The agricultural sector in Colombia is heavily influenced by the country's diverse geography and climate, which provides a strong foundation for agricultural activities. With a wide range of agroecological zones suitable for cultivating different crops and raising livestock, the Colombian agriculture sector is significantly expanding. Furthermore, the export of various agricultural products including Colombian coffee plays a crucial role in the Colombia agriculture market expansion.

The market is experiencing a significant shift towards sustainable and organic practices. This transformation is primarily driven by the growing global awareness of environmental issues and consumer preferences for pesticide-free and healthy products. Colombian farmers are embracing more eco-friendly techniques, reducing their reliance on chemicals, and preserving natural resources. As a result, the production of organic goods like coffee, fruits, and vegetables has increased, leading to a surge in both domestic and international demand. Additionally, the market is bolstered by sustainable agricultural practices that safeguard agricultural productivity.

Furthermore, technological advancements and innovations in the agricultural sector positively impact the market. The utilisation of advanced agricultural equipment like GPS-guided devices and sensors enhances efficiency, productivity, and competitiveness. By enabling precise irrigation and application of fertilisers and pesticides, these technologies help in cutting down production costs and minimising environmental harm by reducing chemical usage and conserving resources, consequently driving up the Colombia agriculture market growth.

Market Segmentation

Colombia Agriculture Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Food Crops and Cereals

- Fruits

- Vegetables

- Oilseeds/Non-food Crops

Market Breakup by Nature

- Organic

- Conventional

Competitive Landscape

Market players are placing a growing emphasis on the adoption of advanced technologies and sustainable methods in the agricultural sector to gain a competitive edge.- The Green Coffee Company

- Mikava Coffee LLC

- Cargill, Incorporated.

- Diana Group

- Bunge Limited

- Olam Group Limited

- Panamir

- Agroindustrial Mill Sonora AP SAS

- Prima Wawona

- Titan Farms, LLC.

- Others

Table of Contents

Companies Mentioned

- The Green Coffee Company

- Mikava Coffee LLC

- Cargill, Incorporated.

- Diana Group

- Bunge Limited

- Olam Group Limited

- Panamir

- Agroindustrial Mill Sonora AP SAS

- Prima Wawona

- Titan Farms, LLC.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 105 |

| Published | May 2025 |

| Forecast Period | 2025 - 2034 |

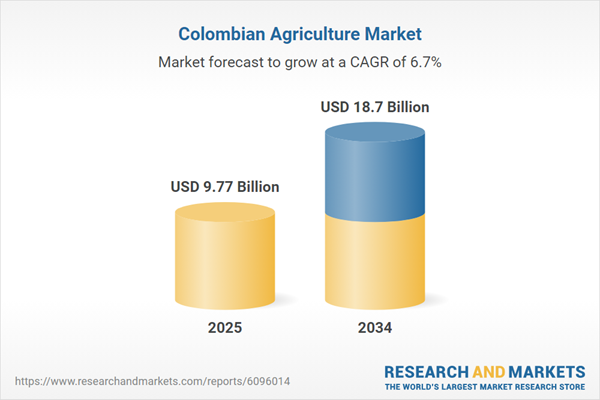

| Estimated Market Value ( USD | $ 9.77 Billion |

| Forecasted Market Value ( USD | $ 18.7 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Colombia |

| No. of Companies Mentioned | 10 |