ultraviolet (UV) disinfection, ultrafiltration, and deionization. The rising global emphasis on ESG compliance, particularly water footprint reduction and sustainability goals, is also steering demand toward water reuse and recycling systems.As urban infrastructure expands and water quality becomes more variable, commercial establishments are facing mounting pressure to integrate robust pre-treatment and filtration systems. Real estate developers, schools, shopping malls, and office complexes are increasingly incorporating centralized water purification systems to reduce dependency on external supplies and mitigate risk from contaminants. Concurrently, awareness of waterborne diseases, chemical residues, and heavy metals is prompting end-users to upgrade from conventional systems to more sophisticated, automated equipment that provides consistent quality at scale.

How Are Technological Advancements Reshaping Treatment Capabilities?

The commercial water treatment landscape is undergoing a transformation fueled by digitalization, automation, and material science innovations. Next-generation systems now feature intelligent sensors, real-time monitoring, and AI-powered analytics, enabling predictive maintenance and system optimization based on usage patterns. Cloud-connected filtration systems allow facility managers to track parameters such as TDS, pH, chlorine levels, and filter life remotely, resulting in enhanced operational efficiency and reduced maintenance costs.Moreover, innovations in membrane technology - particularly nanocomposite membranes and energy-efficient RO systems - have drastically improved recovery rates while lowering operational costs. Modular system architecture has emerged as a preferred choice for commercial users seeking scalable and easy-to-install solutions across multiple facilities. The rise of mobile and containerized water treatment units is further expanding accessibility in locations with infrastructure limitations or emergency needs. These technological strides are not only reducing downtime and enhancing water quality but also driving system adoption in small-to-medium-scale commercial spaces that previously relied on municipal supply or basic filtration.

Which End-Use Sectors Are Fueling the Surge in Equipment Demand?

The application spectrum of commercial water treatment equipment is expanding rapidly, with particularly high traction in healthcare, hospitality, and foodservice sectors. Hospitals and laboratories demand high-purity water for diagnostics, cleaning, and patient safety, necessitating multi-stage treatment protocols. Hotels and resorts require odor-free, mineral-balanced water for guest consumption and utility functions such as laundry, HVAC, and pools. Similarly, restaurants, food courts, and cloud kitchens are integrating water purification and softening systems to ensure hygiene compliance and improve food quality.Educational institutions, data centers, and commercial complexes are also key adopters, driven by both sustainability goals and the need to reduce operational risk. Moreover, the commercial real estate sector is increasingly embedding water treatment systems in green building designs to meet LEED or WELL certification requirements. Industrial parks with shared utilities, airports, and entertainment facilities represent a growing segment that demands high-capacity, multi-feed systems capable of handling varied inflows and contaminant types.

What Are the Principal Growth Drivers Behind Market Expansion?

The growth in the commercial water treatment equipment market is driven by several factors directly linked to technology advancements, regulatory evolution, and end-use dynamics. Rising water scarcity in urban centers has prompted commercial entities to invest in on-site recycling and greywater treatment technologies. Increasingly stringent regulations on wastewater discharge and potable water quality have necessitated the installation of high-efficiency treatment systems capable of meeting dynamic standards. Additionally, the widespread digitization of commercial infrastructure has enabled the integration of smart, automated water management platforms.Rapid expansion of decentralized commercial units - such as coworking spaces, franchise-based clinics, and QSR chains - is fueling demand for compact, modular, and easily maintainable systems. At the same time, the push for brand-level sustainability metrics is compelling enterprises to demonstrate water stewardship, with advanced treatment equipment playing a central role. Finally, government incentives for water-saving technologies, combined with a rise in public-private partnerships for infrastructure upgrades, are further propelling the uptake of sophisticated commercial water treatment systems globally.

Report Scope

The report analyzes the Commercial Water Treatment Equipment market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Equipment Type (Filtration Equipment, Disinfection Equipment, Absorption Equipment, Desalination Equipment, Other Equipment Types); Application (Retail Application, Hospitality Application, Education Application, Food Service Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Filtration Equipment segment, which is expected to reach US$43.8 Billion by 2030 with a CAGR of a 4.7%. The Disinfection Equipment segment is also set to grow at 3.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $25.7 Billion in 2024, and China, forecasted to grow at an impressive 7.8% CAGR to reach $24.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Commercial Water Treatment Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Commercial Water Treatment Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Commercial Water Treatment Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as APC by Schneider Electric, Automatic Voltage Stabilizers Pvt Ltd, Basler Electric, Crompton Greaves, Delta Power Solutions and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Commercial Water Treatment Equipment market report include:

- Aquatech International LLC

- Aqualia

- BWT Holding GmbH

- Calgon Carbon Corporation

- Clack Corporation

- Culligan International Co.

- Danaher Corporation

- Dow Water & Process Solutions

- Ecolab Inc.

- Evoqua Water Technologies LLC

- Grundfos

- Hitachi, Ltd.

- Kurita Water Industries Ltd.

- Lenntech B.V.

- Mitsubishi Rayon Co. Ltd.

- Pall Corporation

- Pentair plc

- SUEZ

- Thermax Ltd.

- Veolia

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aquatech International LLC

- Aqualia

- BWT Holding GmbH

- Calgon Carbon Corporation

- Clack Corporation

- Culligan International Co.

- Danaher Corporation

- Dow Water & Process Solutions

- Ecolab Inc.

- Evoqua Water Technologies LLC

- Grundfos

- Hitachi, Ltd.

- Kurita Water Industries Ltd.

- Lenntech B.V.

- Mitsubishi Rayon Co. Ltd.

- Pall Corporation

- Pentair plc

- SUEZ

- Thermax Ltd.

- Veolia

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 291 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 94.2 Billion |

| Forecasted Market Value ( USD | $ 121.1 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |