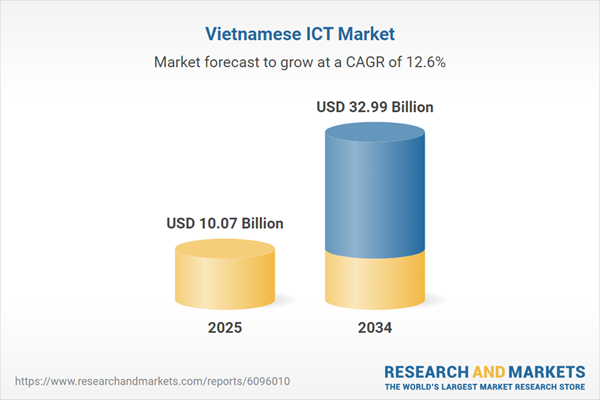

Vietnam ICT Market Growth

The robust economic growth of Vietnam, the emergence of new information technology startups, and the integration of AI and automated machine learning are some of the prominent Vietnam ICT market dynamics and trends. Automated machine learning has emerged as a crucial driver under which repetitive tasks such as data cleansing can be automated to reduce the burden on the technical team in any organisation.There is a significant expansion of IoT devices in several end-use sectors such as telecom due to the rising demand for 5G networks. The rise of 5G standalone (5G SA) networks has led to wider coverage and low latency, which enhances the user experience. Furthermore, due to the favourable business environment and the geopolitical location of the country, there has been a surge in domestic and foreign investments in the ICT sector, which can boost the growth of the ICT sector. Additionally, the government is providing favourable conditions for the development of the ICT industry especially by funding new startups in the market. Upcoming technology parks and incubators are also expected to significantly fuel the demand of Vietnam ICT market.

Key Trends and Recent Developments

Growth in the number of fintech ventures and startups and the increased awareness about cyber security are expected to shape the Vietnam ICT market value.August 8, 2024

Minister of Information and Communications in Vietnam, Nguyen Manh Hung in discussions with leaders from various Japanese companies and Vietnamese businesses, had a mutual agreement to strengthen collaboration on developing the 5G open radio access network (Open RAN) which will help propel the ICT market.July 20, 2024

Luxshare-ICT (Vietnam) Limited, a subsidiary of major Chinese electronics producer Luxshare-ICT has planned to put its USD 504-million project in Vietnam’s northern province of Bac Giang into operation in July 2026.June 25, 2024

Taiwan-headquartered electronics manufacturer Wistron is investing USD 24.5 million in a new factory in Vietnam's northern province of Ha Nam. The factory aims to complete administrative procedures by October, install machinery and equipment in November.February 29, 2024

Hanwha Life signed a memorandum of understanding (MOU) with its local partner, the Vietnam-Korea University of Information and Communication Technology (ICT) under the University of Danang and the Green Umbrella Children's Foundation for the "Future Talent Development Program in Finance and ICT in Vietnam." It is aimed at training ICT talent in the country.Growth in the number of fintech ventures in the market

The increasing popularity of fintech can be observed in the ICT industry in Vietnam. There are numerous mobile wallets and digital payment options launching in the market which has led to significant change in the financial aspect of the country. Vietnam is currently home to more than 260 fintech startups. Adding to this, banks are also rapidly venturing into the digital landscape by providing a multitude of services online to increase ease of access and convenience for customers.Increased focus on cybersecurity due to the rising number of cyber threats

The rapid growth in information and communication technologies as well as the digital spectrum has led to a drastic increase in cybercrimes. Hence, special attention is given to the security aspect of ICT projects to ensure they are safe from cyber threats. Additionally, the market for cyber security services is also witnessing prominent growth as people understand the importance of anti-virus software and other security features for their electronic devices.Growth of 5G and development of smart cities

The Ministry of Information and Communications (MIC) licensed the deployment of 5G services in Vietnam in April 2024. Moreover, two telecommunication service providers, Viettel and VNPT, have also got the business licences and permissions required to use the 5G band. These are big steps towards the development of ICT in the country especially with the increased adoption of IoT devices. The presence of 5G will also play a key role in the development of smart cities in the country, there by supporting the ICT demand forecast in Vietnam.Startup culture is on the rise in Vietnam

The number of start-ups and businesses in the country is experiencing robust growth which has in turn helped boost the ICT sector. As of August 2024, Vietnam has approximately 9.3k startups and the number is constantly growing. New as well as older businesses are adopting ICT technologies for greater efficiency and to reduce manual labour and human effort required for the execution of various tasks.Vietnam ICT Industry Segmentation

“Vietnam ICT Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Hardware

- Network Switches

- Routers and WLAN

- Servers and Storage

- Others

- Software

- IT and Infrastructure Services

- Telecommunication Services

Market Breakup by Industry Vertical

- BFSI

- IT and Telecom

- Government

- Retail and E-Commerce

- Manufacturing

- Energy and Utilities

- Others

Market Breakup by Region

- Southeast

- Red River Delta

- Mekong River Delta

- South Central Coast

- Others

Vietnam ICT Market Share

Based on industry vertical, the market is divided into BFSI, IT and telecom, government, retail and e-commerce, manufacturing, and energy and utilities, among others. The BFSI sector accounts for a substantial market share as it stores a large amount of sensitive financial information which creates ample demand for large data storage. Additionally, banks and financial institutions heavily rely on stringent regulations to ensure the integrity and security of data as well as focus on digital transformation to streamline the operations.Leading Companies in the Vietnam ICT Market

The market players are investing in high-end data storage to gain a competitive edge in the market.- IBM Corp.

- Microsoft Corp.

- Cisco Systems Inc.

- Google LLC

- AT&T Inc.

- Qualcomm Technologies, Inc.

- Oracle Corp.

- Fujitsu Ltd.

- HP Inc.

- Fortinet Inc.

- Others

Vietnam ICT Market Report Snapshots

Vietnam ICT Market Size

Vietnam ICT Market Growth

Vietnam ICT Market Share

Vietnam ICT Companies

Table of Contents

Companies Mentioned

- IBM Corp.

- Microsoft Corp.

- Cisco Systems Inc.

- Google LLC

- AT&T Inc.

- Qualcomm Technologies, Inc.

- Oracle Corp.

- Fujitsu Ltd.

- HP Inc.

- Fortinet Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 133 |

| Published | May 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 10.07 Billion |

| Forecasted Market Value ( USD | $ 32.99 Billion |

| Compound Annual Growth Rate | 12.6% |

| Regions Covered | Vietnam |

| No. of Companies Mentioned | 10 |