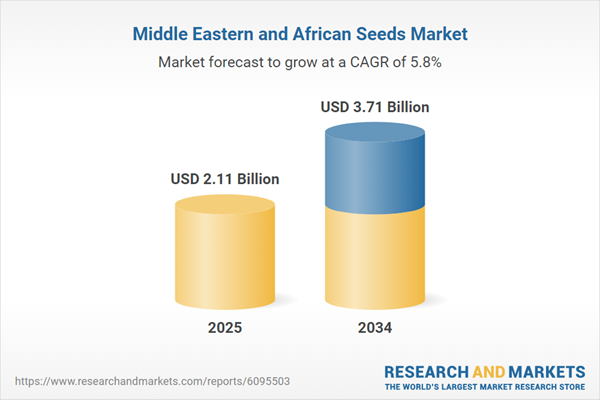

Middle East and Africa Seeds Market Growth

The seed market in the Middle East and Africa is primed for substantial growth due to several factors. These include a rising need for food security, rising income levels, climate change, and progress in seed enhancement technology. Additionally, climate-resistant seeds and organic farming methods are being developed to adapt to the extremely hot and humid climate of the region, aiding the seeds market share in Middle East and Africa.Moreover, as a result of the growing population, governments are making efforts to create a supportive environment for local seed companies by investing in research and development and building agricultural infrastructure to achieve self-sufficiency and significantly boost food security on a large scale. For instance, in 2023, Jordan managed to export seeds to 65 countries worldwide and witnessed an increase in the number of local seed companies from six in 2011 to thirty-six in the year 2023. This has been possible due to their favorable policies and commitment to developing the sector along with other Middle Eastern countries. Thus, attracting prominent seed manufacturing companies is bolstering the growth of Middle East and Africa seeds market.

Key Trends and Recent Developments

Increased demand for food, rising agriculture production, investment in seed treatment technologies, and adoption of GM varieties are increasing the Middle East and Africa seeds market value.December 2023

Silal, a UAE based aggrotech company announced its collaboration with global seed manufacturer Bayer to strengthen the agricultural landscape in the UAE. The partnership is aimed at implementing best agricultural practices, including undertaking comprehensive vegetable seed trials to transform the country’s agricultural landscape. The trials will encompass over 30 vegetable seed varieties and investigate how they perform under challenging desert farming conditions, assessing their tolerance for extreme temperatures and consequent impact on their quality as well and shelf life.May 2022

Corteva Agriscience, world’s leading supplier of agricultural seeds, officially opened its Centre for Seed Applied Technologies (CSAT) laboratory in Rosslyn, Pretoria, one of the only six worldwide. This modern facility is expected to use world-class equipment in order to conduct recipe development and safety testing of applied seed solutions The site will also be integrated into Corteva’s global CSAT network to meet the ongoing demands of grain producers across the Africa Middle East (AME) region.May 2022

The International Center for Agricultural Research in Dry Areas (ICARDA) launched a new Genebank in Morocco. Besides, an affiliated seed bank was also opened on the same day in Lebanon. The purpose behind opening the two seedbanks was to help agricultural researchers develop next-gen high-yeilding and climate-resistant seeds by storing an extensive collection of wheat, barley, chickpea, faba bean, lentil, and forage genetic material. The seedbanks will serve as the foundation of several agricultural research programs in the coming years.September 2021

A new Center of Excellence for Seed Systems in Africa was launched at the AGRF Summit held in Kenya. The center will be aimed at developing quality seeds of improved varieties across the African continent to boost agricultural productivity. It began its operations in 2022 to strengthen the seed value chain in Africa with the development of seeds and their subsequent release, farmer awareness, quality assurance, and policy planning at the national level.Increased Food Consumption Propelling Growth of the Market

According to the World Bank data, the population in the Middle East and African region grew by 3.2% between 2021 and 2023. This has raised the demand for food consumption, propelling the growth of the Middle East and Africa seeds industry. Food consumption in the region is driven by Egypt, Turkey, and Iran in the Middle East whereas Nigeria, Ethiopia and the Democratic Republic of Congo in Africa.Rising Agricultural Production Driving Seeds Demand Growth

Agricultural production is a major driver for market development in the region. The Food and Agriculture Organisation projects its growth at 1.7% up to 2030. With the rise in agricultural production, farmers are expected to increase their demand for high-yielding and quality seeds positively impacting the seeds market in the long run.Growing Environmental Concerns Increases Adoption of Genetically Modified (GM) Seed Varieties

The Middle East and African region frequently suffer from extreme conditions of droughts and water shortages. This has resulted in new and increasing demand for genetically modified seeds with features such as extreme heat tolerance, and high yield. According to the seeds industry statistics in Middle East and Africa, the region planted an estimated 3.4 million hectares of GM crops during 2022, including farmer saved and government supplied seed, a rise of 8.4% over the previous year. South Africa is the driver of the region’s GM cultivation as it represents more than 90% of the GM planted area.Increased Investment in Seed Treatment Technologies Enhances Quality and Efficient Seed Production

Key players such as Corteva Agrisciences are investing in the development of seed treatment technologies and establishment of seed treatment plants. This is expected to raise the quality and efficiency of seeds produced, providing easier and cost-effective access of treated seeds for farmers. Seed treatments involve the application of chemical or biological substances, such as fungicides or insecticides, directly to the surface of a seed, to develop resilience against insects, fungal diseases and soil-borne pathogens.Middle East and Africa Seeds Industry Segmentation

“Middle East and Africa Seeds Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Conventional Seeds

- Genetically Modified Seeds

Market Breakup by Crop Type

- Row Crops

- Fiber Crops

- Forage Crops

- Grains and Cereals

- Oil Seeds

- Pulses

- Vegetables

- Brassicas

- Cucurbits

- Roots and Bulbs

- Solanaceae

- Unclassified Vegetables

Market Breakup by Treatment

- Treated Seeds

- Untreated Seeds

Market Breakup by Trait

- Herbicide Tolerance

- Insect Resistance

- Others

Market Breakup by Country

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Middle East and Africa Seeds Market Share

Based on region, the market is bifurcated into Saudi Arabia, the United Arab Emirates, Nigeria, and South Africa, among others. Among the countries, South Africa has the most developed agricultural sector with large arable land and a wide variety of crops which facilitates seed production. On the other hand, Nigeria also has a large agricultural sector, but its agriculture is dependent on rain and limited modern technology usage. Furthermore, Saudi Arabia and the United Arab Emirates possess arid climates and limited agricultural land, which drives the demand for climate-resistant and high-yielding seeds in the region.Leading Companies in Middle East and Africa Seeds Market

Market players support technological development and strive to meet regulatory standards.- BASF SE

- Bayer AG

- Corteva Inc.

- Enza Zaden Beheer B.V.

- Syngenta AG

- Groupe Limagrain Holding

- KWS SAAT SE & Co. KGaA

- Sakata Seed Corporation

- Rijk Zwaan Zaadteelt en Zaadhandel B.V.

- Takii & Co., Ltd

- Others

Middle East and Africa Seeds Market Report Snapshots

Middle East and Africa Seeds Market Size

Middle East and Africa Seeds Market Growth

Middle East and Africa Seeds Market Share

Middle East and Africa Seeds Companies

Table of Contents

Companies Mentioned

- BASF SE

- Bayer AG

- Corteva Inc.

- Enza Zaden Beheer B.V.

- Syngenta AG

- Groupe Limagrain Holding

- KWS SAAT SE & Co. KGaA

- Sakata Seed Corporation

- Rijk Zwaan Zaadteelt en Zaadhandel B.V.

- Takii & Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 138 |

| Published | May 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 2.11 Billion |

| Forecasted Market Value ( USD | $ 3.71 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Africa, Middle East |

| No. of Companies Mentioned | 10 |