Latin America Baby Furniture Market Growth

In 2021, the infant population (aged 0-4 years) in Latin America and the Caribbean was 49.74 million. Moreover, Latin America is one of the urbanised regions in the world and by 2050, 90% of Latin Americans will live in cities. As of 2022, around two-third of the population lives in cities of 20,000 inhabitants or more.One of the factors driving the Latin America baby furniture market growth is rising disposable incomes. Moreover, by 2035, the disposable income per capita in Brazil and Mexico - the two largest markets of the region, is anticipated to increase to USD 12,435 and USD 17,6113, respectively from USD 11,919 and USD 16,588 in 2022. Additionally, the growth in sustainability concerns and demand for non-toxic baby furniture among Latin Americans compels manufacturers to produce baby furniture from sustainable materials.

Figure: Disposable Income Per Capita in Brazil and Mexico, 2022-2050 (E), in USD

Key Trends and Developments

Expansion of childcare centres, surge in disposable incomes, rising demand for sustainable furniture products, and expanding retail channels, including e-commerce, are the major factors propelling the Latin America baby furniture market demandJanuary 2024

WHP Global and El Puerto de Liverpool expanded their partnership to introduce Babies ‘R' Us to Mexico, starting with a store opening in late 2024, followed by more locations and an ecommerce site.January 2024

Sanchez Y Sanchez SPA celebrated the grand re-opening of its 1,600 sq. mt. Ashley Furniture HomeStore in Punta Arenas.September 2023

IKEA launched its largest South American store in Bogotá, Colombia, offering 6,000 products, reinforcing its global presence with a 26,000-square-meter retail space.Expansion of childcare centres in the region

Childcare centres use baby furniture such as cots, playpens, cribs, and changing tables. Further, the growing participation of women in workforce is increasing the demand for day care services, which in turn, is expected to boost the baby furniture market expansion.Rise in disposable income

The well-being of the economy boosts the disposable income of the middle-class population, which positively influences the market demand.Growing demand for sustainable and compact child-care solutions

Urbanisation leads to smaller living spaces, creating a demand for compact and convenient baby care solutions including changing table and baby cots.Growth in retail channels, including e-commerce

Online channels offer better product visualisation and convenient doorstep delivery while increasing the accessibility of baby furniture to consumers. As of 2022, eCommerce contributed 11% of retail in LATAM countries.Latin America Baby Furniture Market Trends

The Latin America e-commerce market currently boasts over 300 million digital buyers, and this number is poised to surge by over 20% by 2027. According to industry reports, the e-commerce sector in Latin America is expected to grow by 25% between 2021 and 2025, presenting a huge opportunity for merchants to reach new customers by offering their products and services online. Companies such as Ikea, Amazon, and Pottery Barn Kids deliver baby furniture to the doorsteps of consumers.Furthermore, the expanding middle class population drives the demand for innovative and functional baby furniture that ensures the safety of children. Parents' concerns regarding the health of their children aid the demand for baby furniture products made with sustainably harvested wood and non-toxic paints. Key manufacturers of sustainable baby furniture products include Nestig, and Ikea.

Latin America Baby Furniture Industry Segmentation

“Latin America Baby Furniture Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Material:

- Wood

- Plastic

- Metal

- Others

Market Breakup by Product Type:

- Table and Dining Chair

- Car Seats

- Playpens

- Beds, Cots, and Cribs

- Mattresses

- Cabinets, Dressers, and Chests

- Others

Market Breakup by End Use:

- Residential

- Commercial

Market Breakup by Country:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

Latin America Baby Furniture Market Share

By material, wood is expected to hold a significant market share as parents are increasingly conscious of using furniture with non-toxic paints and finishes, free from harmful chemicals and volatile organic compounds (VOCs).Wood is perceived as a safer, sturdy, and a long-lasting material. It is also considered a relatively eco-friendly material compared to synthetic options. In fact, Peru's average furniture production index (base year 2007) stood at 193.7 in 2023. In 2022, the country experienced record growth of 161.4% in the furniture industry compared to the base year. It stands at 249.0 in April 2024.

Plastic furniture is relatively lightweight and affordable, making it accessible to a broader range of consumers, especially in urban settings with limited space. This affordability is crucial for families on a budget with growing babies and changing requirements. With urban density in Latin America and the Caribbean reaching 82% in 2023, the practicality and convenience of plastic furniture make it an ideal choice for urban living.

In neonatal units and paediatric wards, metal baby furniture is often chosen for its durability and high hygiene standards. Common items include metal bassinets and cribs, which are essential for the care and safety of newborns and infants in these settings.

Leading Players in the Latin America Baby Furniture Market

Major market players are focusing on expanding their online presence, adopting aggressive marketing strategies and are utilizing sustainable materials to attract more customersKYK - Indústria e Comércio de Móveis Ltda (Somniare Baby Furniture)

Headquartered in Brazil and founded in 1981, the company offers its products under the brand name Somniare, a pioneering manufacturer of children's furniture. Its product portfolio includes closets, baby crib, beds, dressers, and others.GRAND HOME SA DE CV

Headquartered in Mexico, the company produces wooden furniture design, balancing functionality, design, and quality. It offers various types of furniture products including Sky Crib Bed, Nordic Pop Bureau, Scania Double Bed, and Pearl Trunk Bench, among others.Foundations Worldwide, Inc.

Headquartered in the United States and founded in 2002, Foundations Worldwide is a leading provider of nursery furnishings, available at diverse brick-and-mortar and e-commerce retailers. The company offers various types of baby furniture products including child care cribs, play yards, rockers, and others.

Inter IKEA Systems B.V.

Headquartered in Netherlands and founded in 1943, the company has a global presence with 12 franchisees and an extensive supply chain. It offers various types of baby furniture products including children's storage and organization, cots and cots mattresses, and others.

Other key players in the Latin America baby furniture market include Matic Móveis, and Dorel Industries Inc.

Latin America Baby Furniture Market Analysis by Region

Brazil is a prominent region due to the government support for daycare services

In Brazil, the number of preschool students reached 8.3 million in 2022. The municipalities' annual average expenditure per child is around USD 5,000. Daycare maintenance and structural costs approach USD 3,500, with preschool costs slightly higher.The total number of births registered in Mexico reached 1,891,388 in 2022, marking a 16.1% increase compared to 2020, which saw 1,629,211 births. Further, in Mexico, in January 2024, New Mexico became the first state that guarantees a right to early childhood education.

Peru witnessed an increase in its urban population, rising from 26,076,635 in 2020 to 26,466,645 in 2021, marking a growth of 1.5%, thus driving the furniture demand.

Table of Contents

Companies Mentioned

- KYK - Indústria e Comércio de Móveis Ltda (Somniare Baby Furniture)

- GRAND HOME SA DE CV

- Foundations Worldwide, Inc.

- Inter IKEA Systems B.V.

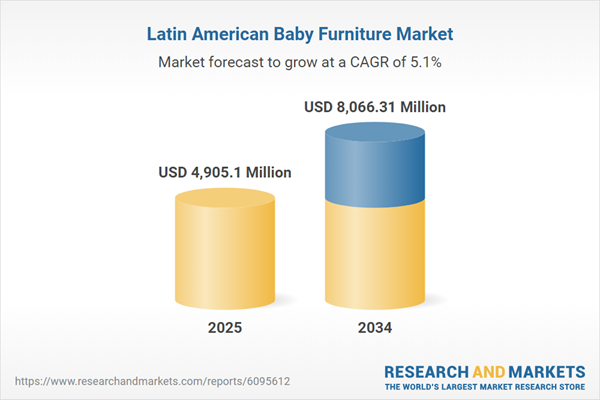

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 168 |

| Published | May 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 4905.1 Million |

| Forecasted Market Value ( USD | $ 8066.31 Million |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Latin America |

| No. of Companies Mentioned | 4 |