India Pharmaceutical Packaging Market Growth

Pharmaceutical packaging is rising in prominence in India, driven by the growing pharmaceutical manufacturing sector. The patient-centricity, rising demand for eco-friendly and sustainable packaging, the need for ease of production, and focus on child-resistant, user-friendly, and tamper-evident packaging are some of the key trends driving the growth of the pharmaceutical packaging market in India.India is a major pharmaceutical manufacturer on a global scale, and the largest provider of generic medicines on a global scale, constituting a share of 20% in global supply by volume, impacting the India pharmaceutical packaging market revenue. The country plays a crucial role in meeting 40 to 70% of the World Health Organisation's (WHO) demands for vaccines like Diphtheria, Tetanus, Pertussis (DTP), and Bacillus Calmette-Guérin (BCG). Key players like Bharat Biotech and Serum Institute of India are pivotal in this landscape, producing a wide range of vaccines that are essential for global immunisation programs. Efficient packaging solutions are needed for vaccines as they are also exported outside India.

Additionally, technological advancements such as the development of smart packaging solutions are gaining traction in the market. Such packaging consists of features such as RFID tags, NFC chips, or QR codes to provide information on the product, including authenticity, expiration dates, and usage instructions.

Key Trends and Recent Developments

Growing pharmaceutical sales, the use of sustainable materials, and advancements in packaging technologies are driving the India pharmaceutical packaging market value.November 2024

Radiant Industries lanched a groundbreaking pharmaceutical packaging technology, the PFS+Vial Machine, at the CPHI & P-MEC India 2024 event. This state-of-the-art machine combined advanced technology with exceptional precision, promising to transform pharmaceutical packaging processes.November 2024

PM Biochemicals, Selenis and Bormioli Pharma partnered to produce the world's first pharmaceutical bottles made from partially wood-based PET. This collaboration aims to support the pharmaceutical industry's shift towards more sustainable packaging solutions, without compromising on product safety and performance. The new pharmaceutical bottles made using UPM's carbon-negative BioMEG featured Selenis' Selcare's partial BioPET resins.January 2024

Bormioli Pharma, in collaboration with Loop Industries, launched an innovative packaging bottle made entirely from 100 per cent recycled virgin quality Loop PET resin, using Infinite Loop technology to upcycle low-quality PET and polyester fibre waste into high-quality, 100 per cent recycled virgin quality Loop PET resin.September 2023

Pluss Advanced Technologies (PLUSS) introduced two new temperature-controlled packaging solutions for the pharmaceutical industry: the Celsure XL Pallet Shipper series and the Celsure VIP Multi-Use Parcel Shipper series. This provided an improved alternative to conventional gel pack solutions and expensive leased containers.Use of Sustainable Materials is Leading to the India Pharmaceutical Packaging Market Development

As sustainability becomes a global priority, the pharmaceutical packaging market in India is shifting towards eco-friendly and biodegradable materials. The use of sustainable packaging options, such as recyclable plastics, biodegradable polymers, and paper-based packaging, is growing. This trend is driven by both environmental concerns and regulatory pressures, as well as increasing consumer demand for greener solutions.Growing Sales of Pharmaceutical Products is Increasing the Demand of India Pharmaceutical Packaging Market

The overall growth in the pharmaceutical sector in India, driven by factors like rising healthcare awareness, an expanding middle class, and increasing access to medical services, is leading to a greater demand for packaging. According to Invest India, the turnover of the sector reached INR 4,17,345 crores between 2023 and 2024. With the rise in sales of both prescription drugs and over-the-counter (OTC) products, the need for efficient, secure, and informative packaging also rises.

Advances in Packaging Technology is Boosting the India Pharmaceutical Packaging Market Growth

The adoption of advanced packaging technologies, including smart packaging (including RFID tags, QR codes, and temperature-sensitive labels) is gaining momentum. These technologies improve product traceability, enhance patient safety, and extend shelf life. Smart packaging also allows for real-time monitoring of conditions, like temperature and humidity, which is vital for sensitive drugs like vaccines and biologics.Government Initiatives and Regulatory Standards are Creating New India Pharmaceutical Packaging Market Opportunities

The Indian government's efforts to enhance healthcare infrastructure, coupled with stricter regulatory standards for packaging materials, are driving innovation in the packaging market. Initiatives aimed at improving healthcare access, along with regulations regarding child-resistant packaging and tamper-evident features, are encouraging pharmaceutical companies to adopt more advanced packaging solutions to meet safety and quality standards.

India Pharmaceutical Packaging Industry Segmentation

India Pharmaceutical Packaging Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Materials

- Plastics and Polymers

- Glass

- Paper and Paperboard

- Aluminium Foil

- Others

Market Breakup by Product Type

- Plastic Bottles

- Speciality Bags

- Parenteral Container

- Blister Packing

- Closures

- Labels

- Others

Market Breakup by Packaging Type

- Primary

- Secondary

- Tertiary

Market Breakup by Drug Delivery Mode

- Oral Drug

- Injectable Packaging

- Topical

- Others

Market Breakup by End Use

- Pharma Manufacturing

- Contract Packaging

- Retail Pharmacy

- Institutional Pharmacy

Market Breakup by Region

- North India

- East and Central India

- West India

- South India

India Pharmaceutical Packaging Market Share

India is the third largest consumer of plastics, after USA and China. Reportedly, about 20 million metric tonnes of plastic is produced per annum in India. Plastics and polymers are widely adopted in pharmaceutical packaging sector due to the characteristics of flexibility, mechanical strength and stability.Andhra Pradesh, Gujarat, Maharashtra, and Goa are the major areas of pharmaceutical manufacturing in the country. For instance, Andhra Pradesh has 261 pharma units, while Gujarat has 3332 units. Also, the major drug clusters are present in Ahmedabad, Vadodara, Mumbai, Aurangabad, Pune, Hyderabad, Chennai, Mysore, Bangalore, and Visakhapatnam.

Leading Manufacturers in India Pharmaceutical Packaging Market

Market players are emphasising on reusable and smart packaging, child-resistant and senior-friendly packaging, and anti-counterfeiting measures to ensure product authenticity and patient safety.- Amcor Plc

- SGD S.A

- Nipro Corp

- Gerresheimer AG

- Uflex Ltd

- West Pharmaceutical Services, Inc.

- Sonoco Products Co.

- Hoffmann Neopac AG

- Schott AG

- WestRock Co.

- AptarGroup, Inc.

- Others

Table of Contents

Companies Mentioned

- Amcor Plc

- SGD S.A.

- Nipro Corp.

- Gerresheimer AG

- Uflex Ltd.

- West Pharmaceutical Services, Inc.

- Sonoco Products Co.

- Hoffmann Neopac AG

- Schott AG

- WestRock Co.

- AptarGroup, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 105 |

| Published | May 2025 |

| Forecast Period | 2025 - 2034 |

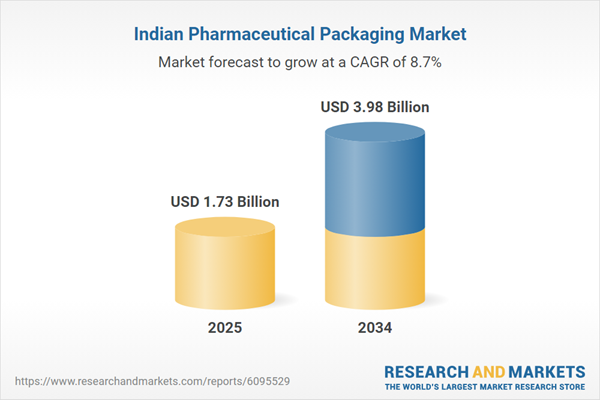

| Estimated Market Value ( USD | $ 1.73 Billion |

| Forecasted Market Value ( USD | $ 3.98 Billion |

| Compound Annual Growth Rate | 8.7% |

| Regions Covered | India |

| No. of Companies Mentioned | 11 |