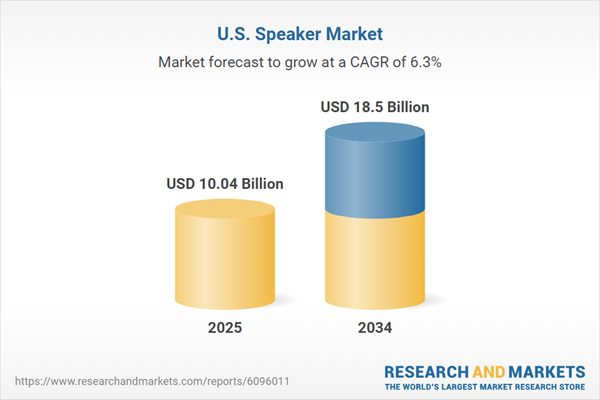

United States Speaker Market Growth

Increased adoption of smart home speakers such as Amazon Echo and Google Home, growth of Bluetooth speakers, and rising popularity of music and video streaming services are some of the prominent market drivers. The proliferation of Bluetooth and Wi-Fi speakers has been made possible by the advancements in wireless technology, offering users the convenience of wireless connectivity and superior sound quality.The rising popularity of home theatre systems, aimed at providing an immersive audio-visual experience, is fuelling the need for high-end speakers and surround sound systems. The expansion of the gaming sector, which places great importance on high-quality audio for an immersive gaming experience, is propelling the demand for superior-quality speakers and gaming headsets. Moreover, the demand for high-resolution audio and hi-fi speaker systems, which offer an exceptional listening experience for audiophiles, is increasing gradually.

United States Speaker Industry Segmentation

“United States Speaker Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Type:

- Wired Speaker

- Wireless Speaker

Market Breakup by Application:

- Consumer Electronics

- Professional Audio

- Automotive

- Others

Market Breakup by Region:

- New England

- Mideast

- Great Lakes

- Plains

- Southeast

- Southwest

- Rocky Mountain

- Farwest

United States Speaker Market Share

Based on application, the market is divided into consumer electronics, professional audio, and automotive, among others. Consumer electronics account for a major market share due to the widespread adoption of smart speakers like Amazon Echo, Google Home, and Apple HomePod. These devices are becoming popular because they are compatible with voice assistants and smart home networks. The increasing demand for premium consumer audio devices is further driven by the growing consumption of digital media, including podcasts, audiobooks, and video streaming.Leading Companies in the United States Speaker Market

The market players are producing speakers with high-resolution audio quality to gain a competitive edge in the market.- Sony Corporation

- Samsung Electronics Co. Ltd.

- Bose Corporation

- Sonos, Inc.

- LG Corporation

- Panasonic Holdings Corporation

- Apple, Inc.

- Amazon.com Inc.

- Alphabet Inc.

- Marshall Group AB

- Others

Table of Contents

Companies Mentioned

- Sony Corporation

- Samsung Electronics Co. Ltd.

- Bose Corporation

- Sonos, Inc.

- LG Corporation

- Panasonic Holdings Corporation

- Apple, Inc.

- Amazon.com Inc.

- Alphabet Inc.

- Marshall Group AB

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 138 |

| Published | May 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 10.04 Billion |

| Forecasted Market Value ( USD | $ 18.5 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |