Japan Seeds Industry Overview

The market for seeds in Japan is poised for considerable growth due to several factors. These include a rising need for food security, an increase in disposable income, and rapid developments in seed treatment technology. Additionally, precision, and smart agriculture techniques are becoming more popular in the country to combat labor shortage and support an ageing agricultural workforce.Also, prominent market players are consistently developing advanced technologies to gain a competitive edge in the seeds market share in Japan while promoting efficient cultivation methods. For instance, BASF Digital Farming collaborated with the National Federation of Agricultural Cooperative Associations (ZEN-NOH)- Japan’s largest agricultural cooperative, to promote precision farming among farmers. This has digitised and automated the overall seed production process and fostered climate-smart agriculture by leveraging artificial intelligence (AI), big data, and the Internet of Things (IoT), among others.

Furthermore, the government is taking steps to promote the sustainability efforts of market players, leading to growth of the Japan seeds market. For instance, in 2024, Japan introduced an eco-labeling system with a three-star scale based on daily consumption of fertiliser, fuel, and pesticide to measure greenhouse reduction rate. This system applies to 23 products, such as tomatoes, rice, and cucumbers, and covers the evaluation of these products from the initial seedling stage to the final output. This has increased the production of high-quality labeled seeds.

Japan Seeds Market Growth

The market is undergoing significant transformation, driven by various factors. In 2023, Japan imported approximately 33,300 seed shipments from countries like Turkey and India, highlighting its reliance on foreign agricultural products. The country boasts nearly 1,000 registered seed companies, primarily small-scale firms specialising in vegetable breeding. Notably, the sale of premium seed products such as Yubari melons can fetch up to USD 25,000 for a pair at auctions, indicating lucrative opportunities for farmers dealing in Japan seeds market.The urban agriculture sector is also expanding, with vertical farming projected to grow substantially by 2032. In 2024, it was reported that vertical farms could yield up to 100 times more produce per square meter compared to traditional farming methods, addressing land scarcity, and increasing demand for locally produced vegetables. The Tokyo Metropolitan Government has also been promoting urban agriculture through various initiatives aimed at increasing local food production and enhancing food security. However, challenges persist, including an ageing farming population as over 65% of farmers are aged 65 or older, which threatens labour availability. Additionally, Japan's strict regulations on genetically modified organisms (GMOs) complicate the introduction of innovative seed varieties, further impacting Japan seeds market dynamics.

Key Trends and Developments

Emergence of smart agriculture, adoption of sustainable farming practices, and development of organic seeds are the key trends fuelling the market growth.June 2024

Sakata Seed Corporation, one of Japan's leading seed companies, announced the establishment of a vegetable seed company in Colombia through its South American subsidiary Sakata Seed Sudamerica LTDA. This move is part of Sakata's strategy to expand its presence in LATAM.May 2024

Corteva reported a 2% increase in seed net sales and a 5% increase in organic sales in the first quarter of 2024. This growth was attributed to a high demand for their advanced seed technologies. Moreover, the company is predicting net sales between USD 17.4 billion and USD 17.7 billion for 2024.March 2024

Corteva launched "Corteva Catalyst," an investment and partnership platform aimed at improving genome editing, biological products, technology platforms, and decision science. This initiative can help develop technologies that enhance sustainable farming and hence, can bring lucrative Japan seeds market opportunities.April 2021

A revision in Japan's Plant Variety Protection and Seed Act was implemented to prohibit the export of seeds and saplings for 2,546 branded crop varieties, including popular ones such as "Amao" strawberries and "Shine Muscat" grapes. This law aimed to safeguard developers' rights due to concerns over unauthorised cultivation abroad and to foster trust in Japan seeds industry.Emergence of Smart Agriculture

Digital transformation is significantly improving Japan seeds market revenue. High investments by market players in digital tools and platforms with integrated data analytics, artificial intelligence (AI), and the Internet of Things (IoT) are enhancing seed productivity in agricultural landscape. For instance, Kubota Corporation recently integrated AI-powered crop management systems into its machinery, which has enabled real-time monitoring of soil conditions, crop health, and weather patterns. Also, these systems help farmers increase crop yields by around 10-15% and reduce reliance on water and fertilisers by more than 20%. The Japanese government’s Smart Agriculture initiative also encourages the adoption of digital technologies, such as seed labelling systems, aiming to boost the use of smart farming tools from 20% of agricultural producers today to over 50% by 2030.Biotechnology Advancements

Japan is leveraging biotechnology to improve crop resilience and productivity. The country has seen a rise in genetically modified (GM) crops, with MAFF reporting that as of 2024, approximately 70% of soybean imports are genetically modified, reflecting the acceptance of biotech solutions to enhance food security. Additionally, research institutions are actively developing new seed varieties that are resistant to climate change impacts, such as drought and flooding, which are becoming increasingly common due to global warming. Such advancements are leading to Japan seeds market development.Rise of Precision Agriculture

The adoption of precision agriculture technologies is significantly enhancing farming efficiency in Japan. According to the Ministry of Agriculture, Forestry, and Fisheries (MAFF), precision farming can boost crop yields by 5-10% while reducing input costs by 15%. This trend is exemplified by companies like Kubota, which are developing autonomous tractors and advanced planting systems to optimise resource use and address labor shortages. In 2024, the precision agriculture market in Japan is expected to see increased investments in IoT and AI technologies, with over 60% of farmers reporting the use of digital tools for crop management.Rising Digital Farming Initiatives

The integration of digital technologies is also transforming farming operations. The Japanese government has invested in advanced weather forecasting systems that provide real-time data, allowing farmers to make informed decisions about planting and harvesting. Reports indicate that over 60% of farmers are now using some form of digital technology for crop management, leading to improved productivity. Tools such as drones for crop monitoring and soil sensors for precise irrigation management are becoming commonplace, enabling farmers to maximise yields while reducing environmental impact.Japan Seeds Market Trends

Seed companies in Japan are increasingly incorporating organic farming and pest-resistant seed varieties to reduce the need for chemical inputs. Takii & Co., a major Japanese seed company has launched several eco-friendly seed lines that are resistant to pesticides, which enable farmers to reduce pesticide usage by nearly 30%. Market players are also engaged in launching different seed varieties to enhance the diversity of the market. For instance, in June 2020, Sakata Seed Corporation launched numerous new vegetable and flower seed products in Japan. This included stem broccoli, two new "dwarf" button flower varieties, kohlrabi, a heat-resistant pak choy cultivar, and an early-maturing, fusarium-resistant winter cultivar of mizuna.Moreover, precision farming techniques like variable-rate technology (VRT) and GPS-guided planting are also being adopted to improve seed placement, reduce overall waste, lower environmental impact of agriculture, and drive Japan seeds market growth. Additionally, the government has set targets for reducing greenhouse gas emissions from agriculture, further encouraging the adoption of sustainable practices among farmers.

Opportunities in Japan Seeds Market

In Japan, there is a substantial scope for seeds market because of the increasing consumer demand for superior and varied food items that are also environment friendly. One opportunity in the market includes growing production levels for premium fruit and vegetable seed like melons, strawberries, or tomatoes. This is because sale of Yubari melons can be worth USD 25,000 for a pair at auctions, which provides significant gain opportunities for farmers and producers.Another trend in the Japan seeds market is the growing demand for seeds that support organic farming, as sustainability has become a priority for both consumers and policymakers. Moreover, urban agriculture industry is progressively growing in Japan, with vertical farming projected to experience high growth by 2026. This is consistent with Japan’s limited land space and an increasing focus on consumption of locally produced fresh vegetables.

Japan Seeds Market Restraints

Several factors are acting as restraints in Japan's seeds market, limiting its growth potential. One of the key challenges is Japan's ageing farming population, with over 65% of farmers aged 65 or older as of 2020, leading to a decline in agricultural labor and knowledge transfer. This demographic issue has caused a reduction in overall farming activity and seeds demand in Japan.Additionally, Japan's strict regulations on genetically modified organisms (GMOs) and stringent import regulations hinder the development of new, innovative seed varieties, particularly for foreign companies. Furthermore, Japan's policies require extensive testing and approval processes, which hinder the production of genetically engineered seeds. High production costs and land scarcity also limit large-scale farming, driving up operational expenses for seed production and distribution. The shrinking agricultural land area, which has decreased by around 35% over the last few decades, further exacerbates these challenges, reducing the potential for crop diversification and seed usage in the country.

Japan Seeds Market Dynamics

Japan plays a robust role in both seed imports and exports, supported by nearly 1,000 registered seed companies, a relatively high number compared to other developed nations. Most of these companies are small-scale and specialise in vegetable breeding, contributing to the Japan seeds market dynamics and trends. According to industry reports, between March 2023 and February 2024, Japan imported 33.3K seed shipments from Turkey, mainly for sunflower seed oil, and India, which supplied cumin and fenugreek seeds. In 2023, Japan's agricultural imports, including seeds, reached USD 9 trillion, underscoring the country's significant reliance on foreign agricultural products.On the export side, Japan sold USD 22.8 million of herbaceous plant seeds in 2023, with a total of 16,307 kg, increasing Japan seeds industry revenue by a large scale. China (USD 8 million), Denmark (USD 3.4 million), the United States (USD 3.4 million), the Netherlands (USD 3 million), and Vietnam (USD 1.5 million) were top destinations of exports. In addition, Japan exported USD 5.5 billion worth of goods to India, which included seeds. These figures reflect Japan's pivotal position in the global seed market.

Japan Seeds Industry Segmentation

The EMR’s report titled “Japan Seeds Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Conventional Seeds

- Genetically Modified Seeds

Market Breakup by Crop Type

- Row Crops

- Fiber Crops

- Forage Crops

- Grains and Cereals

- Oil Seeds

- Pulses

- Vegetables

- Brassicas

- Cucurbits

- Roots and Bulbs

- Solanaceae

- Unclassified Vegetables

Market Breakup by Treatment

- Treated Seeds

- Untreated Seeds

Market Breakup by Trait

- Herbicide Tolerance

- Insect Resistance

- Others

Japan Seeds Market Share

Market Insights by Type

Conventional seeds dominate the market due to consumer preferences, government policies, and strict regulatory controls on genetically modified organisms (GMOs). Japan’s agricultural tradition places a high value on the natural integrity of crops, with consumers often favoring non-GMO and organically grown produce. As a result, conventional seeds are widely used for staple crops like rice, wheat, and vegetables. In 2020, over 90% of seeds used in Japanese agriculture were conventional. Furthermore, country’s organic food market is driving conventional seeds demand growth in Japan, suited for organic farming methods. Additionally, high-value crops like strawberries, Yubari melons, and tomatoes rely on non-GMO varieties to maintain their distinct taste and appearance, which are crucial in Japan’s premium produce culture.Genetically modified seeds represent a smaller portion of seed market due to strict regulations and public skepticism about GMOs. Japan has strict approval procedures for GM seeds, and only a limited number of GM crops are permitted for cultivation. As per Japan seeds market statistics of 2021, Japan has approved only 8 genetically modified crops for food use, with GM seeds being restricted to feed crops such as soybeans, corn, and canola, which are mostly imported rather than grown domestically. In addition, studies demonstrate that over 60% of Japanese consumers express concerns about the safety of GM foods, which influences farmers' decision to avoid GM seed varieties for food crops.

Market Insights by Crop Type

The raw crop segment, which includes staple crops like rice, wheat, and soybeans, plays a critical role in Japan seeds market development. Rice remains the dominant staple crop, with approximately 7.5 million metric tons of rice produced annually. Moreover, the government ensures the use of premium rice seeds, such as Koshihikari, which is known for its quality and taste. However, the cultivation of raw crops is limited by shrinking agricultural land and labor shortages, impacting overall demand for seeds in this segment. For crops like soybeans and corn, Japan is heavily reliant on imports as the country produces only about 250,000 metric tonnes annually, which meets only around 20% of domestic demand.Meanwhile, Japan produces over 14 million metric tons of vegetables annually, with key crops like tomatoes, cucumbers, and spinach. For example, Japan produces around 800,000 metric tons of tomatoes and 500,000 metric tons of cucumbers each year. Vegetable production is also supported by the rise of vertical farming and urban agriculture, which has created a positive seed demand forecast in Japan. In addition, the growing trend toward organic farming, further boosts the demand for high-quality vegetable seeds that support sustainable and pesticide-free cultivation.

Market Insights by Treatment

Treated seeds form a significant part of the Japanese seeds market as these seeds are widely used in commercial farming to improve germination rates, enhance crop resilience, and boost yields. For crops such as rice and vegetables, treated seeds can reduce crop loss, particularly given Japan's reliance on typhoons and unpredictable weather patterns. In the rice sector, processed seeds contribute to higher productivity, with Japan producing approximately 7.5 million metric tonnes of rice annually, despite challenges such as declining farmland. Additionally, the demand for treated seeds is increasing as farmers seek more reliable harvests amid climate change, particularly for key crops such as wheat and soybeans, where pest resistance is a priority. Untreated seeds, however, are in demand primarily for organic farming and small-scale cultivation. According to Japan seeds industry analysis, untreated seeds are less commonly used in large-scale farming due to their sensitivity to pests and diseases, limiting their market share compared to treated seeds.Market Insights by Trait

The market is bifurcated into herbicide tolerance and insect resistance based on trait. Herbicide tolerance is an inherent trait that enables a plant to survive treatment with glyphosate-based herbicides, making weed management easier while being compatible no-till methods. Examples of herbicide-tolerant crops include soybean, cotton, and canola. On the other hand, insect resistance is engineered in genetically modified seeds to protect against harmful pathogens such as viruses, bacteria, and fungi without the need for external pesticide treatments, thus reducing pollution. These traits make the seeds highly desirable amongst cultivators, leading to their increased demand in the Japan seeds market.However, in Japan, where strict regulations limit GM crop cultivation, insect-resistant seeds are not yet widely used for food crops. Japan does, however, import GM crops like corn and soybeans for animal feed. In 2021, Japan imported over 15 million metric tonnes of corn, much of it genetically modified. Recent news also highlights that the Japanese government is cautiously exploring biotechnology advancements to address food security concerns amidst climate change. This could pave the way for increased adoption of insect-resistant traits in domestically cultivated crops.

