North America oil and gas line pipe market growth is driven by several factors, including increased offshore exploration activities and the development of new oil and gas fields. Royal Dutch Shell, a multinational oil and gas company, has made significant investments in offshore exploration and production projects in the Gulf of Mexico.

In North America, the demand for natural gas has aided in growth of the market due to the transition towards cleaner energy sources, the replacement of coal in power generation, and the use of natural gas in industrial processes. For example, TransCanada Corporation, a leading North American energy infrastructure company, operates a large network of natural gas pipelines across the continent.

Technological innovations in pipeline construction, such as the use of high-strength materials and advanced corrosion protection, contribute to the efficiency and safety of transporting upstream resources. For instance, a company called Pipeotech has developed a revolutionary pipeline connection system called the DeltaV-Seal, which offers superior leak-tightness and durability compared to traditional welded connections.

Among type, seamless pipes exhibit the dominating North America oil and gas line pipe market share as they are designed in a manner to bear high-stress conditions. These kinds of pipes are known for their ability to withstand pressure more efficiently in comparison to other methods of pipe manufacturing and are generally used in gas lines, as well as pipes that carry liquids.

On the other hand, welded pipes are also expected to hold a significant share of the market, owing to its lower production cost compared to seamless pipes. For example, Welspun Corp, a leading global pipe manufacturer, offers a wide range of welded pipes for the oil and gas industry, including those used in transportation and distribution applications.

Market Segmentation

North America Oil and Gas Line Pipe Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Seamless

- Welded

- LSAW

- HSAW

- ERW

Market Breakup by Country

- United States of America

- Canada

Competitive Landscape

Market players are focused on utilising technological advancements for manufacturing best-quality pipes across industries to stay ahead in the competition.- JFE Holdings, Inc.

- Tenaris S.A.

- Vallourec S.A.

- Sumitomo Corporation

- Nippon Steel Corp.

- United States Steel Corporation

- EVRAZ Plc

- Others

Table of Contents

Companies Mentioned

- JFE Holdings, Inc.

- Tenaris S.A.

- Vallourec S.A.

- Sumitomo Corporation

- Nippon Steel Corp.

- United States Steel Corporation

- EVRAZ Plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 109 |

| Published | May 2025 |

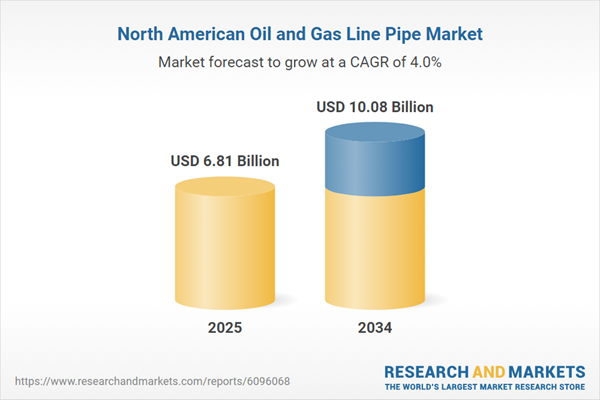

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 6.81 Billion |

| Forecasted Market Value ( USD | $ 10.08 Billion |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | North America |

| No. of Companies Mentioned | 7 |