The transition to digital technologies has led to notable advancements in the logistics sector. One such innovation that has entirely changed the way goods gets transported around the world, is digital freight forwarding. Digital freight forwarding is the process of organising and managing product transportation using digital technologies. It seeks to improve and streamline the movement of goods via various means of transportation, including land and sea.

United States digital freight forwarding market share is increasing because digital freight approach replaces labour-intensive, paper-dependent methods with automated systems, empowering businesses to efficiently oversee their logistics operations such as shipment tracking and order fulfilment. Digital freight services are being adopted by logistics companies such as Uber Freight and uShip, which is further driving the United States digital freight forwarding market development. Uber Freight, for instance, provides a mobile application as a logistics management platform that allows for the booking of load capacities, the hiring of maintenance services, and shipment status updates.

Key Trends and Developments

Rising adoption of AI, increasing focus on sustainability, and growing number of digital freight platforms are boosting the market growthJanuary 2024

Flexport has raised USD 260 million from its existing shareholder, Shopify, through an uncapped convertible note. The funds will be used to further develop Flexport's logistics technology and support its growth in the logistics market.October 2022

Uber Freight and Transplace merged to create one of the world's largest logistics technology platforms. The merger is aimed at optimising the movement of freight across the supply chain and unlocking opportunities for carriers worldwide.September 2022

Kuehne+Nagel expanded its contract logistics network in healthcare sector with the development of a new 1,66,000-square-foot healthcare facility. This expansion ensures the safe and reliable delivery of healthcare products within United States.March 2022

Deutsche Post DHL Group acquired J.F. Hillebrand Group, an ocean freight forwarding services provide for EUR 1.5 billion. The acquisition is expected to strengthen company's ocean freight product portfolio and promote sustainability in the logistics industry.Rising adoption of AI for data security

Data driven decision making is one of the key United States digital freight forwarding market trends propelling the market. Data security and fraud protection through AI, data analysis, or cloud-based technologies results in secured logistics operations, easily accessible data, and faster loading of goods.High emphasis on enhancing last mile delivery

Delivery times may increase if the resources required to deliver goods are not accurately calculated. To overcome this, freight forwarding systems, like Raft figures out the best routes for vehicles to improve last-mile delivery, which is resulting in United States digital freight forwarding market growth.Rising number of digital freight platforms

Enhanced visibility and proactive decision-making offered by digital platforms, such as Flexport is boosting the United States digital freight forwarding market demand. These systems allow for the tracking and monitoring of shipments in real time, giving businesses total supply chain visibility.Increasing focus on sustainability

Freight transportation accounts for 8% of global emissions and might become the highest emitting sector by 2030, as per the Intergovernmental Panel on Climate Change (IPCC). Digitalisation of transportation present several opportunities to help freight forwarders monitor emissions.Digital freight forwarding for logistics companies can improve vehicle performance, optimise routes and capacity, ultimately contributing to the reduction of emissions and the promotion of sustainability in the logistics industry. For instance, the use of shipment tracking software and the digitisation of the quote generating process have been shown to save energy, reduce paper waste, and minimise the chances of error, thereby positively impacting the environment. Additionally, the freight forwarding companies aim to achieve zero net carbon emissions by 2050, and digitalisation of freight can help reduce greenhouse gas emissions by up to 90%, further boosting the market's growth.

In addition, the use of AI-based technologies, such as digital cloud systems are increasing the United States digital freight forwarding market value. Digital cloud systems are used to store transaction details, cargo tracking information, and recipient personal data, preventing unwanted access and data interception. By 2030, cloud services will account for a greater share in the market than traditional on-premises solutions, which, in turn, will propel the United States digital freight forwarding market growth.

Market Segmentation

United States Digital Freight Forwarding Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Mode

- Land

- Sea

- Air

Market Breakup by Industry Vertical

- Manufacturing

- Retail and E-Commerce

- Healthcare

- Automotive

- Others

Market Breakup by Region

- New England

- Mideast

- Great Lakes

- Plains

- Southeast

- Southwest

- Rocky Mountain

- Far West

As per the United States digital freight forwarding market analysis, the sea mode is expected to hold a significant share as it is the most cost-effective mode of shipment when compared with other modes, such as air and land freight. Furthermore, there has been a noticeable decline in ocean shipping accident rates over time, indicating an improvement in maritime safety. For enhanced safety, logistic companies can monitor their shipments and notify their clients via digital platforms like Flexport. This leads to safe and prompt delivery across regions, which further boosts the United States digital freight forwarding market demand.