Competitive Landscape

Market players are continuously investing in research and development and adhering to regulatory norms. The Japan seeds market outlook is dominated by small-scale family-owned seed companies, with nearly 1000 registered firms. These companies operate within close-knit networks and adhere to customary practices, fostering cooperation and collectively agreeing on seed prices. Many contribute to agrobiodiversity by preserving open-pollinated varieties and developing new non-hybrid seeds. The market is also witnessing the rise of large seed companies due to the increased competition and advancements in breeding technology.Bayer AG

Bayer AG, a leading global life sciences corporation with a strong focus on health care and agriculture, was founded in 1863 and is headquartered in Leverkusen, Germany. Bayer has a reputation for its pharmaceutical products and consumer health products and for its crop science innovations.BASF SE

BASF SE, one of the largest chemical companies worldwide was established in 1865 and has its headquarters located at Ludwigshafen, Germany. Its portfolio comprises various products including agricultural products, chemicals, and materials.Corteva Inc.

Corteva Inc., which was founded in 2019 and operates from Delaware, United States emerged out of the merger between Dow AgroSciences and DuPont's agriculture division mainly dealing with crop protection solutions as well as seeds. The mission of Corteva is to improve agricultural productivity but also support sustainable farming practices.

Kaneko Seeds Co., Ltd

Kaneko Seeds Co., Ltd is based at Osaka, Japan where it started up its seed business back in 1910. It focuses primarily on vegetables and flowers seed production. It offers a range of high-quality seeds that are tailored to meet farmers’ needs both domestically within Japan and across the globe.Other Japan seeds market players include Syngenta AG, The Musashino Seed Co., Ltd., KWS SAAT SE & Co. KGaA, Sakata Seed Corporation, Rijk Zwaan Zaadteelt en Zaadhandel B.V., and Takii & Co., Ltd, among others.

Innovative Startups in Japan Seeds Market

Startups in the market are primarily focusing on innovative agricultural technologies and sustainable practices. Many are developing seed treatment solutions that enhance seed performance and protect against pests and diseases, addressing the rising costs associated with high-quality seeds. Many new companies are exploring biological seed treatments and advanced coatings to improve seed viability, reduce environmental impact, and promote growth of the Japan seeds industry. Additionally, there is a growing emphasis on precision agriculture, utilising data analytics and IoT technologies to optimise crop yields.SPREAD Co., Ltd., founded in 2006 and headquartered in Kyoto, Japan, is one of the most prominent agritech startups in Japan. The company gained international recognition for its fully automated vertical farm, "Techno Farm," which can produce over 30,000 heads of lettuce per day. SPREAD is particularly focused on sustainable farming practices and their farming techniques use 99% less water compared to traditional farming, addressing Japan's need for resource-efficient food production. Company’s success is evident in its plans to scale production to 10 million heads of lettuce annually by 2030, setting a new benchmark in the vertical farming industry.

Pirika, Inc.was established in 2010 and its base is in Tokyo, Japan. It has since ventured into agriculture sector where it lays emphasis on sustainable seed development after initially being focused on environmental technology. Pirika leverages AI and machine learning to create seed varieties that are resilient to drought or temperature fluctuations. Their innovation in climate-resilient crops aims to support sustainable agriculture by reducing the need for excessive water, fertilisers, and pesticides. The startup has earned accolades for its contributions to eco-friendly solutions, including winning the Global Environmental Prize in Japan.

Japan Seeds Market Report Snapshots

Japan Seeds Market Size

Japan Seeds Market Growth

Japan Seeds Market Share

Japan Seeds Companies

Table of Contents

Companies Mentioned

- Bayer AG

- BASF SE

- Corteva Inc.

- Kaneko Seeds Co., Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 125 |

| Published | May 2025 |

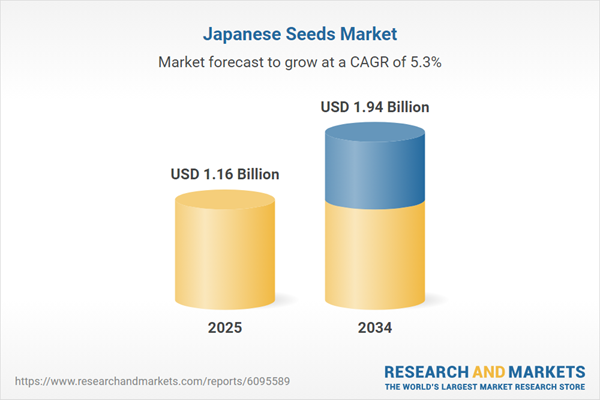

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 1.16 Billion |

| Forecasted Market Value ( USD | $ 1.94 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Japan |

| No. of Companies Mentioned | 4 |