Mexico Eyewear Market Growth

The eyewear market growth in Mexico can be attributed to the growing focus on eye health and the rising awareness regarding the importance of regular eye checkups among Mexicans. Customers in the country are increasingly preferring high-quality eyewear customised as per their requirements.Major Mexico eyewear market players, including EssilorLuxottica are investing to establish new facilities for eyewear manufacturing. This is because of increasing incidences of eyesight-related problems in Mexico. Besides, evolving fashion trends are driving a shift towards eyewear that is trendy and stylish.

The Mexico eyewear market revenue is further being fuelled by the expansion of the e-commerce sector. E-commerce platforms not only offer enhanced convenience to customers but also provide a wide range of eyewear to choose from.

Sustainability is one of the key trends contributing to the eyewear market share in Mexico, which is fostering innovation in the production of eyewear products. For instance, some companies like Ben & Frank are utilising acetate renew to manufacture sustainable eyeglasses which are of high quality. This material is obtained from certain biobased products and diverts tough plastics away from landfills, thereby resulting in a 50% reduction in carbon dioxide emissions. Cross-industry collaboration plays a crucial role in such innovations.

Over the forecast period, an increase in the discovery of new materials and the shift towards sustainability is expected to provide significant the Mexico eyewear market opportunities.

Industry Outlook

As per the import data for Latin America and the Caribbean from ITC Trade Map, total imports for spectacles and goggles rose from 10,781,516 USD thousand in 2019 to 12,525,312 USD thousand in 2023. In 2020, imports fell to 9,828,781 USD thousand but rebounded to 10,818,216 USD thousand in 2021 and further increased to 11,860,561 USD thousand in 2022.As per the eyewear industry in Mexico, Mexico's imports grew from 140,863 USD thousand in 2019 to 199,378 USD thousand in 2023, with yearly figures of 106,640 USD thousand in 2020, 138,313 USD thousand in 2021, and 168,351 USD thousand in 2022. Brazil's imports decreased from 87,061 USD thousand in 2019 to 60,740 USD thousand in 2020 but then rose to 83,847 USD thousand by 2023, with fluctuations in between. Chile's imports initially fell from 47,850 USD thousand in 2019 to 42,938 USD thousand in 2020 but increased to 56,060 USD thousand by 2023. Peru saw growth from 26,938 USD thousand in 2019 to 31,898 USD thousand in 2023, despite a dip in 2021. Overall, the region experienced a general upward trend in demand for these products over the years.

As per the ITC Trade Map data on spectacles and goggles imported by Mexico, total imports increased from 140,863 USD thousand in 2019 to 199,378 USD thousand in 2023. Imports from China grew from 64,041 USD thousand in 2019 to 80,426 USD thousand in 2023. Imports from Italy rose from 47,645 USD thousand in 2019 to 78,740 USD thousand in 2023. Imports from the United States increased from 8,337 USD thousand in 2019 to 13,061 USD thousand in 2023. Imports from Japan showed a decrease from 4,324 USD thousand in 2019 to 3,908 USD thousand in 2021 but increased to 6,679 USD thousand in 2023. Overall, most suppliers saw an upward trend, indicating robust demand for optical products in Mexico.

Recent Developments

The first Mexico-United States Symposium for Eye Health was held in January 2021 as a result of a partnership between the Mexican and US governments in response to the country's growing eye health problems. The conference's major goal was to address the rising number of instances of eye disorders by utilizing low-cost, creative, and scientific public health approaches in cooperative training and binational cooperation.What factors contribute to the Mexico Eyewear Market Share?

- Strong demand for eyewear products driven by a growing middle class and increasing awareness of eye health.

- Presence of well-established international and local brands are providing a wide range of products, which is increasing the Mexico eyewear market value.

- Increasing adoption of fashionable eyewear as a lifestyle accessory.

- Expansion of optical retail chains and e-commerce platforms enhancing product accessibility.

- High dependence on imported eyewear products, leading to vulnerability to exchange rate fluctuations.

- Limited awareness and access to advanced eye care services in rural areas negatively affects the Mexico eyewear industry revenue.

- Price sensitivity among consumers, impacting the adoption of premium eyewear products.

- Regulatory challenges related to standardization and quality control of eyewear products.

- Growing demand for prescription eyewear due to increasing incidences of vision problems.

- Rising popularity of online eyewear sales providing convenience and competitive pricing.

- Potential for growth in the sunglasses segment due to increasing fashion consciousness.

- Opportunities for market expansion through strategic partnerships and collaborations.

- Intense competition from counterfeit and low-quality eyewear products.

- Economic downturns are affecting consumer spending on non-essential items, which may impact the eyewear market dynamics and trends.

- Regulatory changes and trade policies impacting import and distribution of eyewear products.

- Rapid technological advancements requiring continuous innovation and adaptation by eyewear companies.

Market Competition in the Mexico Eyewear Market

- Major international brands dominate the market, leveraging strong brand recognition and marketing.

- Local manufacturers compete by offering affordable, high-quality eyewear options, thus supporting the eyewear demand growth.

- Online retailers are gaining traction, providing convenience and competitive pricing.

- Technological advancements in lens and frame materials differentiate premium products.

- Retail chains are expanding, increasing accessibility and market reach.

- Customizable and fashion-forward designs attract trend-conscious consumers, which will likely influence the eyewear demand forecast.

- Price sensitivity among consumers drives competition on affordability and value.

- Collaborations with fashion designers and influencers enhance brand visibility.

- Eyewear companies are focusing on sustainability and eco-friendly materials to attract environmentally conscious buyers.

Mexico Eyewear Industry Segmentation

Mexico Eyewear Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Product:

- Spectacles

- Sunglasses

- Contact Lenses

- Others

Market Breakup by Price Category:

- Mass

- Premium

Market Breakup by End User:

- Men

- Women

- Kids

Market Breakup by Distribution Channel:

- Online

- Offline

Market Breakup by Region:

- Baja California

- Northern Mexico

- The Bajío

- Central Mexico

- Pacific Coast

- Yucatan Peninsula

Competitive Landscape

The comprehensive report provides an in-depth assessment of the market based on the Porter's five forces model along with giving a SWOT analysis. The report gives a detailed analysis of the following key players in the Mexico Eyewear Market, covering their competitive landscape and latest developments like mergers, acquisitions, investments, and expansion plans.- Kering SA

- Giorgio Armani S.p.A.

- Christian Dior SE

- Johnson & Johnson Services, Inc.

- Gianni Versace S.r.l.

- EssilorLuxottica SA

- Safilo Group S.P.A.

- Alcon Vision LLC

- The Cooper Companies, Inc.

- Gramo Lenses

- Others

Mexico Eyewear Market Report Snapshots

Mexico Eyewear Market Size

Mexico Eyewear Market Growth

Mexico Eyewear Companies

Table of Contents

Companies Mentioned

- Kering SA

- Giorgio Armani S.p.A.

- Christian Dior SE

- Johnson & Johnson Services, Inc.

- Gianni Versace S.r.l.

- EssilorLuxottica SA

- Safilo Group S.P.A.

- Alcon Vision LLC

- The Cooper Companies, Inc.

- Gramo Lenses

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 134 |

| Published | May 2025 |

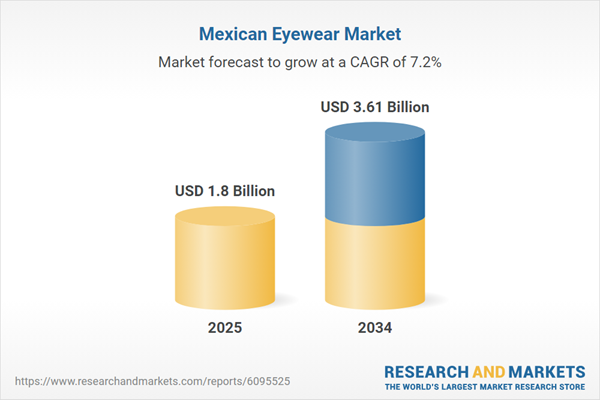

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 1.8 Billion |

| Forecasted Market Value ( USD | $ 3.61 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Mexico |

| No. of Companies Mentioned | 10 |