Additionally, sea freight is a sustainable alternative to air and road transportation due to its lower carbon footprint. For example, air freight produces about 500 grams of CO2 per kilometer of transportation, whereas ships emit between 10 and 40 grams per kilometer. Due to this difference of lower carbon emissions, shipping large items like machinery, furniture, and cars via sea freight is highly adopted.

According to United States digital freight forwarding market report, air mode of transportation, which is suitable high-value and time-sensitive goods, such as, spare parts for cars, perishable food, live animals, artworks, healthcare machinery, and jewellery, is a growing segment as it offers express shipping options, high-level security, and the ability to ship nationally and internationally.

Digital freight forwarding through air increases speed and efficiency by enabling faster transportation of goods, real-time tracking of shipments, and quick resolution of supply chain issues. Additionally, it provides transparency, offering accurate updates about shipment locations, which enhances communication among stakeholders.

Retail and e-commerce sector is expected to continue their dominance due to their increased demand for efficient and reliable freight forwarding

The United States digital freight forwarding market share is expected to be dominated by the retail and e-commerce sectors due to the increased demand for efficient and reliable freight forwarding services to support the movement of goods ordered online. E-commerce companies in United States like Amazon, eBay, and Kroger are exploring ways to reduce the delivery time of orders and operational costs as customers expect order accuracy, speedy delivery, convenience, and free returns. In order to meet this demand, new business models and solutions must be developed through the digitalization of logistics processes and the automation of distribution and warehouse systems. Also, digital freight forwarding services such as real-time tracking are efficient, particularly in terms of last-mile delivery and product return procedures.

Furthermore, as per the United States digital freight forwarding market segmentation, the healthcare sector's growing dominance is attributed to the rising demand for regulatory and temperature standards, as well as the transportation of pharmaceutical products, drugs, vaccines, and medical/surgical devices and equipment. The growth of the healthcare sector in the digital freight forwarding market is further supported by the expansion of free trade agreements. This facilitates the import and movement of goods across borders, enabling the healthcare sector of US to benefit from improved connectivity and logistics operations, ultimately contributing to the digital freight forwarding market in United States.

Competitive Landscape

Market players are engaging in mergers and acquisitions, followed by expansion strategies to stay ahead in the competition.Uber Freight Holding Corporation

Uber Freight Holding Corporation was founded in 2017 and is a logistics platform built on the power of Uber with the goal to reshape global logistics and deliver reliability, flexibility, and transparency for shippers and carriers. The company is headquartered in Chicago, United States.Deutsche Post AG

Deutsche Post AG is a German logistics company, founded in 1995. It provides mail and parcel services, express delivery, freight transport, supply chain management, and e-commerce solutions. It is a part of the DHL Group and operates both nationally and internationally.Flexport, Inc.

Flexport, Inc. was founded in 2013 and is headquartered in California, United States. The company is an American multinational corporation that focuses on supply chain management and logistics, including order management, delivery, trade financing, insurance, freight forwarding, and customs brokerage.

uShip Inc.

uShip Inc. is based in Texas, United States and is an online marketplace for shipping services. The company was founded in 2003 and it connects people with customer-reviewed delivery companies for shipping motorcycles, horses, heavy equipment, household goods, and boats.

Other key players in the United States digital freight forwarding market include Kuehne + Nagel International AG, Agility Holdings Inc. (iContainers Solutions S.L.U.), Expeditors International of Washington Inc., AP Moeller - Maersk A/S, Convoy, Inc., and New York Shipping Exchange, Inc., among others.

Table of Contents

Companies Mentioned

- Uber Freight Holding Corporation

- Deutsche Post AG

- Flexport, Inc.

- uShip Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 115 |

| Published | May 2025 |

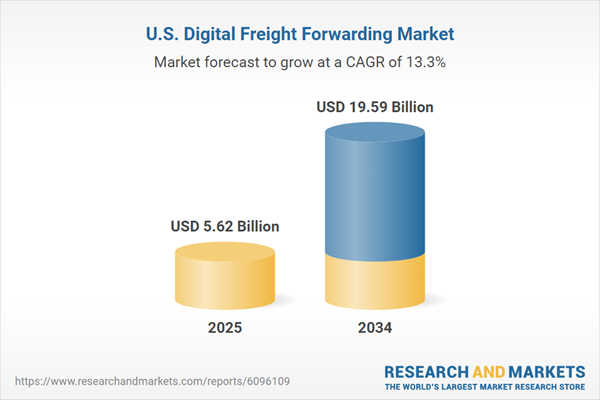

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 5.62 Billion |

| Forecasted Market Value ( USD | $ 19.59 Billion |

| Compound Annual Growth Rate | 13.3% |

| Regions Covered | United States |

| No. of Companies Mentioned | 4 |