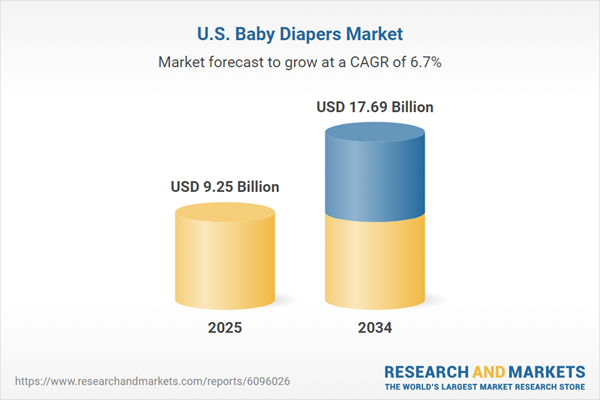

United States Baby Diapers Market Growth

Advancements in production processes are improving the quality, consistency, and design of modern baby diapers. They have also led to a reduction in material wastage and enhanced the efficiency of producing diapers. Modern machines can be customised as per market demands to manufacture a wide variety of diapers with enhanced absorbency levels in different sizes. This is expected to enhance the affordability of baby diapers in the United States.The integration of smart technologies into diaper-making machines is expected to optimise energy consumption and retract defective pieces before they enter the supply chain. This is expected to promote sustainable manufacturing practices and boost brand image simultaneously.

Increasing awareness about hygiene and new product launches have propelled the demand for sustainable diapers, which are manufactured from plant-based ingredients such as hemp fibre, viscose, and bioplastics. Moreover, major market players are focusing on introducing innovative designs in baby diapers that ensure a dry top sheet while effectively distributing fluids inside it. Materials that ensure long-term absorption of fluids are expected to become an increasingly popular raw material for diaper manufacturing companies in the coming years.

United States Baby Diapers Industry Segmentation

United States Baby Diapers Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Age Group

- Infant (0-6 Months)

- Babies and Young Toddlers (6-18 Months)

- Toddlers (18-24 Months)

- Children Above 2 Years

Market Breakup by Type

- Organic

- Conventional

Market Breakup by Product Type

- Cloth Diapers

- Disposable Diapers

Market Breakup by Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmacy and Drug Stores

- Online

- Others

Market Breakup by Region

- New England

- Mideast

- Great Lakes

- Plains

- Southeast

- Southwest

- Rocky Mountain

- Far West

United States Baby Diapers Market Share

Based on age group, the market can be divided into infants (0-6 months), babies and young toddlers (6-18 months), toddlers (18-24 months), and children above 2 years. Over the forecast period, the demand for organic and conventional diapers for infants and babies and young toddlers is anticipated to significantly surge.Leading Companies in the United States Baby Diapers Market

The report provides a detailed analysis of the following key players in the market, covering their competitive landscape and latest developments like mergers and acquisitions, investments, and capacity expansion.- Procter & Gamble Co.

- Cardinal Health Inc.

- Johnson & Johnson

- Kimberly-Clark Corporation

- Kao Corp.

- Essity AB

- S. C. Johnson & Son, Inc.

- Ontex Group N.V.

- Honest Company Inc.

- First Quality Enterprises, Inc.

- Others

Table of Contents

Companies Mentioned

- Procter & Gamble Co.

- Cardinal Health Inc.

- Johnson & Johnson

- Kimberly-Clark Corporation

- Kao Corp.

- Essity AB

- S. C. Johnson & Son, Inc.

- Ontex Group N.V.

- Honest Company Inc.

- First Quality Enterprises, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 109 |

| Published | May 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 9.25 Billion |

| Forecasted Market Value ( USD | $ 17.69 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |