North America Electric Power Steering Market Growth

Electric power steering (EPS) is an advanced steering system in vehicles that replaces older hydraulic systems with an electric motor for steering assistance. Its primary goal is to enhance driver control by adjusting steering assistance based on driving conditions and speeds, offering smoother and more responsive handling. Unlike hydraulic systems, EPS functions without a hydraulic pump, which enhances fuel efficiency and drives the growth of the North America electric power steering market.North America Electric Power Steering Market Analysis

Electric power steering (EPS) systems provide significant fuel efficiency gains by eliminating belt-driven hydraulic or manual pumps that run continuously, regardless of the need for steering assistance. EPS can save up to 0.4 litres of fuel per 100 kilometres travelled and reduce CO2 emissions by up to 7 grams per kilometre.The North America electric power steering market dynamics and trends are being driven by its benefits in enhancing fuel efficiency, reducing weight, and improving steering feel. EPS also provides greater reliability, design flexibility, and speed-dependent assistance. Additionally, it reduces environmental impact, noise, and maintenance costs, while incorporating advanced safety features for an improved driving experience.

North America Electric Power Steering Industry Outlook

The American Automakers AAPC projects a steady rise in U.S. auto production from 2018 to 2028, reaching 12.2 million vehicles by 2028. Starting from 11.3 million vehicles in 2018, production saw a 52% increase since the recession. However, production was noted at 10.8 million in 2021 and further to 11.7 million in 2022. In 2023, production reached 12.1 million vehicles and is anticipated to rise to 12.3 million by 2025. It is anticipated that the number of vehicles will stabilise at 12.2 million by 2028. This increase is expected to boost the North America electric power steering market revenue, as EPS is a steering system designed to help drivers turn the wheel with less effort than conventional hydraulic systems.According to the Alliance for Automotive Innovation, U.S. car sales, which were around 400,000 units in April 2019, experienced a decline to below 200,000 units in April 2020. Sales rebounded slightly to approximately 200,000 units by April 2021 and have maintained this level through April 2023. In terms of U.S. light truck sales, the figures reached around 1,000,000 units in April 2019, dipped to approximately 600,000 units in April 2020, and surged to nearly 1,200,000 units in April 2021. This stability is contributing to the growth of the North America electric power steering industry revenue, driven by rising automobile sales. The electric power steering systems offer electronically adjustable steering assistance, providing customisable driving experiences.

Continuous innovation in electric power steering (EPS) technology enhances vehicle safety, fuel efficiency, and driving comfort is driving the North America electric power steering industry revenue.

- Growing consumer preference for advanced automotive features, including improved handling and manoeuvrability, supports the adoption of EPS systems in North America.

- Supportive regulations promoting fuel efficiency and safety standards encourage the implementation of EPS technology in vehicles.

- EPS systems are technologically complex, requiring significant R&D and precision manufacturing, which can lead to higher production costs.

- The market is becoming increasingly competitive with numerous players, which can lead to price pressure and reduced profit margins.

- The rise of autonomous driving technology presents opportunities for integrating advanced EPS systems to enhance vehicle control and safety.

- The growth of electric vehicles (EVs) in North America provides an opportunity to expand EPS adoption, as EVs typically benefit from the efficiency of electric steering systems.

- Rapid advancements in alternative steering technologies may challenge the dominance of current EPS solutions.

- Disruptions in the supply chain for critical components can impact the production and availability of EPS systems.

Key Players in the North America Electric Power Steering Market and Their Key Initiatives

Mitsubishi Electric Corporation

- Enhanced production capabilities for EPS systems to capture the North America electric power steering market opportunities.

- Developed next-generation EPS systems incorporating AI for improved vehicle safety.

Robert Bosch GmbH

- Launched ServoE, a fully electric steering system for automated driving.

- Introduced over-the-air updates for EPS systems.

Denso Corporation

- Partnered with Aeva to integrate LiDAR into electric power steering systems.

- Invested in advanced EPS technology to support autonomous driving to meet the growing demand of the North America electric power steering market.

JTEKT Corporation

- Began mass production of MCU with JFOPS4 for enhanced electric power steering systems.

- Signed a virtual Power Purchase Agreement with Greenalia for 142.8MW of renewable energy.

North America Electric Power Steering Industry Segmentation

“North America Electric Power Steering Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Product Type

- Rack Assist Type (REPS)

- Column Assist Type (CEPS)

- Pinion Assist Type (PEPS)

Market Breakup by Component

- Steering Rack/Column

- Sensors

- Electric Motor

- Others

Market Breakup by Vehicle Type

- Passenger Car

- Commercial Vehicle

Market Breakup by Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

Market Breakup by Region

- United States of America

- Canada

North America Electric Power Steering Market Share

Leading electric power steering manufacturers have a strong presence in the U.S., which is also home to electric vehicles expected to use EPS. The country's robust automobile manufacturing sector and investments in automotive technologies are driving the growth of the North America electric power steering market.With a focus on innovation and safety, electric power steering systems are poised to play a pivotal role in shaping the future of vehicle steering and autonomy driving the North America electric power steering market development.

Leading Companies in the North America Electric Power Steering Market

The companies offer electronics and electrical equipment, delivering innovative solutions across multiple sectors such as automotive, industrial automation, and energy.- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- Denso Corporation

- JTEKT Corporation

- NSK Ltd.

- thyssenkrupp AG

- ZF Friedrichshafen AG

- Knorr-Bremse AG

- Dowlais Group Plc (GKN Automotive Ltd.)

- Nexteer Automotive Corporation

- Others

North America Electric Power Steering Market Report Snapshots

North America Electric Power Steering Market Size

North America Electric Power Steering Market Growth

North America Electric Power Steering Market Analysis

North America Electric Power Steering Market Share

North America Electric Power Steering Companies

Table of Contents

Companies Mentioned

- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- Denso Corporation

- JTEKT Corporation

- NSK Ltd.

- thyssenkrupp AG

- ZF Friedrichshafen AG

- Knorr-Bremse AG

- Dowlais Group Plc (GKN Automotive Ltd.)

- Nexteer Automotive Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | May 2025 |

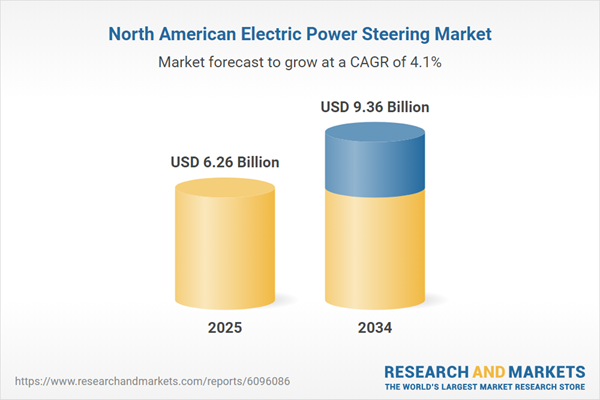

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 6.26 Billion |

| Forecasted Market Value ( USD | $ 9.36 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | North America |

| No. of Companies Mentioned | 10 |