Global Counter Unmanned Aircraft Systems (UAS) Market - Key Trends & Drivers Summarized

Why Is the Demand for Counter UAS Solutions Accelerating Worldwide?

The rapid proliferation of commercial and military drones has necessitated the parallel development of counter unmanned aircraft systems (C-UAS) to detect, track, and neutralize unauthorized or hostile drones. These systems are now critical to safeguarding sensitive facilities, critical infrastructure, public gatherings, airspace near airports, and military bases. As drones become more affordable, autonomous, and capable of payload delivery, the risk posed by rogue or weaponized drones has escalated, making C-UAS technology a national security priority for many governments.Counter UAS systems are increasingly used in both defense and civilian environments. In military applications, they protect troops, logistics lines, and airfields from surveillance or explosive drones. In civilian contexts, they guard airports, oil refineries, prisons, stadiums, and borders against unauthorized drone activity. The escalating number of drone-related security breaches has prompted regulatory agencies and private enterprises to accelerate investments in C-UAS solutions to ensure operational continuity and safety.

Which Technologies Are Shaping the Modern C-UAS Ecosystem?

Modern C-UAS platforms integrate a range of technologies, including radar, radio frequency (RF) analyzers, electro-optical/infrared (EO/IR) cameras, GPS spoofing, and radio jamming. Detection capabilities rely on multi-sensor fusion for real-time tracking, while mitigation involves techniques such as signal jamming, drone capture via nets, directed energy weapons (like high-power microwaves or lasers), and cyber-takeover protocols. AI-based threat classification and autonomous response systems are enhancing accuracy and reducing the need for human intervention.Advanced C-UAS systems are now modular and scalable, allowing deployment in mobile units, fixed installations, or even handheld formats. Cloud-connected threat intelligence databases and remote command interfaces are enabling operators to receive instant alerts and deploy countermeasures from centralized control centers. Additionally, the development of “soft kill” techniques - non-destructive methods that disable drones without collateral damage - is gaining preference in urban and civilian settings, offering flexible engagement options.

What Are the Primary Use Cases and Regional Hotspots Driving Adoption?

Defense remains the largest adopter of C-UAS, especially in conflict zones where drone swarms pose significant tactical threats. Militaries are increasingly integrating C-UAS into perimeter defense, vehicle convoys, and forward-operating bases. Civilian demand is also growing rapidly in critical infrastructure sectors, event security, airports, and border control, where the legal, privacy, and safety implications of drone intrusion are particularly severe.Regionally, the United States leads in technology development and deployment, followed by China, Israel, and key European nations like the UK, France, and Germany. In the Middle East, conflict-prone regions are investing in advanced counter-drone systems to defend oilfields, military bases, and urban centers. Asia-Pacific countries such as India, South Korea, and Japan are strengthening airport and defense infrastructure with localized C-UAS procurement initiatives. Emerging markets are also exploring portable, cost-effective solutions to address growing threats from commercial drone misuse.

What Factors Are Driving Growth in the Counter UAS Market?

The growth in the counter unmanned aircraft systems market is driven by escalating security threats posed by rogue drones, increasing deployment of drones in civilian airspace, and rising demand for integrated detection and neutralization technologies. Technological advancements in multi-sensor surveillance, AI-powered analytics, and directed energy weapons are enabling more accurate and efficient countermeasures across diverse environments.Growing adoption by defense and homeland security agencies, combined with increased funding for border protection and public safety, is fueling procurement of both fixed and mobile C-UAS platforms. Regulatory mandates for drone activity near airports, stadiums, and industrial facilities are also creating commercial demand. Furthermore, rising geopolitical tensions and asymmetric warfare strategies are prompting governments to scale up investments in drone neutralization technologies. These factors collectively position the C-UAS market for sustained expansion in both military and civilian sectors.

Report Scope

The report analyzes the Counter Unmanned Aircraft Systems (UAS) market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Technology (Laser System Technology, Kinetic System Technology, Electronic System Technology); System Configuration (Portable System Configuration, Vehicle Mounted System Configuration, Standalone System Configuration); Platform (Air Platform, Ground Platform, Naval Platform); End-Use (Military & Defense End-Use, Commercial End-Use, Homeland Security End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Laser System Technology segment, which is expected to reach US$3.3 Billion by 2030 with a CAGR of a 20.5%. The Kinetic System Technology segment is also set to grow at 23.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $457 Million in 2024, and China, forecasted to grow at an impressive 20.8% CAGR to reach $877.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Counter Unmanned Aircraft Systems (UAS) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Counter Unmanned Aircraft Systems (UAS) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Counter Unmanned Aircraft Systems (UAS) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Akzenta, AMD Medicom, Benco Dental Supply Co., Cantel Medical, COLTENE Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Counter Unmanned Aircraft Systems (UAS) market report include:

- Aaronia AG

- Accipiter Radar Corp.

- Airbus S.A.S.

- Allen-Vanguard Corp.

- Anduril Industries

- Battelle Memorial Institute

- Baykar

- Blighter Surveillance Systems

- Boeing Company

- Citadel Defense Company

- Dedrone Holdings, Inc.

- DeTect Inc.

- DJI

- Drone Defence

- DroneShield Ltd.

- Hensoldt AG

- Israel Aerospace Industries Ltd.

- Leonardo S.p.A.

- Liteye Systems, Inc.

- Northrop Grumman Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aaronia AG

- Accipiter Radar Corp.

- Airbus S.A.S.

- Allen-Vanguard Corp.

- Anduril Industries

- Battelle Memorial Institute

- Baykar

- Blighter Surveillance Systems

- Boeing Company

- Citadel Defense Company

- Dedrone Holdings, Inc.

- DeTect Inc.

- DJI

- Drone Defence

- DroneShield Ltd.

- Hensoldt AG

- Israel Aerospace Industries Ltd.

- Leonardo S.p.A.

- Liteye Systems, Inc.

- Northrop Grumman Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 206 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

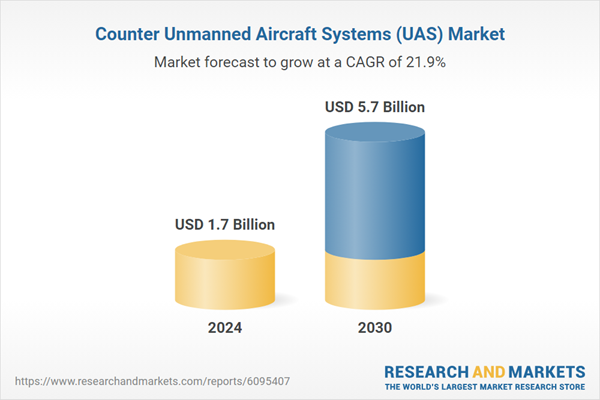

| Estimated Market Value ( USD | $ 1.7 Billion |

| Forecasted Market Value ( USD | $ 5.7 Billion |

| Compound Annual Growth Rate | 21.9% |

| Regions Covered | Global |