United States Grocery Market Growth

The American packaged food industry boasts a diverse array of products catering to customer needs and preferences. Key trends include a demand for natural, healthy, convenient, and sustainable products. Consumers favour items that are easy to prepare and nutritious, such as plant-based, high-protein, and low-sugar options.In May 2024, Nestle launched Vital Pursuit, a new food line for GLP-1 weight loss medication users and those focused on weight management in the U.S. These products are high in protein, rich in fibre, contain essential nutrients, and are portioned to align with the reduced appetite of weight loss medication users.

Unpackaged food refers to fresh food sold without packaging. These items can be sourced in bulk, ordered from processing companies, or delivered unpackaged to firms. Retailers must track unpackaged foods and provide customers with information like the food's name, country of origin, and any advisory statements per FSANZ regulations. Many unpackaged foods, such as fruits, vegetables, raw poultry, and raw fish, should not be in direct contact with undrained ice.

United States Grocery Market Segmentation

United States Grocery Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Product Type

- Packaged Food

- Unpackaged Food

- Drinks

- Tobacco

- Household Products

- Others

Market Breakup by Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Online Channels

- Others

Market Breakup by Region

- New England

- Mideast

- Great Lakes

- Plains

- Southeast

- Southwest

- Rocky Mountain

- Far West

United States Grocery Market Share

Tobacco items play a crucial role in bolstering the revenue of grocery stores, attracting loyal patrons and broadening the customer demographic. Their presence not only adds convenience but also boosts store traffic and ensures competitiveness. Similarly, household goods available alongside groceries streamline shopping, increase purchases, cultivate customer loyalty, expand revenue channels, and enhance the overall shopping journey.Leading Companies in the United States Grocery Market

- Nestlé S.A.

- The Procter & Gamble Company

- Unilever plc

- The Coca-Cola Company

- Pepsico, Inc.

- Mondelez International Inc.

- Danone SA

- General Mills Inc.

- Kraft Heinz Co.

- Kellanova

- Others

Table of Contents

Companies Mentioned

- Nestlé S.A.

- The Procter & Gamble Company

- Unilever plc

- The Coca-Cola Company

- Pepsico, Inc.

- Mondelez International Inc.

- Danone SA

- General Mills Inc.

- Kraft Heinz Co.

- Kellanova

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | May 2025 |

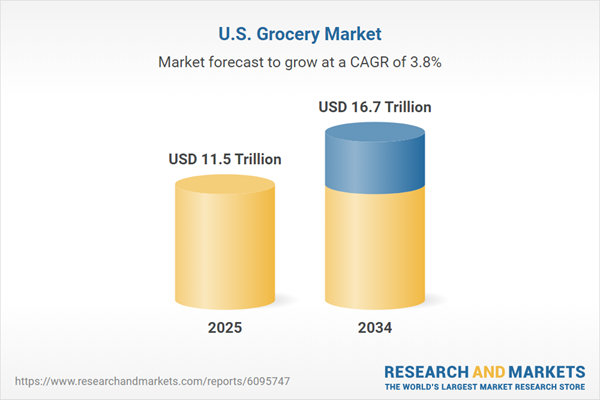

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 11.5 Trillion |

| Forecasted Market Value ( USD | $ 16.7 Trillion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |