Global Community Banking Market - Key Trends & Drivers Summarized

Why Is Community Banking Regaining Relevance in a Digitally Dominated Financial World?

Community banking has experienced a resurgence in relevance as both consumers and small businesses seek more personalized, locally anchored financial services. Unlike large national or multinational banks, community banks operate within a defined geographic footprint and emphasize relationship-based banking. This localized approach enables them to tailor lending decisions, investment strategies, and financial advisory services based on intimate knowledge of the communities they serve. Amid rising concerns about financial inclusion, economic disparities, and depersonalized banking experiences, community banks are being viewed as critical vehicles for inclusive economic growth.These institutions play a central role in funding small business growth, local infrastructure, and home ownership, particularly in underserved or rural markets where larger banks may lack presence or interest. By reinvesting deposits back into local economies through small-scale commercial loans, agricultural financing, and consumer credit, community banks help sustain regional economic cycles. Their deep-rooted understanding of local industries, risk patterns, and socio-economic needs gives them a competitive edge in niche financial services, especially during economic disruptions or post-crisis recoveries. In fact, community banks often demonstrate higher loan approval rates for small enterprises and demonstrate resilience in portfolio management, owing to their conservative risk profiles and strong community ties.

How Are Technology Adoption and Digital Platforms Shaping Community Banking's Next Chapter?

While community banks have traditionally lagged behind larger institutions in tech adoption, a growing shift toward digital transformation is redefining their competitive position. Spurred by customer expectations and regulatory modernization, many community banks are now adopting cloud-based core banking platforms, mobile banking applications, automated underwriting tools, and digital onboarding systems. These digital enhancements enable them to provide modern banking conveniences - such as contactless payments, remote check deposits, and 24/7 account access - while maintaining the personal customer service they are known for.Fintech partnerships and banking-as-a-service (BaaS) models are also helping community banks innovate without significant capital outlay. By collaborating with third-party tech providers, they can quickly deploy advanced features such as AI-powered chatbots, fraud detection algorithms, credit scoring analytics, and loan servicing automation. Moreover, cloud-native infrastructure allows for scalable operations, better data security, and reduced maintenance costs. Despite their smaller scale, these institutions are leveraging agile digital ecosystems to compete with neobanks and larger incumbents, without compromising their core mission of community-centered financial stewardship.

What Role Do Regulatory Shifts and Economic Trends Play in Community Bank Expansion?

Policy reforms and shifting macroeconomic conditions are having a pronounced impact on the trajectory of community banking. Regulatory agencies in many countries are increasingly recognizing the systemic importance of community banks and are implementing tiered compliance frameworks to reduce regulatory burdens on smaller institutions. Measures such as simplified capital requirements, support for local lending initiatives, and access to public funding programs have enabled community banks to extend their services to broader population segments.Rising interest rates, inflationary pressures, and changing credit demand patterns are also altering how community banks structure their portfolios. Their conservative lending strategies and focus on asset quality have generally shielded them from the credit volatility experienced by larger institutions with high exposure to speculative markets. Furthermore, as consumer trust in big banks wanes - often in response to high-profile data breaches, hidden fees, or impersonal service - community banks are gaining customer loyalty through transparent, accessible, and ethical banking practices. Their agility in adjusting to local economic cycles also makes them attractive to depositors and borrowers seeking financial partners with a deep commitment to regional stability.

What Are the Core Drivers Sustaining Growth in the Community Banking Sector?

The growth in the community banking market is driven by several interlinked factors centered around local economic integration, relationship-based financial services, and evolving customer expectations. One of the primary drivers is the expanding demand for personalized banking solutions from small and medium-sized businesses (SMBs), independent professionals, and rural customers. These groups often find traditional banks too rigid or digitally disconnected from their unique needs, prompting a shift toward community-centric institutions.Another key growth driver is the acceleration of hybrid banking models that combine digital convenience with in-person relationship management. As community banks continue to digitize customer touchpoints while preserving personal engagement, they are creating a compelling alternative to both high-tech neobanks and mass-market incumbents. Additionally, favorable policy frameworks and public-sector support aimed at boosting regional lending and entrepreneurship are reinforcing the market's upward momentum. Lastly, demographic shifts - including the financial empowerment of younger entrepreneurs and local investors - are reshaping community banking's client base, injecting new life into an industry once considered traditional, but now central to resilient, inclusive financial systems.

Report Scope

The report analyzes the Community Banking market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Service Type (Retail Banking Services, Commercial Banking Services, Wealth Management & Financial Advisory Services, Other Services); Area (Metropolitan, Rural & Micropolitan); Application (Small Business Application, Commercial Real Estate Application, Agriculture Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Retail Banking Services segment, which is expected to reach US$434.2 Billion by 2030 with a CAGR of a 3.3%. The Commercial Banking Services segment is also set to grow at 3.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $205.4 Billion in 2024, and China, forecasted to grow at an impressive 6.7% CAGR to reach $186.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Community Banking Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Community Banking Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Community Banking Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ametek Inc., Analog Devices Inc., Anritsu Corporation, Aplab Ltd., Astronics Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Community Banking market report include:

- Amerant Bank

- Bank OZK

- Brighton Bank

- Capital Community Bank

- Carson Community Bank

- Central Bank of the South

- Feliciana Bank & Trust Company

- First Bank

- First Bank of Owasso

- First Citizens National Bank

- First Credit Bank

- First Federal Savings and Loan

- First Hawaiian Bank

- First Interstate BancSystem

- First State Bank of Beecher City

- Friend Bank

- KeyBank

- Luminate Bank

- Needham Bank

- TransPecos Banks, SSB

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amerant Bank

- Bank OZK

- Brighton Bank

- Capital Community Bank

- Carson Community Bank

- Central Bank of the South

- Feliciana Bank & Trust Company

- First Bank

- First Bank of Owasso

- First Citizens National Bank

- First Credit Bank

- First Federal Savings and Loan

- First Hawaiian Bank

- First Interstate BancSystem

- First State Bank of Beecher City

- Friend Bank

- KeyBank

- Luminate Bank

- Needham Bank

- TransPecos Banks, SSB

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 381 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

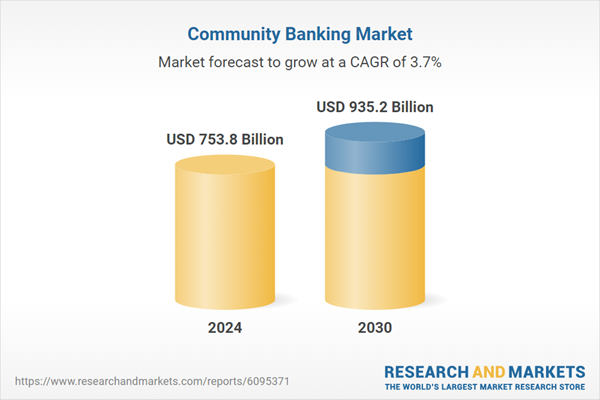

| Estimated Market Value ( USD | $ 753.8 Billion |

| Forecasted Market Value ( USD | $ 935.2 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Global |