The green tea segment is expected to witness exponential growth during the forecast period due to a rise in awareness about health and fitness and an increase in the number of educated tea consumers. The black tea segment generates the highest revenue and is expected to remain dominant until 2032 due to the rising numbers of global tea drinkers and black tea's health benefits, including a high concentration of antioxidants and polyphenols.

By packaging, the market is fragmented into plastic containers, loose tea, paperboard, aluminium tins, and tea bags. The paperboard segment accounts for a large share in tea market in Mexico due to its eco-friendliness, biodegradability, and recyclability. They are usually treated, coated, laminated, or impregnated with materials such as waxes, resins, or lacquers to improve their functional and protection properties.

The residential segment is the largest consumer of tea in Mexico, accounting for a major share of the tea market. The demand for tea in this segment is driven by the health benefits associated with tea consumption, such as boosting metabolism, improving brain function, reducing the risk of cancer and heart disease, and promoting weight loss.

Additionally, Mexico exported USD 1.99M in Tea in 2022, making it the 68th largest exporter of Tea in the world, which indicates that the country has a significant tea industry. Mexico's tea exports can help to promote the country's tea industry and increase demand for Mexican tea, both domestically and internationally, propelling the Mexico tea market. Moreover, the revenue generated from tea exports can contribute to the Mexican economy, providing resources for further investment in the tea industry.

Market Segmentation

Mexico Tea Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Product Type:

- Black Tea

- Green Tea

- Oolong Tea

- Others

Market Breakup by Packaging:

- Plastic Containers

- Paper Boards

- Tea Bags

- Loose Tea

- Aluminum Tin

- Others

Market Breakup by Distribution Channel:

- Hypermarkets/Supermarkets

- Convenience Stores

- Online Channels

- Others

Competitive Landscape

Market players are focused on providing premium quality of tea to consumers to stay ahead in the competition.- Lipton Teas and Infusions

- Bigelow Tea

- R. Twining and Company Limited

- Traditional Medicinals & WorldPantry.com® LLC.

- Yogi Tea GmbH.

- Vahdam Teas Private Limited

- Ahmad Tea Ltd.

- Others

Table of Contents

Companies Mentioned

- Lipton Teas and Infusions

- Bigelow Tea

- R. Twining and Company Limited

- Traditional Medicinals & WorldPantry.com® LLC.

- Yogi Tea GmbH.

- Vahdam Teas Private Limited

- Ahmad Tea Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 105 |

| Published | May 2025 |

| Forecast Period | 2025 - 2034 |

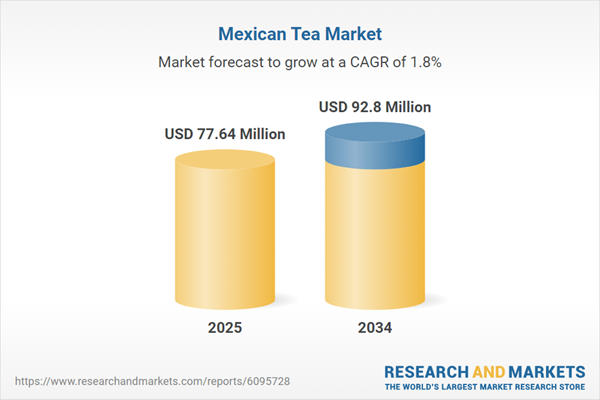

| Estimated Market Value ( USD | $ 77.64 Million |

| Forecasted Market Value ( USD | $ 92.8 Million |

| Compound Annual Growth Rate | 1.8% |

| Regions Covered | Mexico |

| No. of Companies Mentioned | 7 |