Key Takeaways

Baby food is any easy-to-consume food and is a substitute for breastmilk. It is made specifically for babies between six months to two years old. It is often pureed or minced for easy ingestion by infants and comes in many varieties and flavours. The North America baby food market encompasses a wide range of nutritionally tailored food products specifically designed for infants and toddlers. These products cater to the dietary needs of young children, providing essential nutrients for their growth and development.The North America baby food market outlook looks promising due to factors such as the increasing awareness of infant nutrition, changing parental lifestyles, and a growing focus on convenient and healthy nutrition for babies. The paramount focus on infant nutrition, with parents seeking wholesome and nutritionally balanced food options, such as multi-grain porridge, milk powders, and beetroot flour for their children, acts as a significant driver for the market.

Key Trends and Developments

Increasing innovations in baby food packaging and rising launch of plant-based baby food products are boosting the demand for baby food in North AmericaNorth America Baby Food Market Trends

As more parents, especially working mothers, opt for ready-to-eat baby food to maintain a work-life balance, there is a clear opportunity for market growth to meet the evolving needs of modern families. While the preference for homemade baby food remains a restraint in the market, the increasing innovation in baby food products and packaging, as well as the rising demand for organic and vegan-based options, are indicative of the market growth.In addition, the availability of recyclable baby food pouches is promoting the North America baby food market development, as it reflects the growing demand for sustainable and eco-friendly products among consumers. In 2020, Nestlé S .A. introduced a single-material pouch for its baby food products, made from polypropylene (PP), to create recycled plastics that are safe for babies.

Market Segmentation

North America Baby Food Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Product Type:

- Milk Formula

- Dried Baby Food

- Prepared Baby Food

- Others

Market Breakup by Distribution Channel:

- Hypermarkets/Supermarkets

- Drugstores/Pharmacies

- Convenience Stores

- Online

- Others

Market Breakup by Region:

- United States of America

- Canada

Dried baby foods hold a significant market share as they are prepared with natural ingredients

The dried baby food segment, which includes a variety of fruits, vegetables, and oats, is expected to hold a significant North America baby food market share over the forecast period. These products are high in nutritional content and are considered ideal for babies, especially as they can be easily converted into a sauce by mixing with water or breast milk.Furthermore, the milk formula segment is growing due to the increasing population of newborns and availability of specialised formula compositions that meet specific health needs. Furthermore, the market is witnessing a rising demand for organic, soy-based, and lactose-free infant formula products, reflecting a growing consumer preference for these options. This is further increasing the North America baby food market size.

Hypermarkets/supermarkets is the leading market segment as they offer a wide range of baby food products under one roof

As per North America baby food market analysis, the retail outlets, including supermarkets/ hypermarkets, is one of the leading segments in the market, as they offer a wide range of baby food products under one roof. Hypermarkets/supermarkets constitutes diverse baby food products, such as Similac, milk powders, multi-grain porridge, and organic flours, in all sizes and quantities. These stores are a go-to destination for parents in case of emergencies, as they cannot rely on online websites due to their 2-3 business days delivery time.

Meanwhile, online sales of baby food are also experiencing steady growth, with e-commerce platforms like Amazon, Target, and Walmart providing parents with the convenience of ordering baby food products from the comfort of their homes. In addition to convenience, e-commerce websites offer a diverse range of baby food products, including organic and vegan options offered by companies like Organix, which may not be readily available in supermarkets. This wide variety enables consumers to purchase products that align with their children's nutritional requirements and taste, thereby aiding the North America baby food market development.

Competitive Landscape

The market players are introducing new baby foods with organic ingredients as per the regulatory landscape to stay ahead in the competition and to expand their global presence.Other key players in the North America baby food market include Nestlé S.A., The Kraft Heinz Company, The Hain Celestial Group, Inc., Danone S.A., Hero AG, and Cerebelly Inc., among others.

North America Baby Food Market Analysis by Region

United States dominates the market share due to a rise in country's birth rate

The United States dominates the baby food market in North America due to a rise in country's birth rate. The birth rate in the US was 12.023 births per 1000 people in 2023, representing a 0.09% increase from 2022. This upward trend in birth rates is leading to a higher demand for baby food products, particularly organic options. Many players are gaining market share in the country due to their focus on premium and organic baby food products and competitive pricing. This shift in parents' preference towards organic baby food is impacting the market.However, as per North American baby food market report, Canada is witnessing steady growth over the coming years due to the improving disposable income of working mothers in the country. Working parents demand for convenient and on-the-go baby food solutions as they are portable and easy to feed, which continues to drive the baby food market growth in North America.

Table of Contents

Companies Mentioned

- Nestlé S.A.

- The Kraft Heinz Company

- Abbott Laboratories

- The Hain Celestial Group, Inc.

- Danone S.A.

- Hero AG

- Sprout Foods, Inc.

- Tiny Organics Inc.

- Baby Gourmet Foods Inc.

- Cerebelly Inc

Table Information

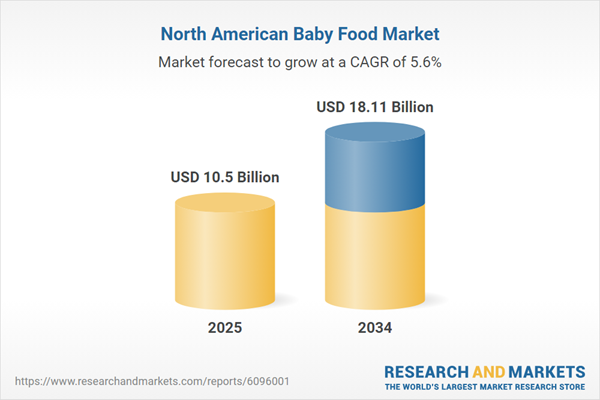

| Report Attribute | Details |

|---|---|

| No. of Pages | 116 |

| Published | May 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 10.5 Billion |

| Forecasted Market Value ( USD | $ 18.11 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | North America |

| No. of Companies Mentioned | 10 |