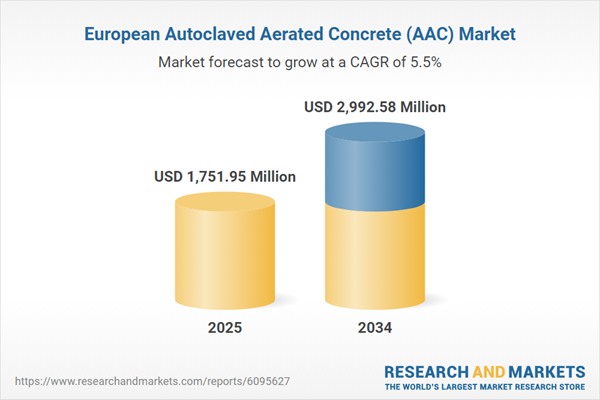

Europe Autoclaved Aerated Concrete (AAC) Market Growth

Autoclaved Aerated Concrete (AAC) is a green precast building material that offers insulation, structure, and fire protection. It is extensively deployed in Europe in the residential, commercial, and industrial construction. Due to its thermal insulation qualities, AAC can reduce heating and cooling requirements by up to 30%, which provides long term monetary benefits to homeowners.Spain issued the highest number of licenses in Europe in 2022, despite challenges due to higher interest rates and building material prices. The number of licensed square metres expanded by 43.4% in 2022 compared to 2021. In the residential sector, building permits increased by 44.2%, while the non-residential building sector experienced a rise of 41.7%.

The growth in the number of licensed square metres for residential construction in Spain was driven by a strong demand for single-family homes during H1 2022 while the demand for new offices aided the growth of the non-residential sector.

Figure: Year-on-Year Growth in Building Permits in 2022 for European Countries, in m2 of Useful Floor Area

Key Trends and Developments

Reduction in carbon emissions of AAC; rising renovation activities across Europe; increasing construction of green buildings; and significant advantages offered by AAC blocks over concrete are impacting the Europe autoclaved aerated concrete (AAC) market growth.Jan 23, 2024

Xella Polska inaugurated an advanced production line in Ostrołeka, Poland, for manufacturing large-size Ytong panels with a sleek surface. The investment, a collaboration between Xella Group and Aircrete Europe, aimed to meet the evolving demands of the rapidly changing Polish construction market.Jan 10, 2024

Holcim's AAC plant in Romania recently underwent an upgrade, adopting the latest flat-cake technology to address challenges in the country's construction sector. With the shift towards automated production, Romania aimed to mitigate labor shortages, reduce environmental impact, and improve quality assurance standards.Nov 16, 2023

Holcim Romania expanded its Abjud autoclaved aerated concrete (AAC) block plant with a Euro 15 m investment, incorporating equipment from AAC specialist Aircrete Europe. The upgrade resulted in a 45% increase in the plant's production capacity, showcasing the company's commitment to enhancing its manufacturing capabilities.Aug 1, 2023

Invest International provided a EUR 27 million loan to Kovalska Group, a leading Ukrainian construction material company, to support the import of Aircrete Europe's AAC block production technology to Ukraine.Initiatives to reduce CO2 emissions associated with AAC use

The European Autoclaved Aerated Concrete Association (EAACA)’s NetZero Roadmap is helping the AAC sector reach net-zero emissions by 2050. The key levers, such as the use of low carbon cement and lime, renewable energy sources, low emissions transport, reusing and recycling AAC, and recarbonation are expected to reduce the carbon emissions of AAC products from 180 kg to -70 kg of CO2e per m3 by 2050, increasing their sustainability.Surge in renovation activities

The EU’s building sector is responsible for 40% of energy consumption and 36% of total GHG emissions. Under the EU’s Renovation Wave strategy, the government aims to enhance the energy efficiency of its buildings. This will increase the demand for AAC insulation products due to their superior thermal insulation properties and support the Europe autoclaved aerated concrete (AAC) market expansion.Growing adoption of green building designs

AAC is the preferred walling material for LEED-certified buildings and is a 100% green building material. There is a growing demand for green buildings in the EU among commercial customers who are willing to pay a premium to lease them. For instance, in London, the average rental premium for green-certified offices is over 11%.AAC blocks display robust properties over clay bricks and concrete

AAC blocks are around 3-4 times lighter than red bricks, making them economical and easy to transport. There is a greater strength-to-weight ratio with AAC blocks. This reduces the number of blocks needed per square metre and provides monetary benefits. Further, AAC blocks result in reduced structural costs as it saves steel use by up to 15%.Europe Autoclaved Aerated Concrete (AAC) Market Trends

AAC products are widely used in the EU. It is used in over 40% of construction projects in the UK and 60% in Germany. AAC is made from natural ingredients, does not contain any chemicals or volatile compounds, and emits no pollutants by-products during manufacturing. This makes it a healthy, safe, and 100% sustainable building material. It is a walling material of choice for LEED-certified buildings. AAC products also enhance the indoor air quality of structures.In 2022, around 40 million Europeans were unable to afford energy to heat their homes. The EU’s Renovation Wave strategy launched in October 2020 as part of the Green Deal, aims at renovating 35 million buildings by 2030 to improve their energy efficiency. The European Green Deal is viewed by the AAC market as an opportunity for growth that provides it a competitive edge over other building materials due to its sustainability benefits. AAC is a 100% recyclable material, making it an ideal solution to meet the needs of circularity and reduce GHG emissions.

Europe Autoclaved Aerated Concrete (AAC) Industry Segmentation

“Europe Autoclaved Aerated Concrete (AAC) Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Element

- Blocks

- Beams and Lintels

- Roof Panels

- Wall Panels

- Floor Elements

- Others

Market Breakup by End Use

- Residential

- Non-Residential

- Commercial

- Government

- Industrial

Market Breakup by Country

- Germany

- United Kingdom

- France

- Italy

- Spain

- Poland

- Netherlands

- Switzerland

- Sweden

- Belgium

- Others

Europe Autoclaved Aerated Concrete (AAC) Market Share

Based on element, blocks account for a significant share of the market

AAC blocks are known to be half the weight and ten times the size of traditional bricks. This makes it suitable for simple installation and offers the required flexibility, cutting, shaping, etc. AAC blocks are soundproof due to their lightweight and porous characteristics. Hence, it is being widely used across hospitals, schools, studios across the region.AAC floor elements, on the other hand, are known for their combination of strength, thermal, and acoustic insulation. The adoption of AAC floor elements provides the features of concrete floors at significantly lower cost and with better insulation values.

Meanwhile, AAC industrial wall panels can be used as both internal load-bearing structure or an outer wall. The panels are medium/heavily reinforced allowing them to hold the weight of multiple-story buildings. The presence of high precision on thickness makes them suitable for double-sided applications.

Based on end use, the residential sector significantly contributes to the Europe autoclaved aerated concrete (AAC) market revenue

Autoclaved aerated concrete (AAC) is adopted as masonry blocks and prefabricated reinforced elements majorly in residential buildings. AAC blocks are being used as exterior walls in residential projects. The significant importance of fireproof houses is catering to an increased adoption of AAC panels on roofs to protect the structure from the flying embers that ignite house fires. By 2026, it is estimated that Europe will have finished constructing about 1.5 million housing units.

Leading Companies in the Europe Autoclaved Aerated Concrete (AAC) Market

The market players are investing in upgrading their production plants to enhance energy efficiency, optimize production processes, improve personnel safety, and minimize ecological footprint.H+H International A/S

H+H is a prominent supplier of wall-building solutions and materials, headquartered in Denmark. The company has 27 manufacturing plants globally with a total of 2.9 million cubic meters of wall-building materials production registered in 2023.CRH plc

CRH plc is a leading provider of building materials solutions, specialising in transportation, utility infrastructure, non-residential construction, and outdoor living solutions. Founded in 1970, the company employs 78,500 individuals while operating at 3,390 locations in 29 countries across four continents.Bauroc AS

Bauroc, is the largest producer of autoclaved aerated concrete (AAC) in Northern Europe. Headquartered in Estonia, the family-owned group, Bauroc, runs three cutting-edge AAC factories across the Baltic region and a calcium silicate facility in Lithuania.Xella International GmbH

The company is recognised as one of the world's largest manufacturers of autoclaved aerated concrete and calcium silicate materials. Founded in 1929, Xella leads in building materials made from autoclaved aerated concrete (AAC) and calcium silicate through its brands including Ytong, Silka and Hebel.Other notable players operating in the Europe autoclaved aerated concrete (AAC) market are Holcim Limited, and Solbet Sp. z o.o., among others.

Europe Autoclaved Aerated Concrete (AAC) Market Analysis by Region

According to the US Green Building Council (USGBC), in 2022, Italy ranked ninth in the top countries in the world for LEED-certified buildings. In 2023, about 135 LEED projects were certified in Italy, accounting for nearly two million gross square meters (GSM) of space.In its 2021-2026 National Resilience and Recovery Plan (NRRP), the government of France has laid out the plan of adopting Climate and Resilience Law, to strengthen its green transition. The plan also put forward the revision of thermal regulation of new buildings (‘RE2020’). Such initiatives are expected to favour the adoption of sustainable building materials, thereby boosting theEurope autoclaved aerated concrete (AAC) market development.

AAC is considered as the second popular construction material, led by clay bricks. The majority of AAC products are set in place in terms of masonry units in residential buildings, especially in one- and two-family houses in Germany. Researchers are engaged in developing belite cement clinker from aerated concrete waste. The clinker can substitute Portland cement used in AAC production, lowering its carbon footprint.

Table of Contents

Companies Mentioned

- H+H International A/S

- CRH plc

- Bauroc AS

- Xella International GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 138 |

| Published | May 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 1751.95 Million |

| Forecasted Market Value ( USD | $ 2992.58 Million |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 4 |