Global Completion Equipment and Services Market - Key Trends & Drivers Summarized

Why Are Well Completion Systems Critical to Maximizing Hydrocarbon Recovery?

Completion equipment and services form the backbone of production enablement in the oil and gas sector, linking subsurface resources to surface facilities after a well is drilled. This critical phase determines the efficiency, safety, and cost-effectiveness of hydrocarbon extraction. Completion activities involve the installation of downhole tools, casing, packers, liners, valves, and production tubing, and they are customized based on reservoir type, fluid composition, and operational environment. Whether it's a vertical, horizontal, or multilateral well, the completion strategy has a direct impact on long-term production optimization and reservoir management.There has been a significant shift toward more complex and high-performance completion systems as operators increasingly target unconventional reserves such as shale gas, tight oil, and deepwater plays. Advanced equipment like intelligent well systems, multistage hydraulic fracturing tools, and zonal isolation devices are being adopted to enhance precision, minimize downtime, and extend well life. Services are also expanding to include completion engineering, pressure testing, sand control design, and real-time data interpretation - making completion a sophisticated, high-tech domain within the upstream oilfield services landscape.

How Are Technology and Automation Redefining Completion Strategies?

Technology is playing a pivotal role in transforming well completion operations. Innovations in hydraulic fracturing, fiber-optic monitoring, and downhole sensors are enabling operators to visualize subsurface dynamics in real time. This data-centric approach supports dynamic completion design adjustments, improving well stimulation, production efficiency, and reservoir sustainability. Moreover, remote-control valves, smart packers, and autonomous intervention tools are gaining traction, particularly in high-risk or inaccessible environments such as offshore and high-pressure, high-temperature (HPHT) wells.Automation and digitalization are reducing operational risks and lowering completion times through better pre-job planning, automated execution, and predictive maintenance of tools. Digital twins and simulation software are increasingly used to model well behavior and optimize the placement of perforations, sleeves, and flow control devices. As environmental regulations tighten, completion systems are also being redesigned for minimal environmental impact, with enhanced sand control systems, waterless fracking methods, and reduced chemical footprints gaining popularity.

What Market Forces Are Driving the Expansion of Completion Services Worldwide?

The growth in the completion equipment and services market is driven by several factors, including the expansion of unconventional drilling, increased focus on reservoir optimization, and rising global energy demand. One of the most significant drivers is the acceleration of shale and tight formation development in regions like North America, Argentina, and China, where multistage completions and advanced stimulation techniques are indispensable. Additionally, the recovery in offshore exploration, particularly in ultra-deepwater and frontier basins, is generating demand for high-spec completion tools capable of withstanding extreme conditions.Another key growth factor is the industry's emphasis on cost control and asset maximization. As upstream operators aim to boost recovery rates from existing fields and lower lifting costs, the demand for customized and intelligent completion systems continues to rise. Furthermore, the shift toward integrated service contracts - where operators engage completion providers for design, execution, and post-completion diagnostics - is fostering market consolidation and vertical integration among service companies. The increasing role of digital technologies in real-time decision-making, coupled with the drive to minimize operational risks and environmental impact, is solidifying completion services as a strategic and fast-evolving component of the global oil and gas value chain.

Report Scope

The report analyzes the Completion Equipment and Services market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Packers, Sand Control Tools, Liner Hangers, Valves, Other Types); Service (Well Planning & Design, Casing & Tubing Running, Cementing Services, Perforating Services, Sand Control Services, Artificial Lift Services, Other Services); Application (Onshore Application, Offshore Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Packers segment, which is expected to reach US$6 Billion by 2030 with a CAGR of a 6.2%. The Sand Control Tools segment is also set to grow at 7.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.3 Billion in 2024, and China, forecasted to grow at an impressive 9.4% CAGR to reach $3.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Completion Equipment and Services Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Completion Equipment and Services Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Completion Equipment and Services Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Accuryn Medical, Arthrex, Inc., Biometrix Ltd., B. Braun Melsungen AG, BD (Becton, Dickinson and Company) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Completion Equipment and Services market report include:

- Aker Solutions

- Baker Hughes

- Calfrac Well Services

- C&J Energy Services

- Clyde Blowers Capital

- Essential Energy Services

- FTS International

- Halliburton

- Helmerich & Payne

- Hunting PLC

- Jereh Group

- Nabors Industries

- National Oilwell Varco (NOV)

- Oil States International

- OneSubsea (SLB)

- Packers Plus Energy Services

- Precision Drilling

- Schlumberger (SLB)

- Superior Energy Services

- Weatherford International

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aker Solutions

- Baker Hughes

- Calfrac Well Services

- C&J Energy Services

- Clyde Blowers Capital

- Essential Energy Services

- FTS International

- Halliburton

- Helmerich & Payne

- Hunting PLC

- Jereh Group

- Nabors Industries

- National Oilwell Varco (NOV)

- Oil States International

- OneSubsea (SLB)

- Packers Plus Energy Services

- Precision Drilling

- Schlumberger (SLB)

- Superior Energy Services

- Weatherford International

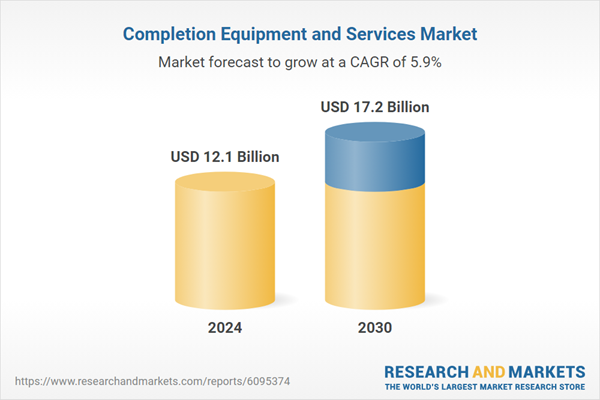

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 389 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 12.1 Billion |

| Forecasted Market Value ( USD | $ 17.2 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |