Key Takeaways

A washing machine is a household appliance used to wash laundry, such as clothes and household linen. It is a machine that uses water and detergent to clean clothes and other textiles and can have various features such as water heating, different wash cycles, high-speed load clearance, and automatic dirt sensors. Additionally, washing machines are inbuilt with different programs for distinguishing types of clothes and fabrics to maintain the quality of clothes.The United Kingdom washing machine market growth is driven by changing consumer preferences, technological advancements, and sustainability considerations. Factors such as population growth and increasing reliance on electronic gadgets and appliances also helps in increasing demand for washing machine in United Kingdom. Nowadays washing machines comes in varied prices, ranging from budget-friendly options to premium models with advanced features, allowing consumers with varying budgets to find a washing machine that meets their requirements.

Key Trends and Developments

Adoption of water-efficient washing machines, increasing sales of smart-connected washing machines, and launch of customised washing programs are factors driving the product demandUnited Kingdom Washing Machine Market Trends

Manufacturers are concentrating on the creation of new products using technological advancements, such as energy efficiency, smart features, and advanced washing modes, which have encouraged customers to replace their outdated models and has led to United Kingdom washing machine market development. In 2021, more than 4.46 million people in UK were using washing machines made by Robert Bosch and these numbers are expected to grow because of the advance features implemented in the company's household appliances.Furthermore, energy efficiency is another key trend in the washing machine market in United Kingdom, as consumers are increasingly conscious of energy consumption and environmental impact. This has led to a focus on developing energy-efficient washing machines. Factors such as the rising number of working women, rapid urbanisation, and lifestyle changes have contributed to the increasing United Kingdom washing machine market size.

Therefore, the convenience and time-saving features of smart washing machines are anticipated to draw in customers. These drivers reflect the evolving consumer demands and the industry's response to technological and environmental considerations, shaping the United Kingdom washing machine market outlook.

Market Segmentation

United Kingdom Washing Machine Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Top Load

- Front Load

Market Breakup by Product Type

- Fully Automatic

- Semi-Automatic

Market Breakup by Technology

- Smart Connected

- Conventional

Market Breakup by Capacity

- Less than 6kg

- 6kg to 8kg

- More Than 8kg

Market Breakup by End User

- Residential

- Commercial

Market Breakup by Distribution Channel

- Multi-Brand Stores

- Exclusive Stores

- Online

- Others

The United Kingdom washing machine market report reflects a substantial consumer preference for fully automatic washing machines, driven by factors such as increasing disposable income and busy lifestyles. These machines offer complete automation and are widely available in the market, with various models and brands, including innovative features such as AI-powered washers, automatic dosing, and sensor technology.

However, there is also a rising demand for semi-automatic washing machines in the country, attributed to factors such as advanced features like remote control and monitoring via smartphone applications, cost-effectiveness, and lower water consumption. Online retailers such as Amazon offer a wide selection of both fully and semi-automatic washing machines on discounts and varied finance options, further contributing to the increased demand for washing machines in the United Kingdom.

Washing machines with capacity of more than 8kg is the dominating segment because they can wash larger loads

Washing machines with capacities exceeding 8kg hold a dominant United Kingdom washing machine market share, driven by the demand for machines capable of handling larger loads. Larger washing machines can process more laundry in a single cycle, which is particularly useful for families with multiple members or those who prefer to do laundry after long intervals. The rising population in UK has led to increased demand for higher capacity washing machines.

Also, larger washing machines can also save user's money in the long run by reducing the number of cycles needed to clean clothes and other apparels. Thus, the reduced operational costs cater to its high demand in the region and is increasing the overall United Kingdom washing machine market value. Moreover, larger washing machines are more suitable for washing heavy or bulky items, such as curtains, duvets, and pillows, which may not fit in smaller or mid-sized machines. Some key players, including Samsung, LG, and Haier have been working on increasing the capacity of washing machines to accommodate larger loads.

Competitive Landscape

The market players are introducing advanced automation technologies to stay ahead in the competition, further increasing their presence in the international marketOther key players in the United Kingdom washing machine market analysis include, Arçelik A.Ş., AB ELECTROLUX, Haier Group Corporation, Miele & Cie. KG, Panasonic Holdings Corporation, and Glen Dimplex Group, among others.

Table of Contents

Companies Mentioned

- Whirlpool Corporation

- Robert Bosch GmbH

- Arçelik A.?.

- Samsung Electronics co. Ltd

- LG Electronics

- AB ELECTROLUX

- Haier Group Corporation

- Miele & Cie. KG

- Panasonic Holdings Corporation

- Glen Dimplex Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 142 |

| Published | May 2025 |

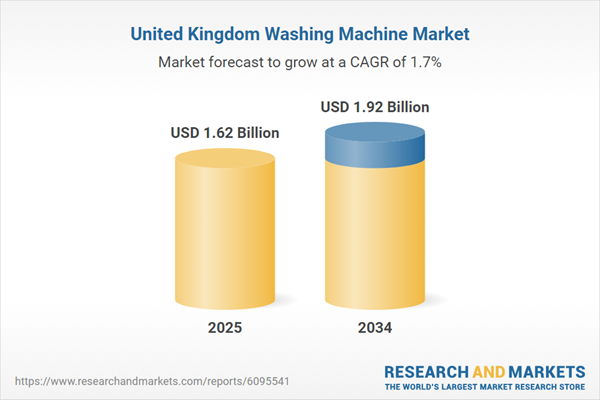

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 1.62 Billion |

| Forecasted Market Value ( USD | $ 1.92 Billion |

| Compound Annual Growth Rate | 1.7% |

| Regions Covered | United Kingdom |

| No. of Companies Mentioned | 10 |